Question

Mitchell Inc. received $568,547 from the issuance of 600, 6%, $1,000 bonds on January 1, 2020. The bonds pay cash interest semiannually each July

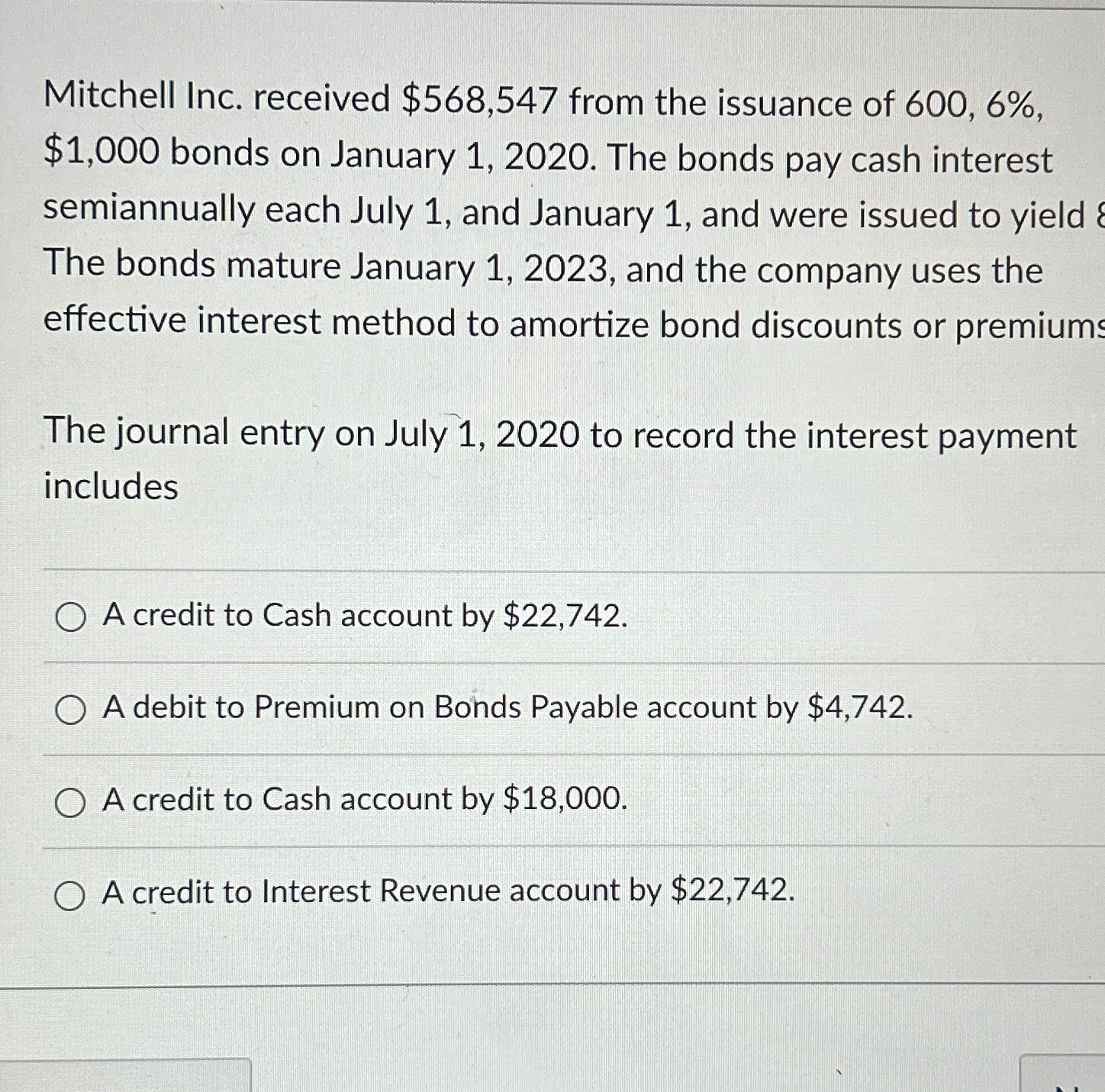

Mitchell Inc. received $568,547 from the issuance of 600, 6%, $1,000 bonds on January 1, 2020. The bonds pay cash interest semiannually each July 1, and January 1, and were issued to yield & The bonds mature January 1, 2023, and the company uses the effective interest method to amortize bond discounts or premiums The journal entry on July 1, 2020 to record the interest payment includes OA credit to Cash account by $22,742. A debit to Premium on Bonds Payable account by $4,742. A credit to Cash account by $18,000. OA credit to Interest Revenue account by $22,742.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate accounting

Authors: J. David Spiceland, James Sepe, Mark Nelson

7th edition

978-0077614041, 9780077446475, 77614046, 007744647X, 77647092, 978-0077647094

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App