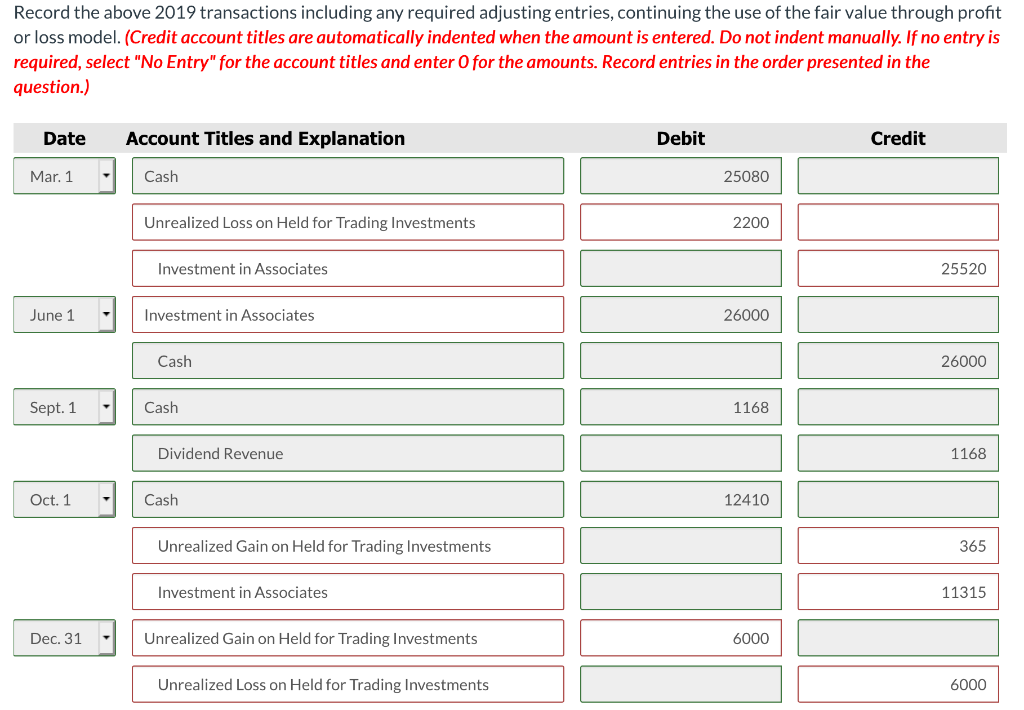

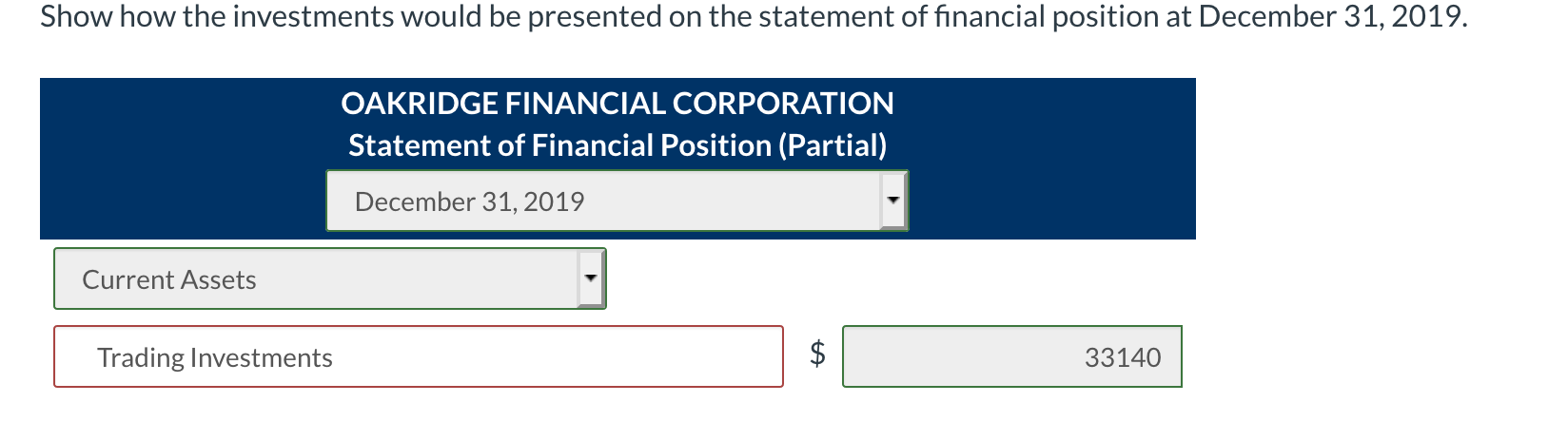

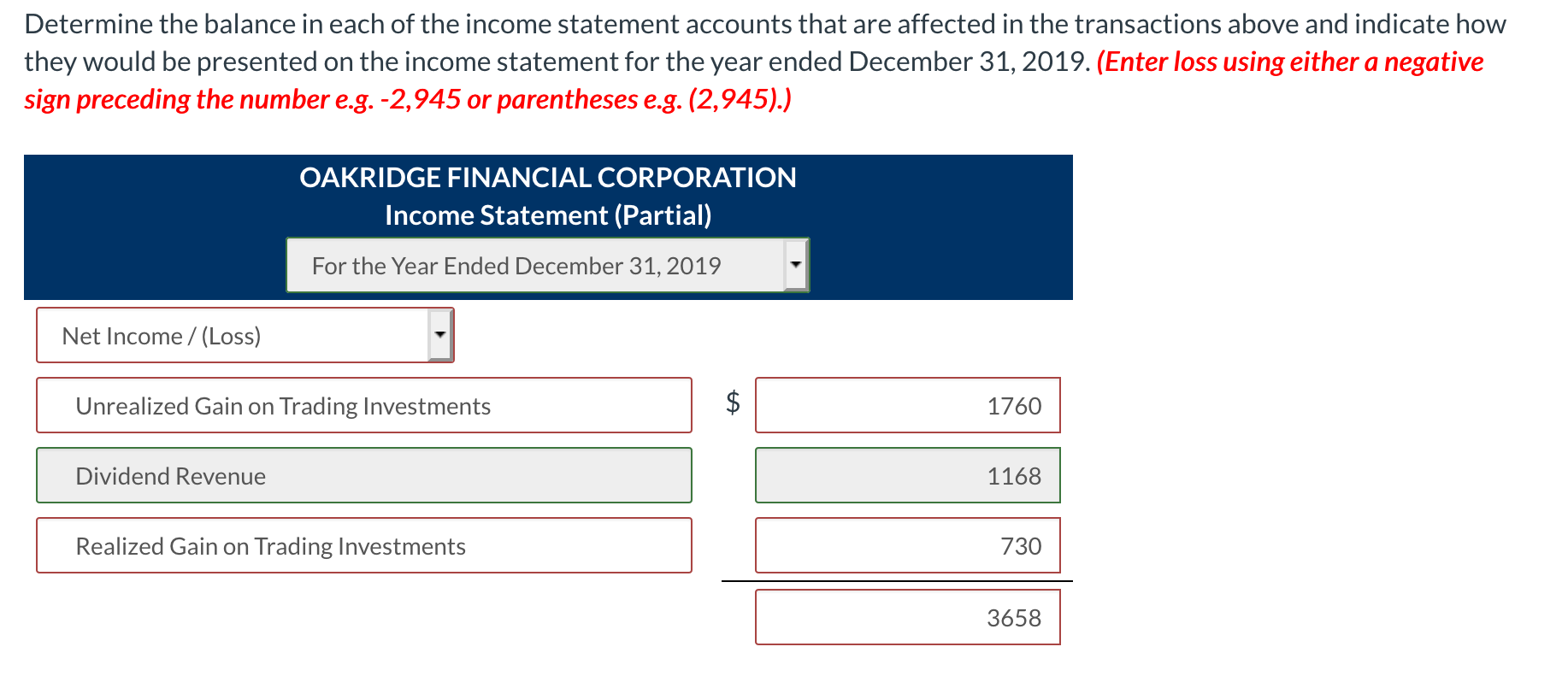

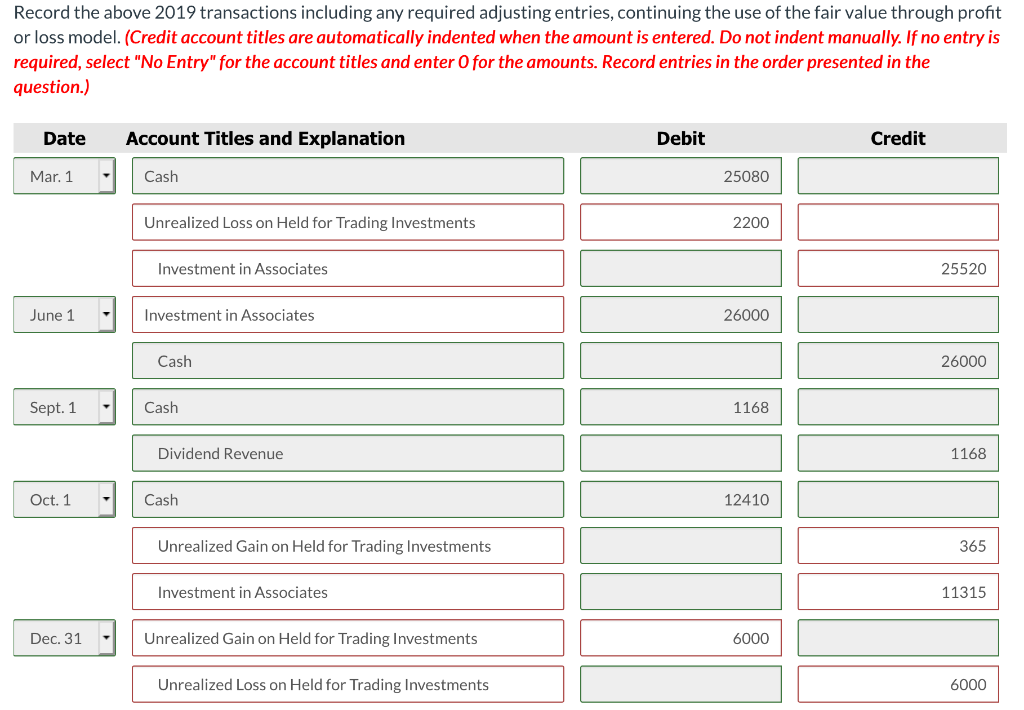

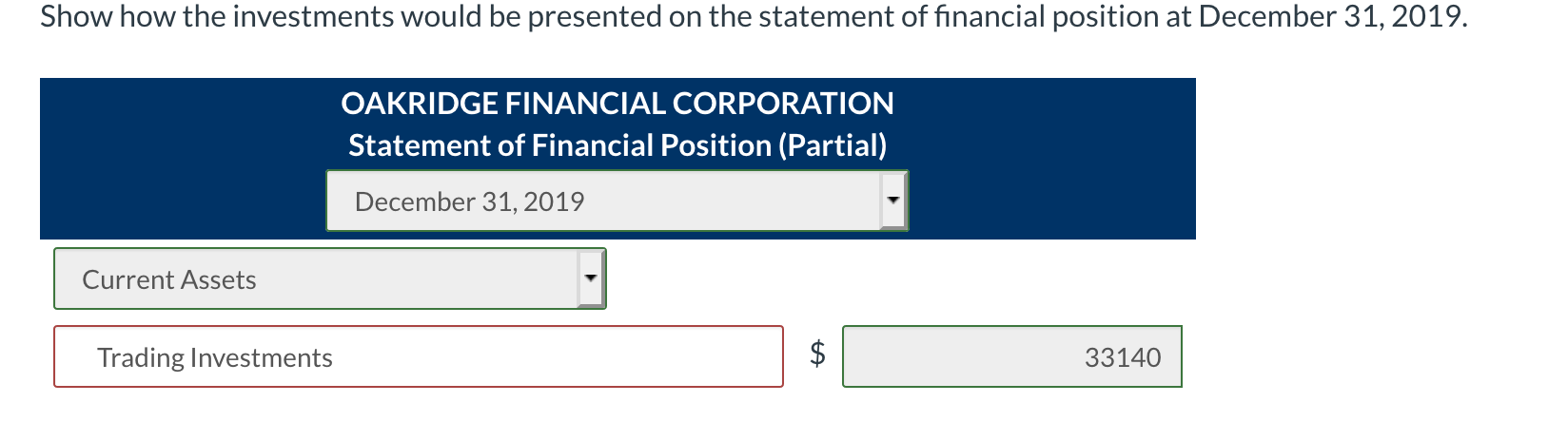

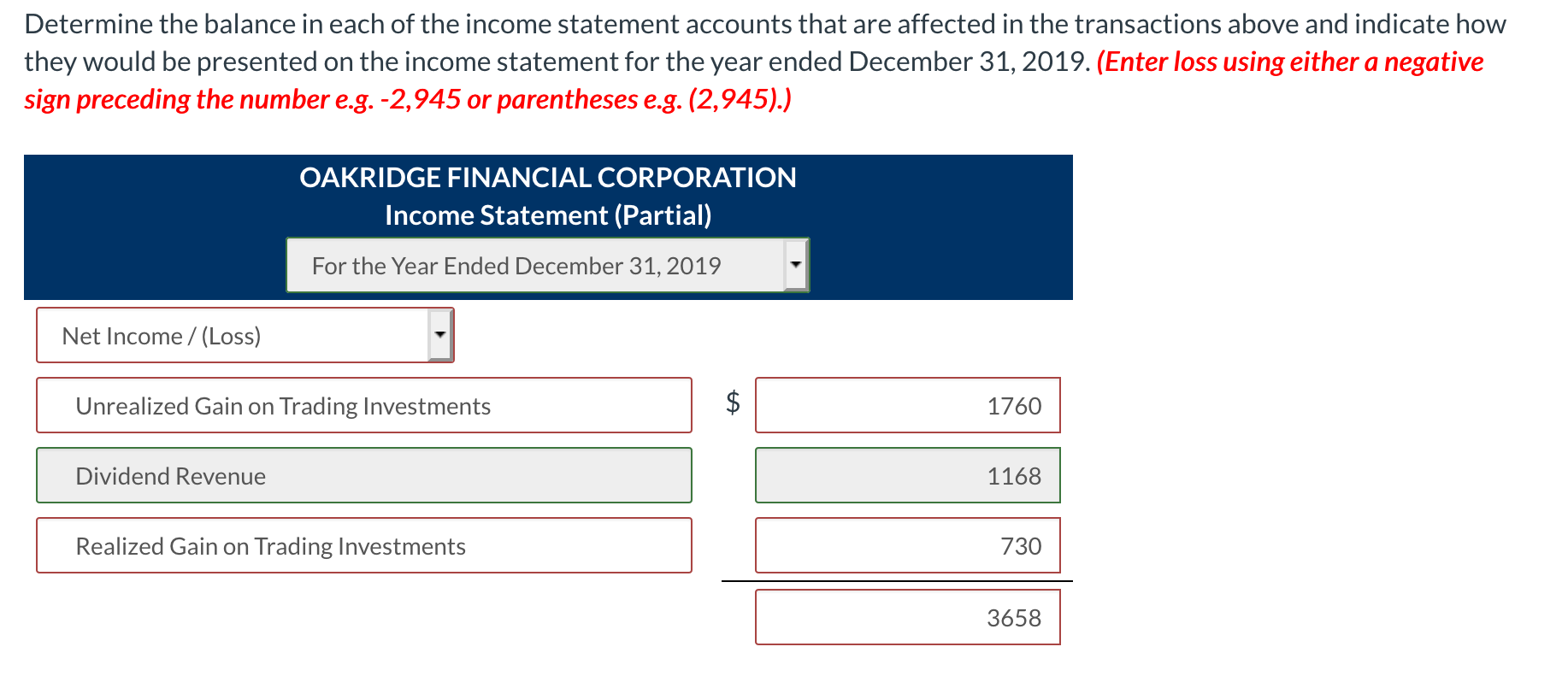

During 2018, Oak Ridge Financial Corporation had the following held for trading investment transactions: Feb. 1 Purchased 660 CBF common shares for $38,280. Mar. 1 Purchased 730 RSD common shares for $22,630. Apr. 1 Purchased 6% MRT bonds at face value, for $58,000. Interest is received semi-annually on April 1 and October 1. July 1 Received a cash dividend of $3 per share on the CBF common shares. Aug. 1 Sold 220 CBF common shares at $56 per share. Sept. 1 Received a cash dividend of $1.60 per share on the RSD common shares. Oct. 1 Received the semi-annual interest on the MRT bonds. 1 Sold the MRT bonds for $59,900. Dec. 31 The market prices of the CBF and RSD common shares were $53 and $32 per share, respectively. Oak Ridge had the following held for trading investment transactions in 2019: Mar. 1 Sold 440 CBF common shares for $25,080. June 1 Purchased 2,000 KEF common shares for $26,000. Sept. 1 Received a cash dividend of $1.60 per share on the RSD common shares. Oct. 1 Sold 365 RSD common shares for $12,410. Dec. 31 The market prices of the RSD and KEF common shares were $36 and $10 per share, respectively. Record the above 2019 transactions including any required adjusting entries, continuing the use of the fair value through profit or loss model. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Record entries in the order presented in the question.) Date Account Titles and Explanation Debit Credit Mar. 1 Cash 25080 Unrealized Loss on Held for Trading Investments 2200 Investment in Associates 25520 June 1 Investment in Associates 26000 Cash 26000 Sept. 1 Cash 1168 Dividend Revenue 1168 Oct. 1 Cash 12410 Unrealized Gain on Held for Trading Investments 365 Investment in Associates 11315 Dec. 31 Unrealized Gain on Held for Trading Investments 6000 Unrealized Loss on Held for Trading Investments 6000 Show how the investments would be presented on the statement of financial position at December 31, 2019. OAKRIDGE FINANCIAL CORPORATION Statement of Financial Position (Partial) December 31, 2019 Current Assets Trading Investments $ 33140 Determine the balance in each of the income statement accounts that are affected in the transactions above and indicate how they would be presented on the income statement for the year ended December 31, 2019. (Enter loss using either a negative sign preceding the number e.g. -2,945 or parentheses e.g. (2,945).) OAKRIDGE FINANCIAL CORPORATION Income Statement (Partial) For the Year Ended December 31, 2019 Net Income / (Loss) Unrealized Gain on Trading Investments ta 1760 Dividend Revenue 1168 Realized Gain on Trading Investments 730 3658