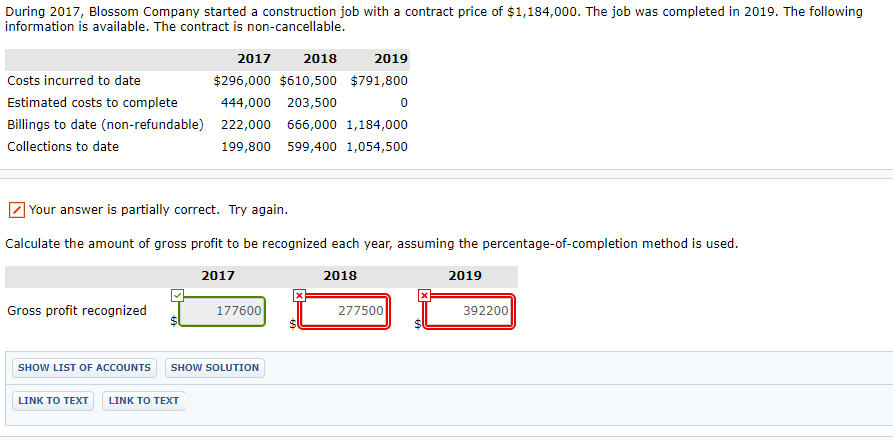

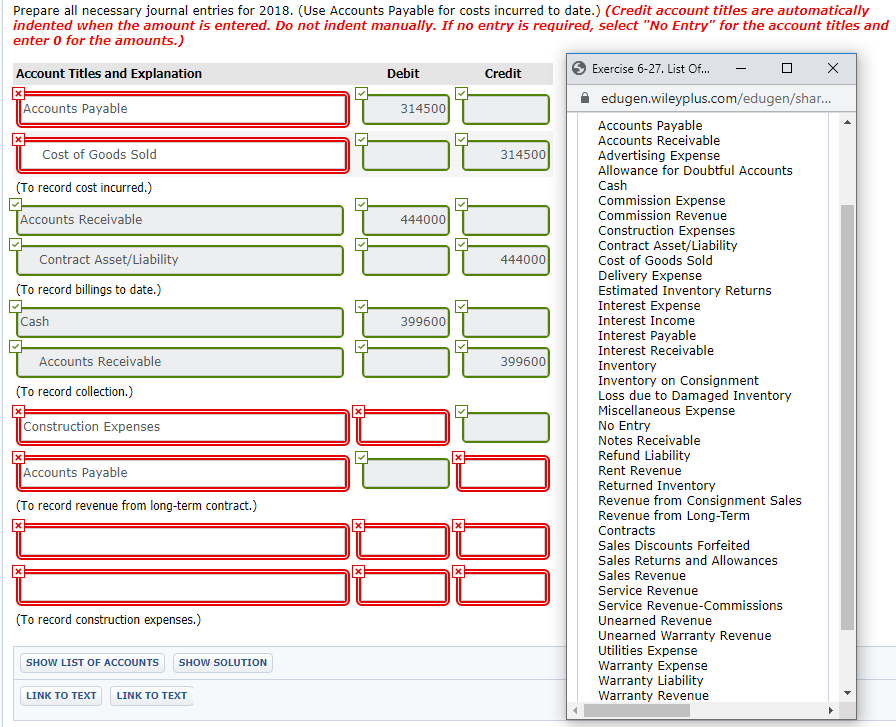

During 2017, Blossom Company started a construction job with a contract price of $1,184,000. The job was completed in 2019. The following information is available. The contract is non-cancellable. 2017 2018 2019 Costs incurred to date $296,000 $610,500 $791,800 Estimated costs to complete 444,000 203,500 Billings to date (non-refundable) 222,000 666,000 1,184,000 Collections to date 199,800 599,400 1,054,500 0 Your answer is partially correct. Try again. Calculate the amount of gross profit to be recognized each year, assuming the percentage-of-completion method is used. 2017 2018 2019 Gross profit recognized 177600 277500 392200 SHOW LIST OF ACCOUNTS SHOW SOLUTION LINK TO TEXT LINK TO TEXT X Prepare all necessary journal entries for 2018. (Use Accounts Payable for costs incurred to date.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Exercise 6-27. List Of... edugen.wileyplus.com/edugen/shar... Accounts Payable 314500 Accounts Payable Accounts Receivable Cost of Goods Sold 314500 Advertising Expense Allowance for Doubtful Accounts (To record cost incurred.) Cash Commission Expense Accounts Receivable 444000 Commission Revenue Construction Expenses Contract Asset/Liability Contract Asset/Liability 444000 Cost of Goods Sold Delivery Expense (To record billings to date.) Estimated Inventory Returns Interest Expense Cash 3996001 Interest Income Interest Payable Interest Receivable Accounts Receivable 399600 Inventory Inventory on Consignment (To record collection.) Loss due to Damaged Inventory Miscellaneous Expense Construction Expenses No Entry Notes Receivable Refund Liability Accounts Payable Rent Revenue Returned Inventory (To record revenue from long-term contract.) Revenue from Consignment Sales Revenue from Long-Term Contracts Sales Discounts Forfeited Sales Returns and Allowances Sales Revenue Service Revenue Service Revenue-Commissions (To record construction expenses.) Unearned Revenue Unearned Warranty Revenue Utilities Expense SHOW LIST OF ACCOUNTS SHOW SOLUTION Warranty Expense Warranty Liability LINK TO TEXT LINK TO TEXT Warranty Revenue DO IT TO OT X il x X X