Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Duration is a very important concept that allows investors to better understand the risk of owning a particular bond. For example, we are interested in

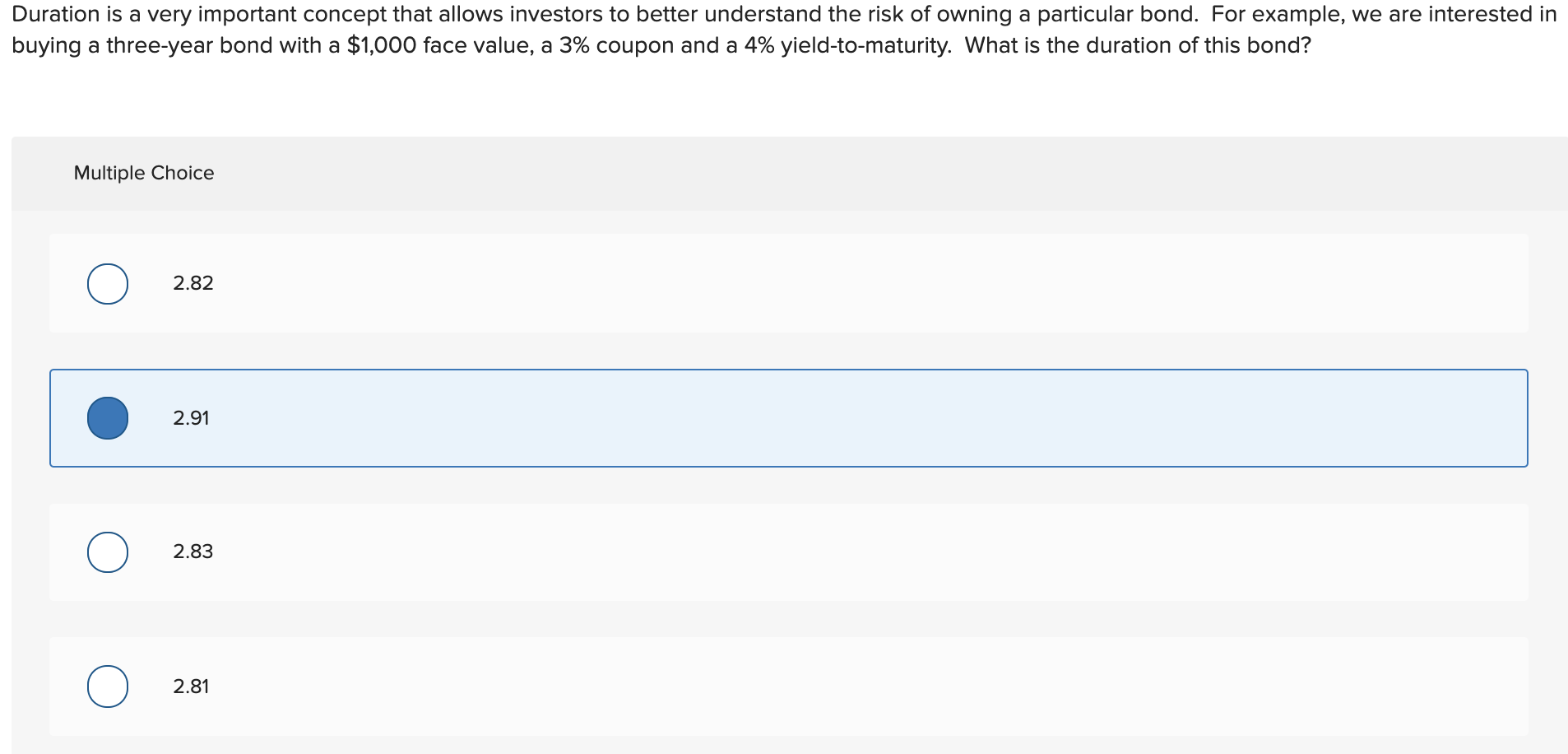

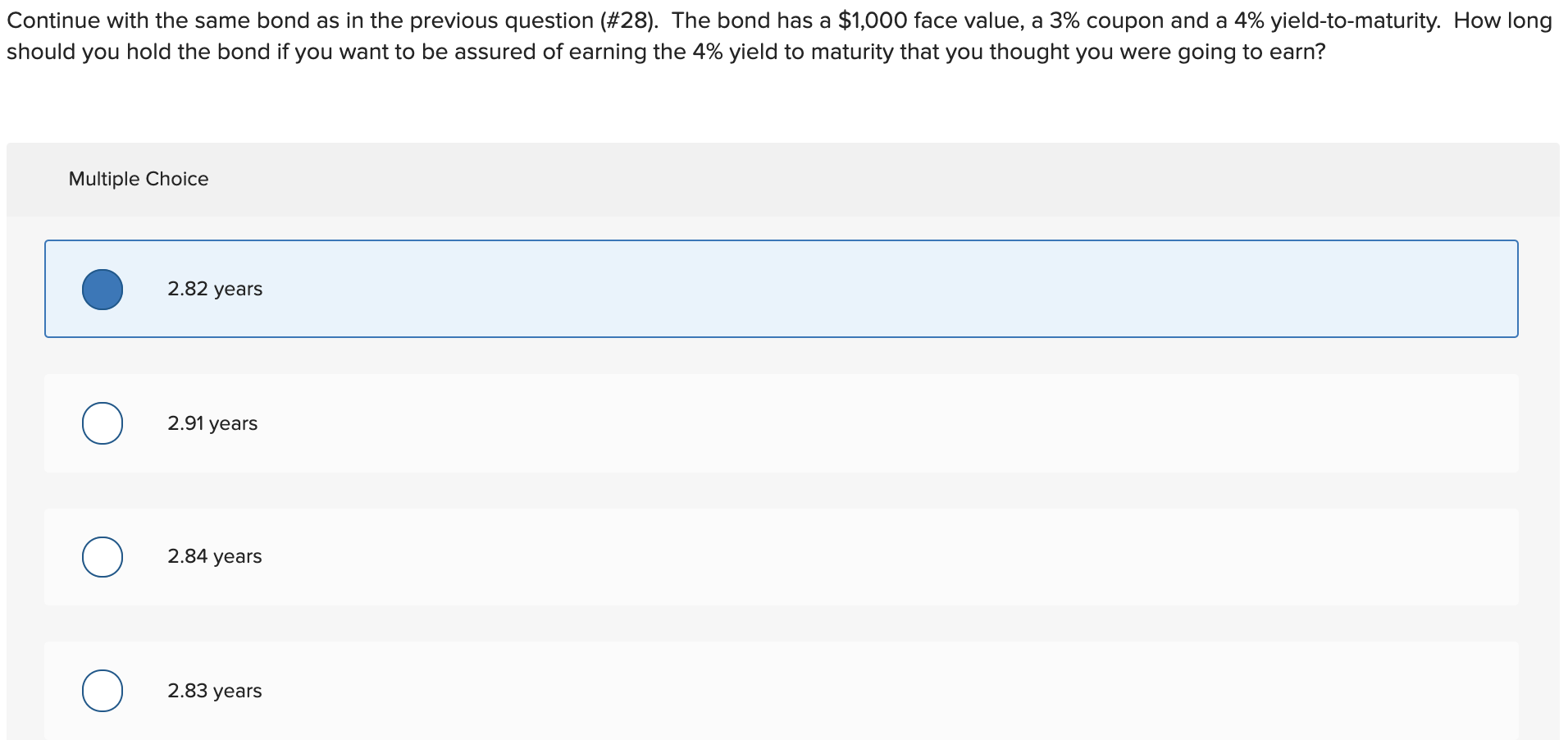

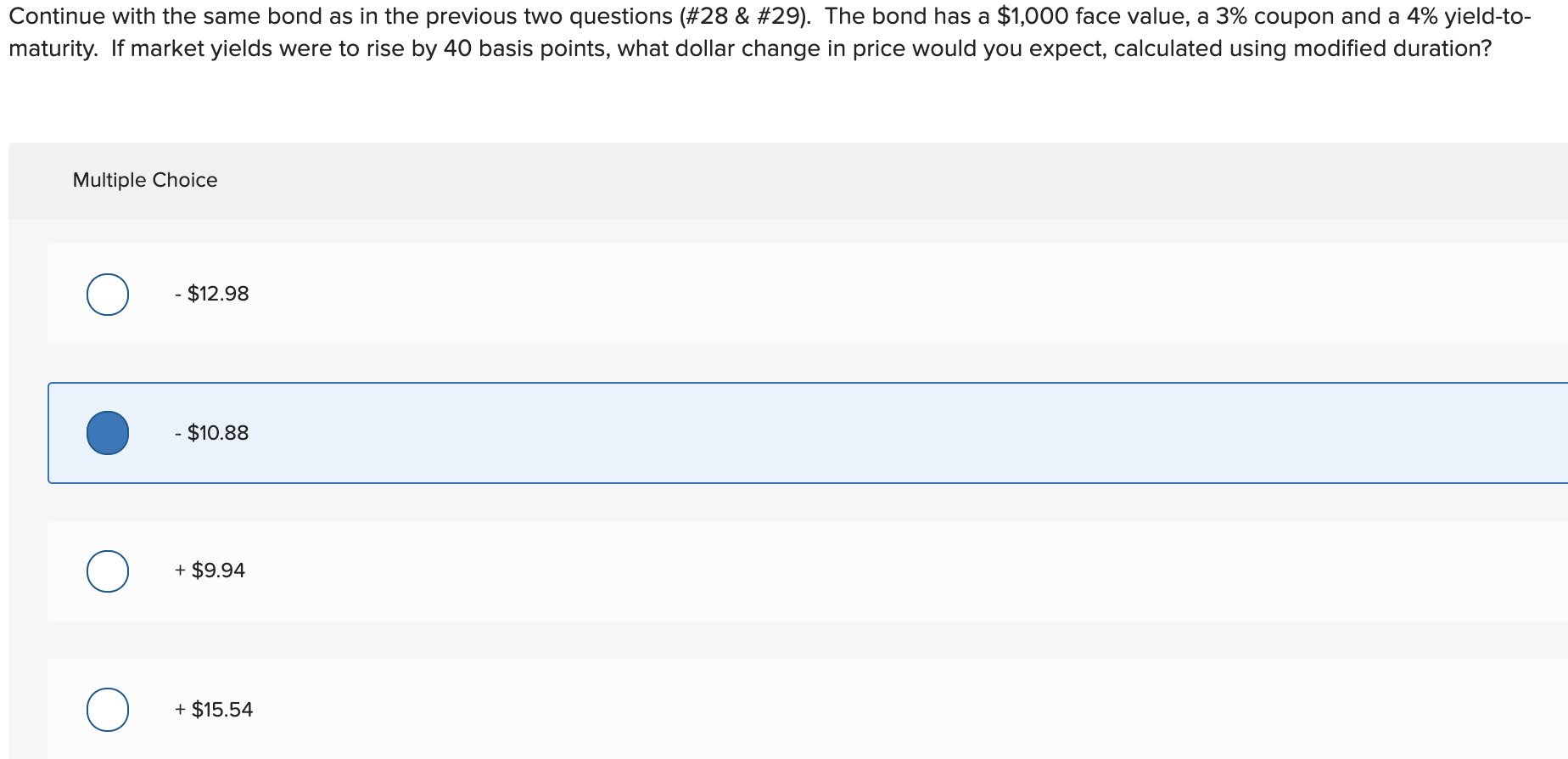

Duration is a very important concept that allows investors to better understand the risk of owning a particular bond. For example, we are interested in buying a three-year bond with a $1,000 face value, a 3% coupon and a 4% yield-to-maturity. What is the duration of this bond? Multiple Choice 2.82 2.91 2.83 2.81 Continue with the same bond as in the previous question (#28). The bond has a $1,000 face value, a 3% coupon and a 4% yield-to-maturity. How long should you hold the bond if you want to be assured of earning the 4% yield to maturity that you thought you were going to earn? Multiple Choice 2.82 years 2.91 years 2.84 years 2.83 years Continue with the same bond as in the previous two questions (#28 & #29). The bond has a $1,000 face value, a 3% coupon and a 4% yield-to- maturity. If market yields were to rise by 40 basis points, what dollar change in price would you expect, calculated using modified duration? Multiple Choice $12.98 - $10.88 + $9.94 + $15.54

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started