Answered step by step

Verified Expert Solution

Question

1 Approved Answer

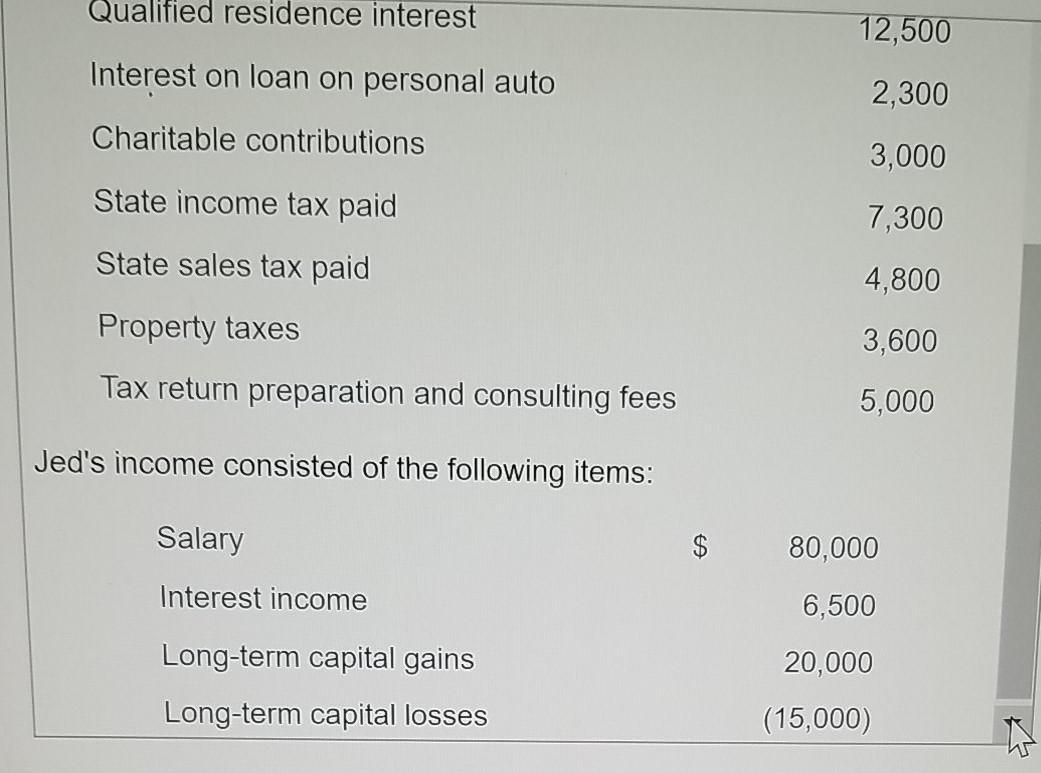

During 2020, Jed, a single, cash method taxpayer had the following income items and expenditures: (Click the icon to view the income items and

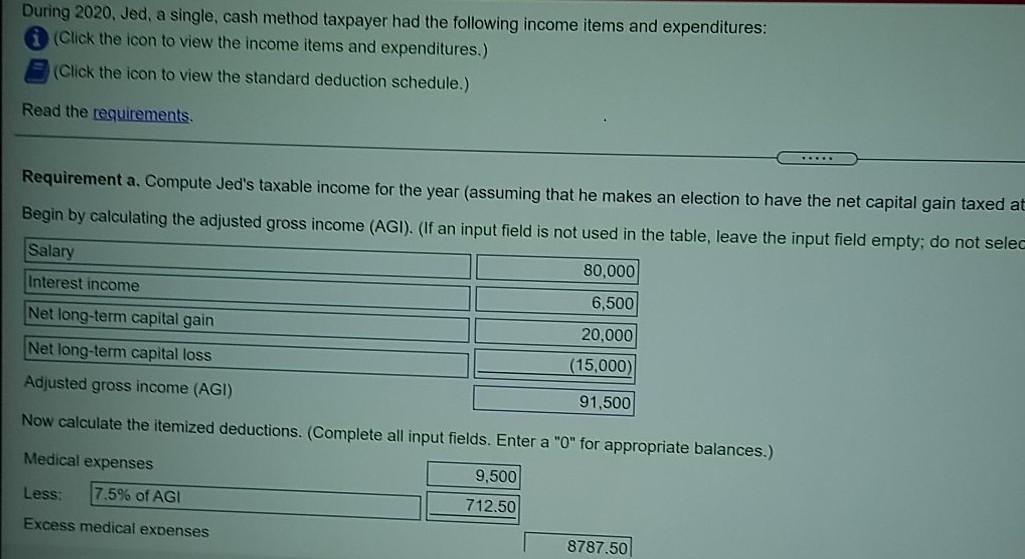

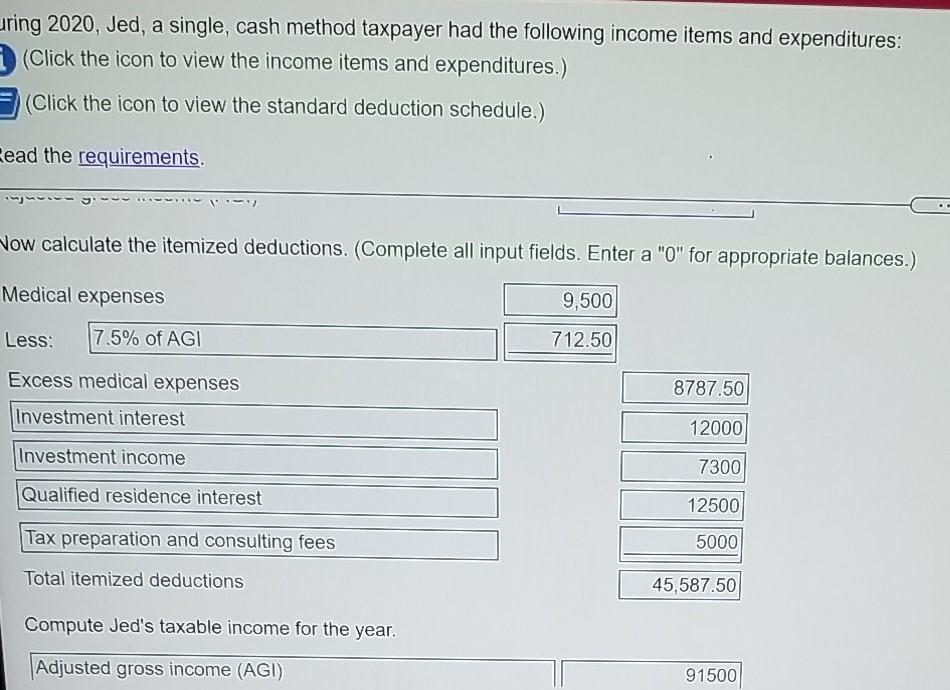

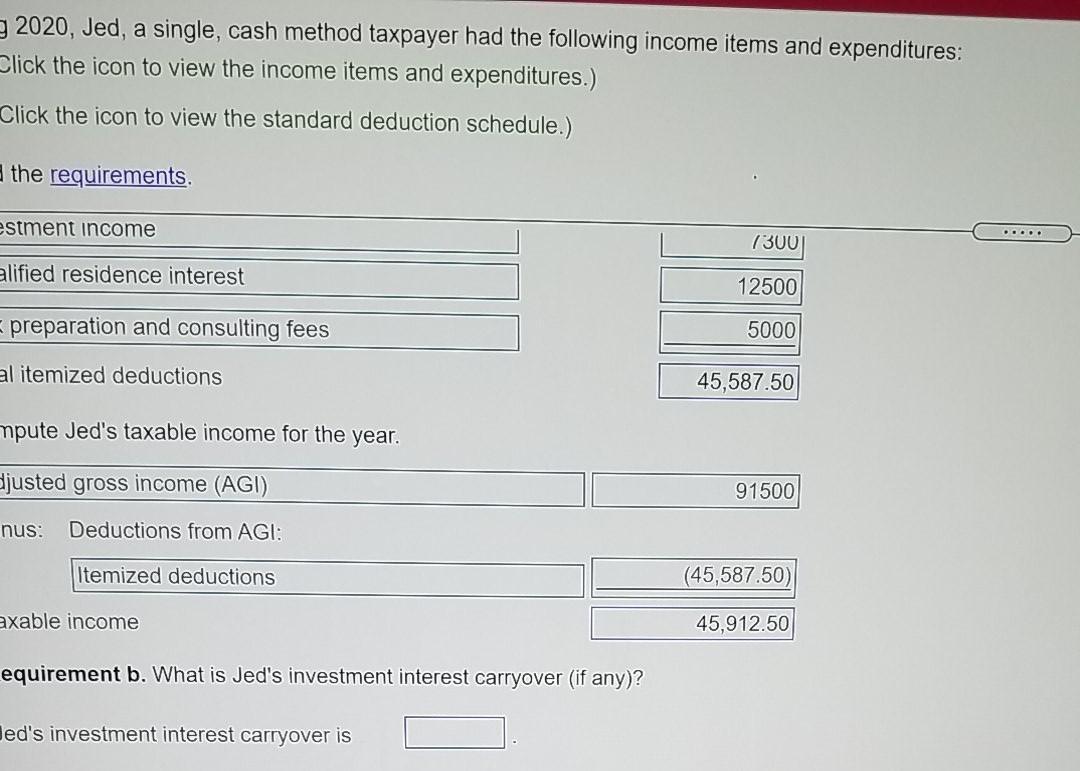

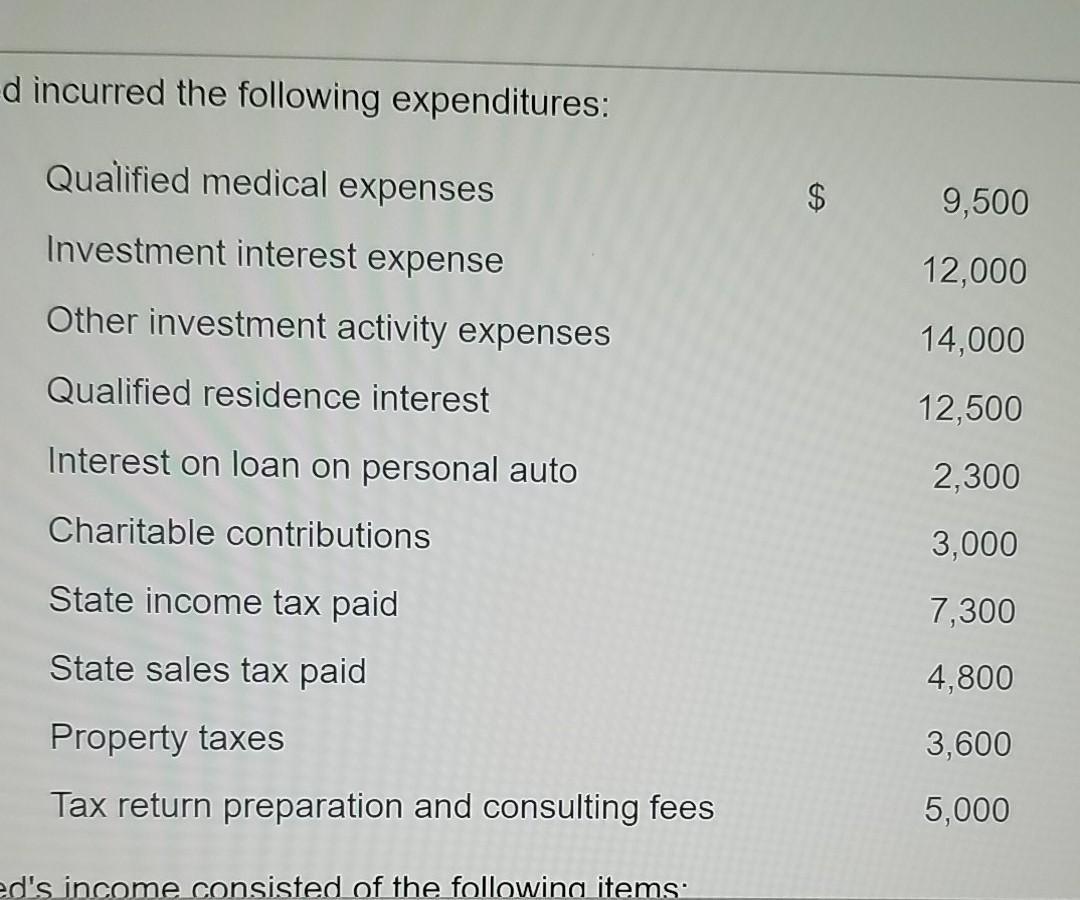

During 2020, Jed, a single, cash method taxpayer had the following income items and expenditures: (Click the icon to view the income items and expenditures.) (Click the icon to view the standard deduction schedule.) Read the requirements. Requirement a. Compute Jed's taxable income for the year (assuming that he makes an election to have the net capital gain taxed at Begin by calculating the adjusted gross income (AGI). (If an input field is not used in the table, leave the input field empty; do not selec Salary Interest income Net long-term capital gain Net long-term capital loss Adjusted gross income (AGI) Now calculate the itemized deductions. (Complete all input fields. Enter a "0" for appropriate balances.) Medical expenses Less: 7.5% of AGI Excess medical expenses 80,000 6,500 20,000 (15,000) 91,500 9,500 712.50 ***** 8787.50 uring 2020, Jed, a single, cash method taxpayer had the following income items and expenditures: (Click the icon to view the income items and expenditures.) (Click the icon to view the standard deduction schedule.) Read the requirements. Now calculate the itemized deductions. (Complete all input fields. Enter a "0" for appropriate balances.) Medical expenses Less: 7.5% of AGI Excess medical expenses Investment interest Investment income Qualified residence interest Tax preparation and consulting fees Total itemized deductions Compute Jed's taxable income for the year. Adjusted gross income (AGI) 9,500 712.50 8787.50 12000 7300 12500 5000 45,587.50 91500 2020, Jed, a single, cash method taxpayer had the following income items and expenditures: Click the icon to view the income items and expenditures.) Click the icon to view the standard deduction schedule.) the requirements. estment income alified residence interest preparation and consulting fees al itemized deductions mpute Jed's taxable income for the year. djusted gross income (AGI) nus: Deductions from AGI: Itemized deductions axable income equirement b. What is Jed's investment interest carryover (if any)? ed's investment interest carryover is 7300 12500 5000 45,587.50 91500 (45,587.50) 45,912.50 ..... d incurred the following expenditures: Qualified medical expenses Investment interest expense Other investment activity expenses Qualified residence interest Interest on loan on personal auto Charitable contributions State income tax paid State sales tax paid Property taxes Tax return preparation and consulting fees ed's income consisted of the following items: $ 9,500 12,000 14,000 12,500 2,300 3,000 7,300 4,800 3,600 5,000 Qualified residence interest Interest on loan on personal auto Charitable contributions State income tax paid State sales tax paid Property taxes Tax return preparation and consulting fees Jed's income consisted of the following items: Salary Interest income Long-term capital gains Long-term capital losses $ 12,500 2,300 3,000 7,300 4,800 3,600 5,000 80,000 6,500 20,000 (15,000) W

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Requirement a Jeds taxable income for the year 2020 is 4591250 Step 1 Calculate Jeds adjusted gross ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started