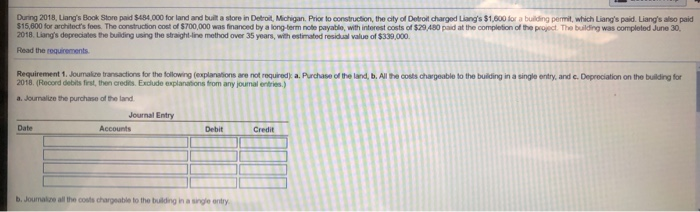

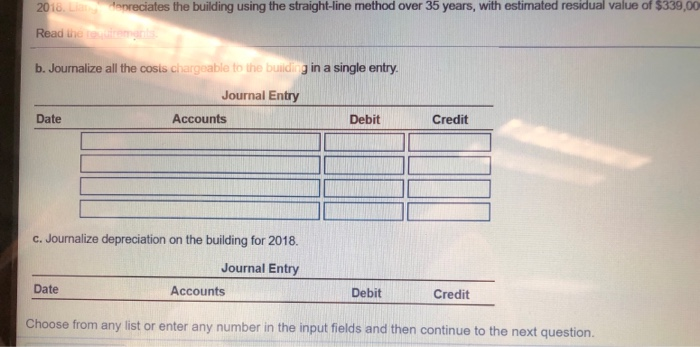

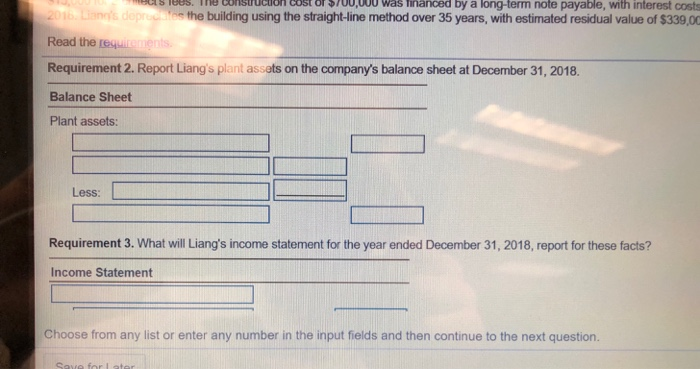

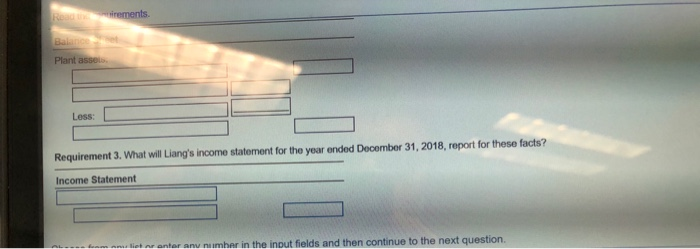

During 2018, Liang's Book Store paid $484,000 for land and built a slore in Detroit, Michigan. Prior to construction, the city of Detroil charged Liang's $1,600 for a building permit, which Liang's paid. Liang's also paid $15,600 for architect's foos. The construction cost of $700,000 was financed by a long-term note payable, with interest costs of $29.480 paid at the completion of the project. The building was completed June 30, 2018. Liang's depreciates he building using the straight-line method over 35 years, with estimated residual value of $339,000 Read the requirements Requirement 1. Joumalze transactions for the following (explanations are not required) a. Purchase of the land, b. All the costs chargeable to the building in a single entry, and e. Deprociation on the building for 2018. (Record debits first, then credits. Exclude explanations from any journal entries.) a. Jounalize the purchase of the land Journal Entry Date Accounts Debit Credit b. Joumalze all the costs chargeable to the building in a singe entry 2018. Li opreciates the building using the straight-line method over 35 years, with estimated residual value of $339,00 Read the teuufrement b. Journalize all the cosis chargeable to the building in a single entry Journal Entry Date Accounts Debit Credit c. Journalize depreciation on the building for 2018. Journal Entry Date Accounts Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question. 0 was financed by a long-term note payable, with interest Costs 2016.Liann's doprectes the building using the straight-line method over 35 years, with estimated residual value of $339,00 Read the requirements Requirement 2. Report Liang's plant assets on the company's balance sheet at December 31, 2018. Balance Sheet Plant assets: Less: Requirement 3. What will Liang's income statement for the year ended December 31, 2018, report for these facts? Income Statement Choose from any list or enter any number in the input fields and then continue to the next question. Save for I ater irements. Read Balance e Plant assels Less: Requirement 3. What will Liang's income statement for the year ended December 31, 2018, report for these facts? Income Statement ---fom om Siet or enter anu number in the input fields and then continue to the next