Answered step by step

Verified Expert Solution

Question

1 Approved Answer

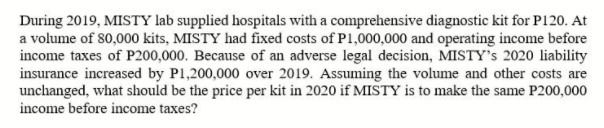

During 2019, MISTY lab supplied hospitals with a comprehensive diagnostic kit for P120. At a volume of 80,000 kits, MISTY had fixed costs of

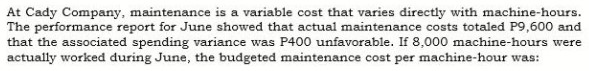

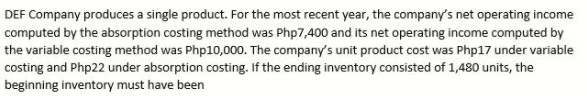

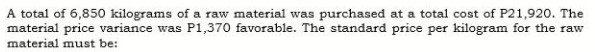

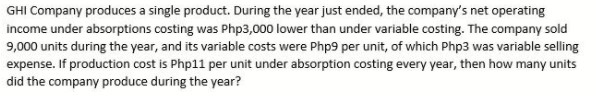

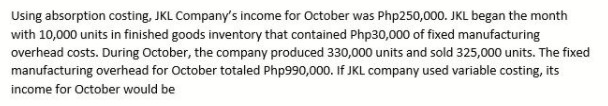

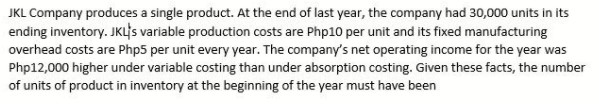

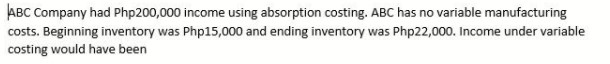

During 2019, MISTY lab supplied hospitals with a comprehensive diagnostic kit for P120. At a volume of 80,000 kits, MISTY had fixed costs of P1,000,000 and operating income before income taxes of P200,000. Because of an adverse legal decision, MISTY's 2020 liability insurance increased by P1,200,000 over 2019. Assuming the volume and other costs are unchanged, what should be the price per kit in 2020 if MISTY is to make the same P200,000 income before income taxes? At Cady Company, maintenance is a variable cost that varies directly with machine-hours. The performance report for June showed that actual maintenance costs totaled P9,600 and that the associated spending variance was P400 unfavorable. If 8,000 machine-hours were actually worked during June, the budgeted maintenance cost per machine-hour was: DEF Company produces a single product. For the most recent year, the company's net operating income computed by the absorption costing method was Php7,400 and its net operating income computed by the variable costing method was Php10,000. The company's unit product cost was Php17 under variable costing and Php22 under absorption costing. If the ending inventory consisted of 1,480 units, the beginning inventory must have been A total of 6,850 kilograms of a raw material was purchased at a total cost of P21,920. The material price variance was P1,370 favorable. The standard price per kilogram for the raw material must be: GHI Company produces a single product. During the year just ended, the company's net operating income under absorptions costing was Php3,000 lower than under variable costing. The company sold 9,000 units during the year, and its variable costs were Php9 per unit, of which Php3 was variable selling expense. If production cost is Php11 per unit under absorption costing every year, then how many units did the company produce during the year? Using absorption costing, JKL Company's income for October was Php250,000. JKL began the month with 10,000 units in finished goods inventory that contained Php30,000 of fixed manufacturing overhead costs. During October, the company produced 330,000 units and sold 325,000 units. The fixed manufacturing overhead for October totaled Php990,000. If JKL company used variable costing, its income for October would be JKL Company produces a single product. At the end of last year, the company had 30,000 units in its ending inventory. JKL's variable production costs are Php10 per unit and its fixed manufacturing overhead costs are Php5 per unit every year. The company's net operating income for the year was Php12,000 higher under variable costing than under absorption costing. Given these facts, the number of units of product in inventory at the beginning of the year must have been ABC Company had Php200,000 income using absorption costing. ABC has no variable manufacturing costs. Beginning inventory was Php15,000 and ending inventory was Php22,000. Income under variable costing would have been

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started