Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During 2022, Right Corp. had outstanding 125,00 shares of common stock and 7,500 shares of noncumulative, 8%, P 50 par preferred stock. Each preferred

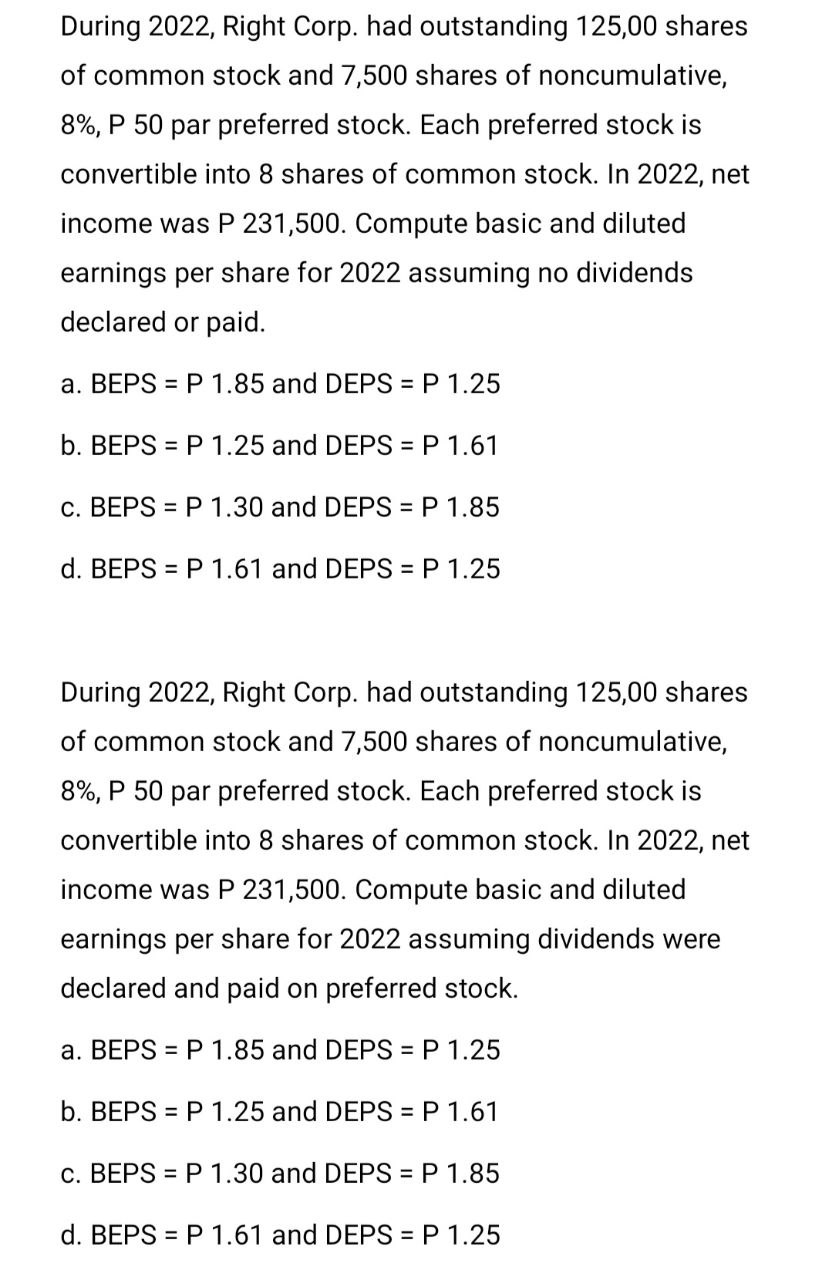

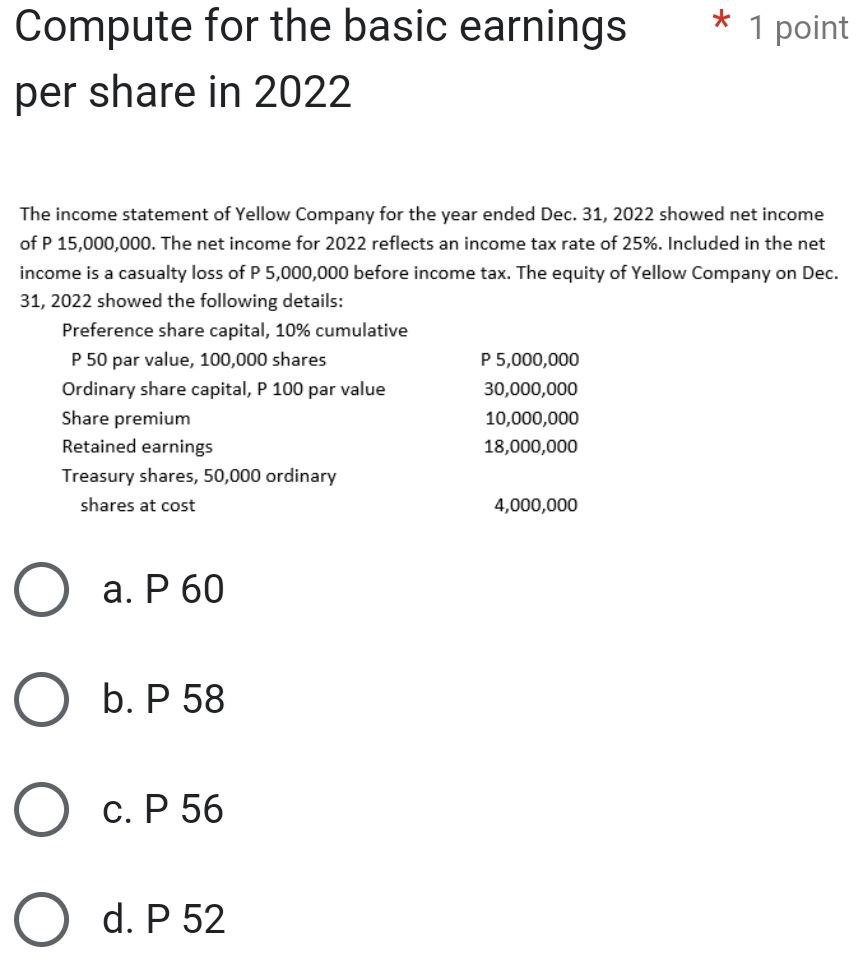

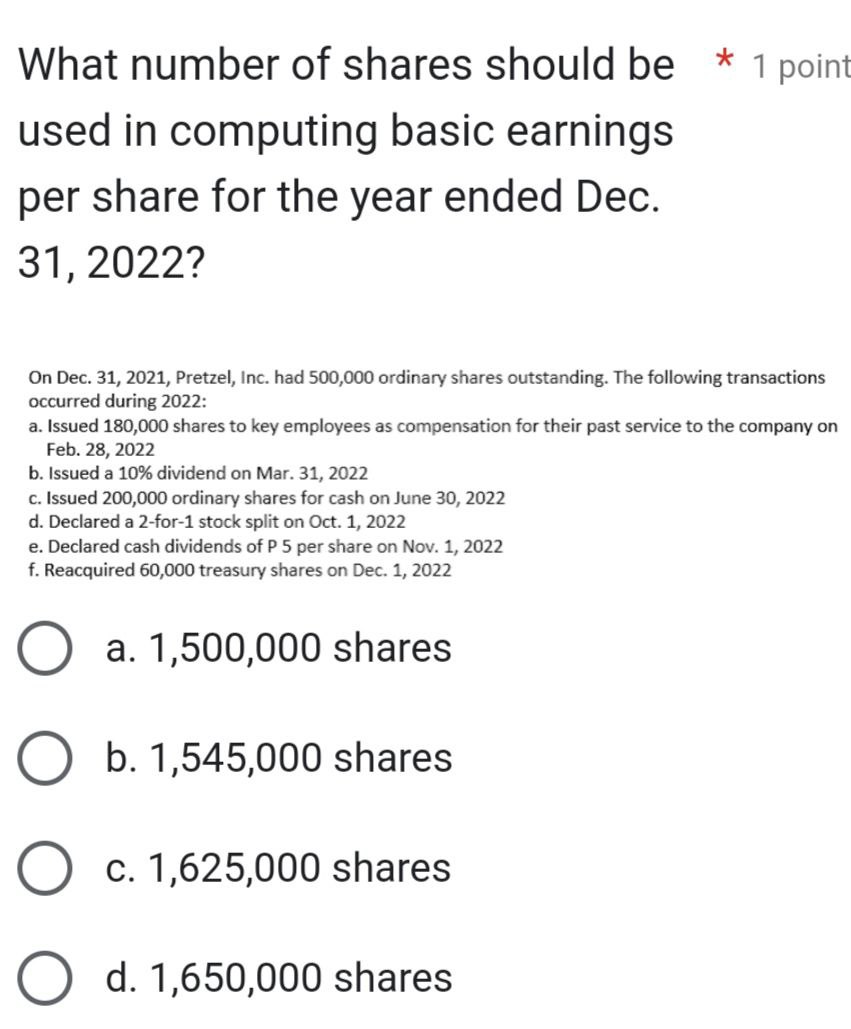

During 2022, Right Corp. had outstanding 125,00 shares of common stock and 7,500 shares of noncumulative, 8%, P 50 par preferred stock. Each preferred stock is convertible into 8 shares of common stock. In 2022, net income was P 231,500. Compute basic and diluted earnings per share for 2022 assuming no dividends declared or paid. a. BEPS P 1.85 and DEPS = P 1.25 b. BEPS P 1.25 and DEPS = P 1.61 = = c. BEPS P1.30 and DEPS = P 1.85 d. BEPS P 1.61 and DEPS = P 1.25 During 2022, Right Corp. had outstanding 125,00 shares of common stock and 7,500 shares of noncumulative, 8%, P 50 par preferred stock. Each preferred stock is convertible into 8 shares of common stock. In 2022, net income was P 231,500. Compute basic and diluted earnings per share for 2022 assuming dividends were declared and paid on preferred stock. a. BEPS P 1.85 and DEPS = P 1.25 b. BEPS P 1.25 and DEPS = P 1.61 = c. BEPS P 1.30 and DEPS = P 1.85 = d. BEPS P 1.61 and DEPS = P 1.25 = Compute for the basic earnings per share in 2022 * 1 point The income statement of Yellow Company for the year ended Dec. 31, 2022 showed net income of P 15,000,000. The net income for 2022 reflects an income tax rate of 25%. Included in the net income is a casualty loss of P 5,000,000 before income tax. The equity of Yellow Company on Dec. 31, 2022 showed the following details: Preference share capital, 10% cumulative P 50 par value, 100,000 shares Ordinary share capital, P 100 par value Share premium Retained earnings P 5,000,000 30,000,000 10,000,000 18,000,000 Treasury shares, 50,000 ordinary shares at cost a. P 60 b. P 58 c. P 56 d. P 52 4,000,000 What number of shares should be used in computing basic earnings per share for the year ended Dec. 31, 2022? * * 1 point On Dec. 31, 2021, Pretzel, Inc. had 500,000 ordinary shares outstanding. The following transactions occurred during 2022: a. Issued 180,000 shares to key employees as compensation for their past service to the company on Feb. 28, 2022 b. Issued a 10% dividend on Mar. 31, 2022 c. Issued 200,000 ordinary shares for cash on June 30, 2022 d. Declared a 2-for-1 stock split on Oct. 1, 2022 e. Declared cash dividends of P 5 per share on Nov. 1, 2022 f. Reacquired 60,000 treasury shares on Dec. 1, 2022 a. 1,500,000 shares O b. 1,545,000 shares c. 1,625,000 shares d. 1,650,000 shares

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started