Answered step by step

Verified Expert Solution

Question

1 Approved Answer

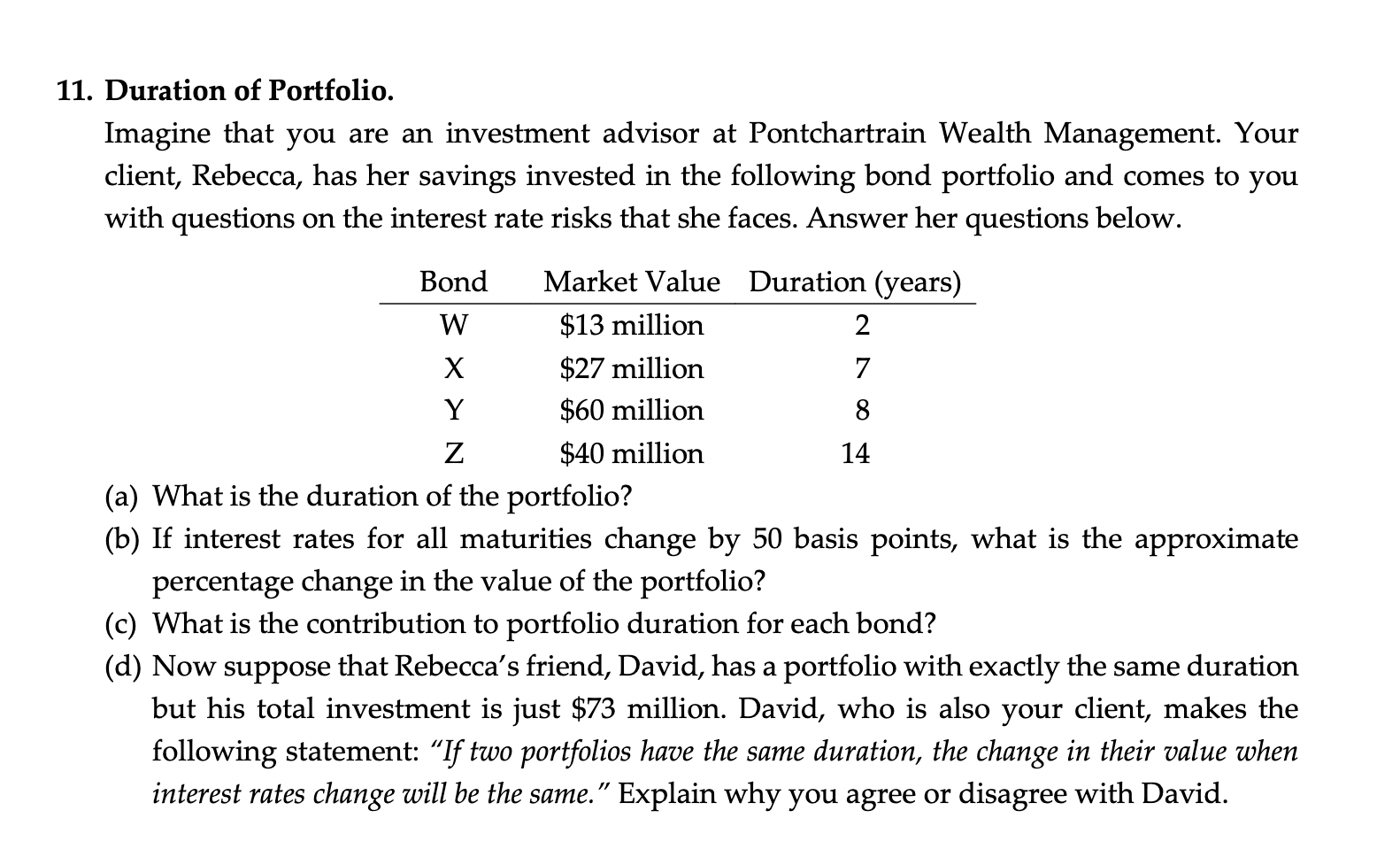

Duration of Portfolio. Imagine that you are an investment advisor at Pontchartrain Wealth Management. Your client, Rebecca, has her savings invested in the following bond

Duration of Portfolio. Imagine that you are an investment advisor at Pontchartrain Wealth Management. Your client, Rebecca, has her savings invested in the following bond portfolio and comes to you with questions on the interest rate risks that she faces. Answer her questions below. (a) What is the duration of the portfolio? (b) If interest rates for all maturities change by 50 basis points, what is the approximate percentage change in the value of the portfolio? (c) What is the contribution to portfolio duration for each bond? (d) Now suppose that Rebecca's friend, David, has a portfolio with exactly the same duration but his total investment is just $73 million. David, who is also your client, makes the following statement: "If two portfolios have the same duration, the change in their value when interest rates change will be the same." Explain why you agree or disagree with David

Duration of Portfolio. Imagine that you are an investment advisor at Pontchartrain Wealth Management. Your client, Rebecca, has her savings invested in the following bond portfolio and comes to you with questions on the interest rate risks that she faces. Answer her questions below. (a) What is the duration of the portfolio? (b) If interest rates for all maturities change by 50 basis points, what is the approximate percentage change in the value of the portfolio? (c) What is the contribution to portfolio duration for each bond? (d) Now suppose that Rebecca's friend, David, has a portfolio with exactly the same duration but his total investment is just $73 million. David, who is also your client, makes the following statement: "If two portfolios have the same duration, the change in their value when interest rates change will be the same." Explain why you agree or disagree with David Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started