Question

Duffy Dog Corporation reported the following selected items at February 28, 2024: Accounts payable $1,106,840 Accounts receivable 554,600 Allowance for expected credit losses 35,400

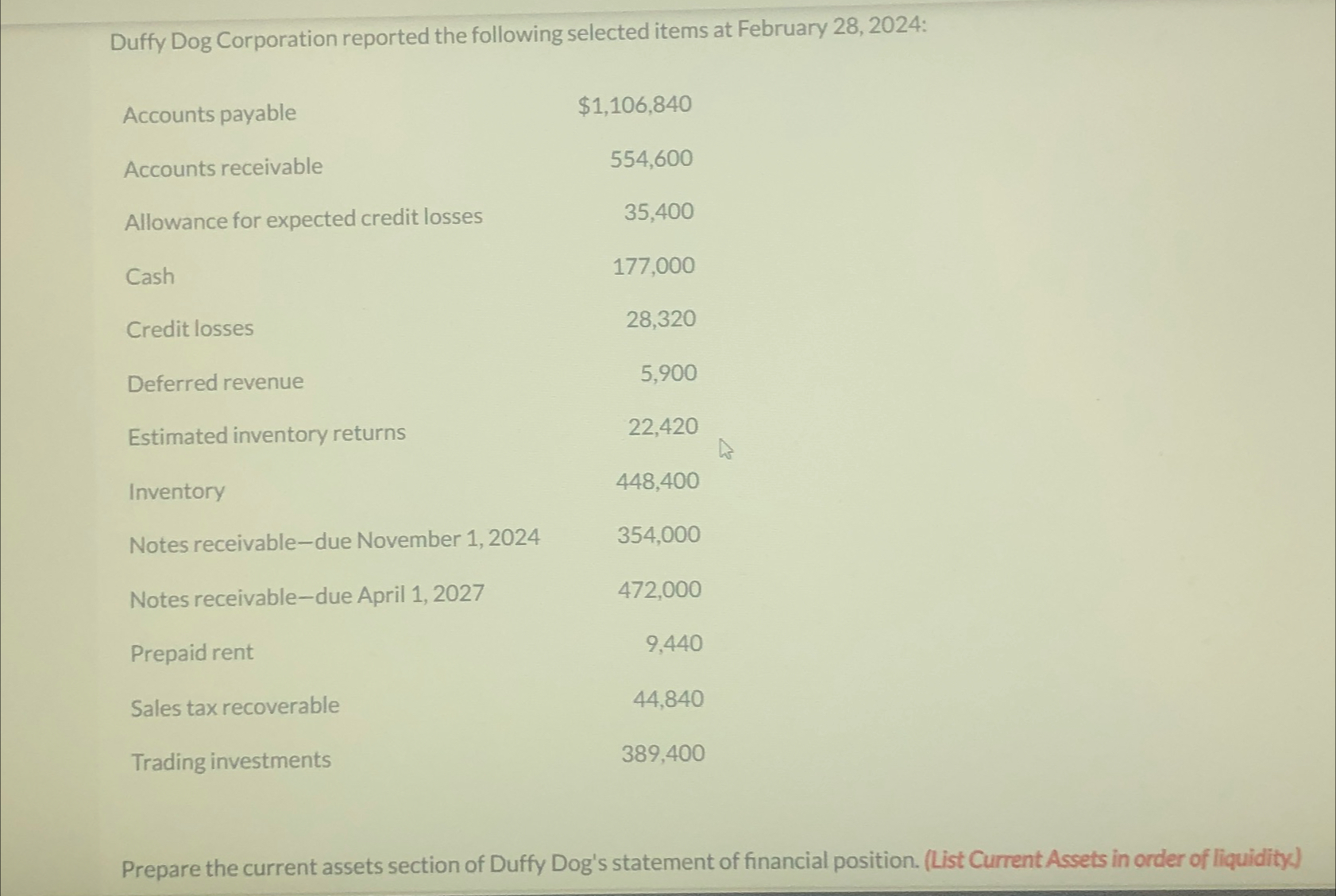

Duffy Dog Corporation reported the following selected items at February 28, 2024: Accounts payable $1,106,840 Accounts receivable 554,600 Allowance for expected credit losses 35,400 Cash 177,000 Credit losses 28,320 Deferred revenue 5,900 Estimated inventory returns 22,420 Inventory 448,400 Notes receivable-due November 1, 2024 354,000 Notes receivable-due April 1, 2027 472,000 Prepaid rent 9,440 Sales tax recoverable 44,840 Trading investments 389,400 Prepare the current assets section of Duffy Dog's statement of financial position. (List Current Assets in order of liquidity.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Duffy Dog Corporation Current Assets As of February 28 2024 Current assets a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine

7th Canadian edition

1119368456, 978-1119211587, 1119211581, 978-1119320623, 978-1119368458

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App