Answered step by step

Verified Expert Solution

Question

1 Approved Answer

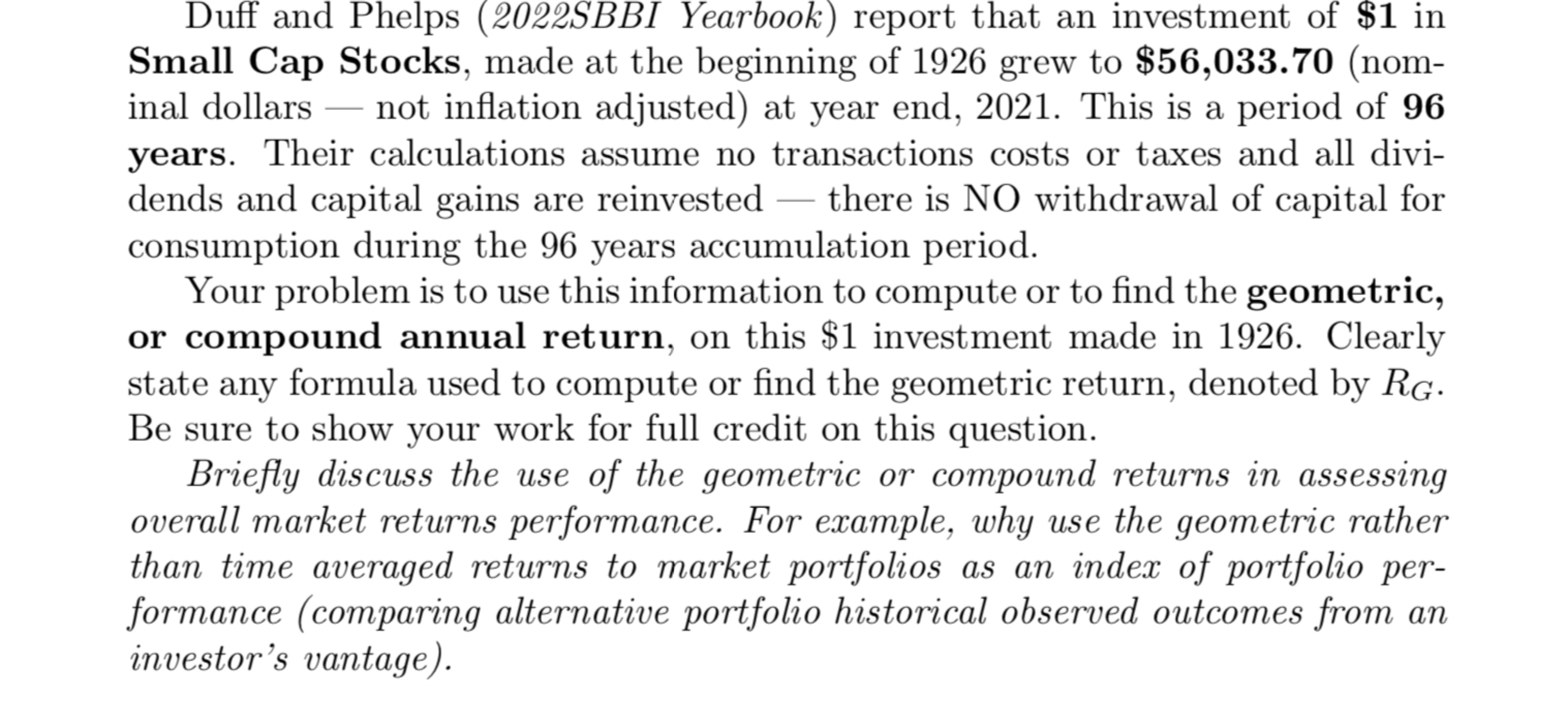

Duff and Phelps ( 2 0 2 2 SBBI Yearbook ) report that an investment of $ 1 in Small Cap Stocks, made at the

Duff and Phelps SBBI Yearbook report that an investment of $ in

Small Cap Stocks, made at the beginning of grew to $nom

inal dollars not inflation adjusted at year end, This is a period of

years. Their calculations assume no transactions costs or taxes and all divi

dends and capital gains are reinvested there is NO withdrawal of capital for

consumption during the years accumulation period.

Your problem is to use this information to compute or to find the geometric,

or compound annual return, on this $ investment made in Clearly

state any formula used to compute or find the geometric return, denoted by

Be sure to show your work for full credit on this question.

Briefly discuss the use of the geometric or compound returns in assessing

overall market returns performance. For example, why use the geometric rather

than time averaged returns to market portfolios as an index of portfolio per

formance comparing alternative portfolio historical observed outcomes from an

investor's vantage

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started