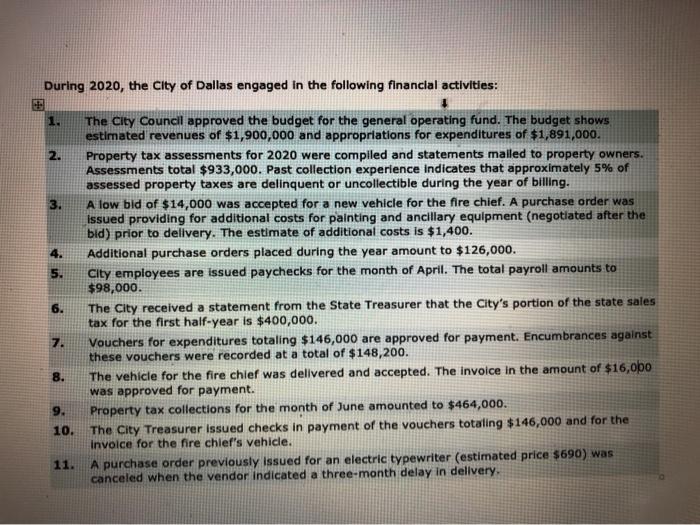

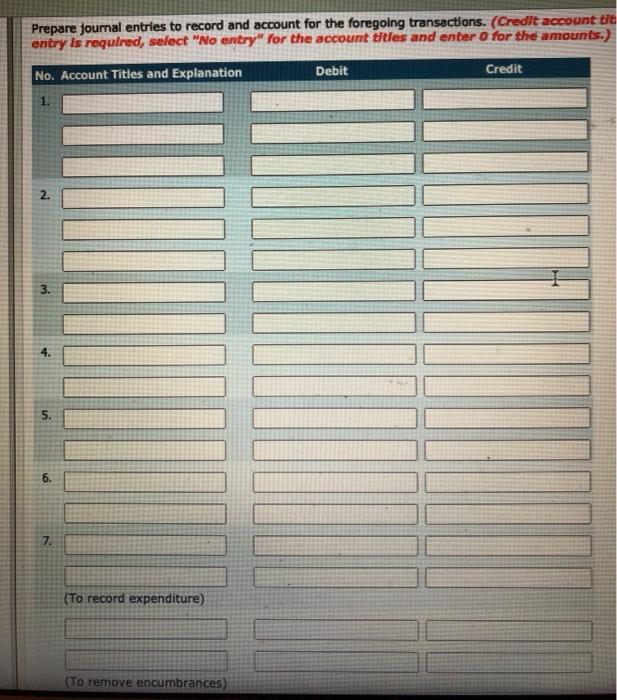

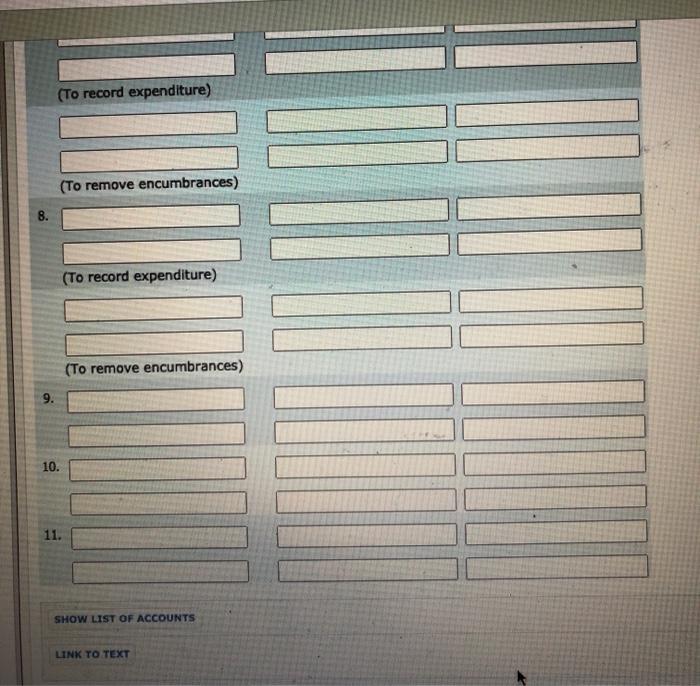

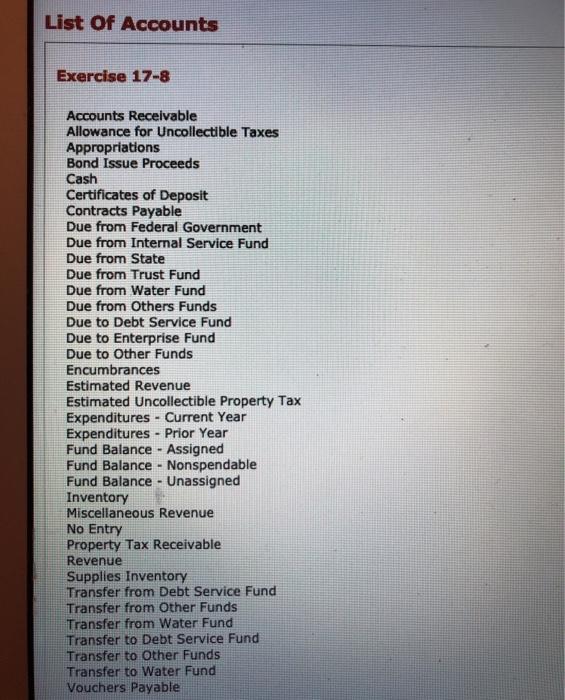

During 2020, the City of Dallas engaged in the following financial activities: CE . 1. The City Council approved the budget for the general operating fund. The budget shows estimated revenues of $1,900,000 and appropriations for expenditures of $1,891,000. 2. Property tax assessments for 2020 were compiled and statements mailed to property owners. Assessments total $933,000. Past collection experience indicates that approximately 5% of assessed property taxes are delinquent or uncollectible during the year of billing. 3. A low bld of $14,000 was accepted for a new vehicle for the fire chief. A purchase order was issued providing for additional costs for painting and ancillary equipment (negotiated after the bid) prior to delivery. The estimate of additional costs $1,400. 4. Additional purchase orders placed during the year amount to $126,000. 5. City employees are issued paychecks for the month of April. The total payroll amounts to $98,000. 6. The City received a statement from the State Treasurer that the City's portion of the state sales tax for the first half-year is $400,000. 7. Vouchers for expenditures totaling $146,000 are approved for payment. Encumbrances against these vouchers were recorded at a total of $148,200. 8. The vehicle for the fire chief was delivered and accepted. The invoice in the amount of $16,000 was approved for payment. 9. Property tax collections for the month of June amounted to $464,000. 10. The City Treasurer issued checks in payment of the vouchers totaling $146,000 and for the invoice for the fire chief's vehicle. 11. A purchase order previously issued for an electric typewriter (estimated price $690) was canceled when the vendor indicated a three-month delay in delivery. Prepare journal entries to record and account for the foregoing transactions. (Credit account tit entry is required, select "No entry" for the account titles and enter for the amounts.) Debit Credit No. Account Titles and Explanation 1. 2. 3. 4. 5. 6. 7. (To record expenditure) (To remove encumbrances) (To record expenditure) (To remove encumbrances) 8. (To record expenditure) (To remove encumbrances) 9. 10. 11. SHOW LIST OF ACCOUNTS LINK TO TEXT List of Accounts Exercise 17-8 Accounts Receivable Allowance for Uncollectible Taxes Appropriations Bond Issue Proceeds Cash Certificates of Deposit Contracts Payable Due from Federal Government Due from Internal Service Fund Due from State Due from Trust Fund Due from Water Fund Due from Others Funds Due to Debt Service Fund Due to Enterprise Fund Due to Other Funds Encumbrances Estimated Revenue Estimated Uncollectible Property Tax Expenditures - Current Year Expenditures - Prior Year Fund Balance - Assigned Fund Balance - Nonspendable Fund Balance - Unassigned Inventory Miscellaneous Revenue No Entry Property Tax Receivable Revenue Supplies Inventory Transfer from Debt Service Fund Transfer from Other Funds Transfer from Water Fund Transfer to Debt Service Fund Transfer to Other Funds Transfer to Water Fund Vouchers Payable During 2020, the City of Dallas engaged in the following financial activities: CE . 1. The City Council approved the budget for the general operating fund. The budget shows estimated revenues of $1,900,000 and appropriations for expenditures of $1,891,000. 2. Property tax assessments for 2020 were compiled and statements mailed to property owners. Assessments total $933,000. Past collection experience indicates that approximately 5% of assessed property taxes are delinquent or uncollectible during the year of billing. 3. A low bld of $14,000 was accepted for a new vehicle for the fire chief. A purchase order was issued providing for additional costs for painting and ancillary equipment (negotiated after the bid) prior to delivery. The estimate of additional costs $1,400. 4. Additional purchase orders placed during the year amount to $126,000. 5. City employees are issued paychecks for the month of April. The total payroll amounts to $98,000. 6. The City received a statement from the State Treasurer that the City's portion of the state sales tax for the first half-year is $400,000. 7. Vouchers for expenditures totaling $146,000 are approved for payment. Encumbrances against these vouchers were recorded at a total of $148,200. 8. The vehicle for the fire chief was delivered and accepted. The invoice in the amount of $16,000 was approved for payment. 9. Property tax collections for the month of June amounted to $464,000. 10. The City Treasurer issued checks in payment of the vouchers totaling $146,000 and for the invoice for the fire chief's vehicle. 11. A purchase order previously issued for an electric typewriter (estimated price $690) was canceled when the vendor indicated a three-month delay in delivery. Prepare journal entries to record and account for the foregoing transactions. (Credit account tit entry is required, select "No entry" for the account titles and enter for the amounts.) Debit Credit No. Account Titles and Explanation 1. 2. 3. 4. 5. 6. 7. (To record expenditure) (To remove encumbrances) (To record expenditure) (To remove encumbrances) 8. (To record expenditure) (To remove encumbrances) 9. 10. 11. SHOW LIST OF ACCOUNTS LINK TO TEXT List of Accounts Exercise 17-8 Accounts Receivable Allowance for Uncollectible Taxes Appropriations Bond Issue Proceeds Cash Certificates of Deposit Contracts Payable Due from Federal Government Due from Internal Service Fund Due from State Due from Trust Fund Due from Water Fund Due from Others Funds Due to Debt Service Fund Due to Enterprise Fund Due to Other Funds Encumbrances Estimated Revenue Estimated Uncollectible Property Tax Expenditures - Current Year Expenditures - Prior Year Fund Balance - Assigned Fund Balance - Nonspendable Fund Balance - Unassigned Inventory Miscellaneous Revenue No Entry Property Tax Receivable Revenue Supplies Inventory Transfer from Debt Service Fund Transfer from Other Funds Transfer from Water Fund Transfer to Debt Service Fund Transfer to Other Funds Transfer to Water Fund Vouchers Payable