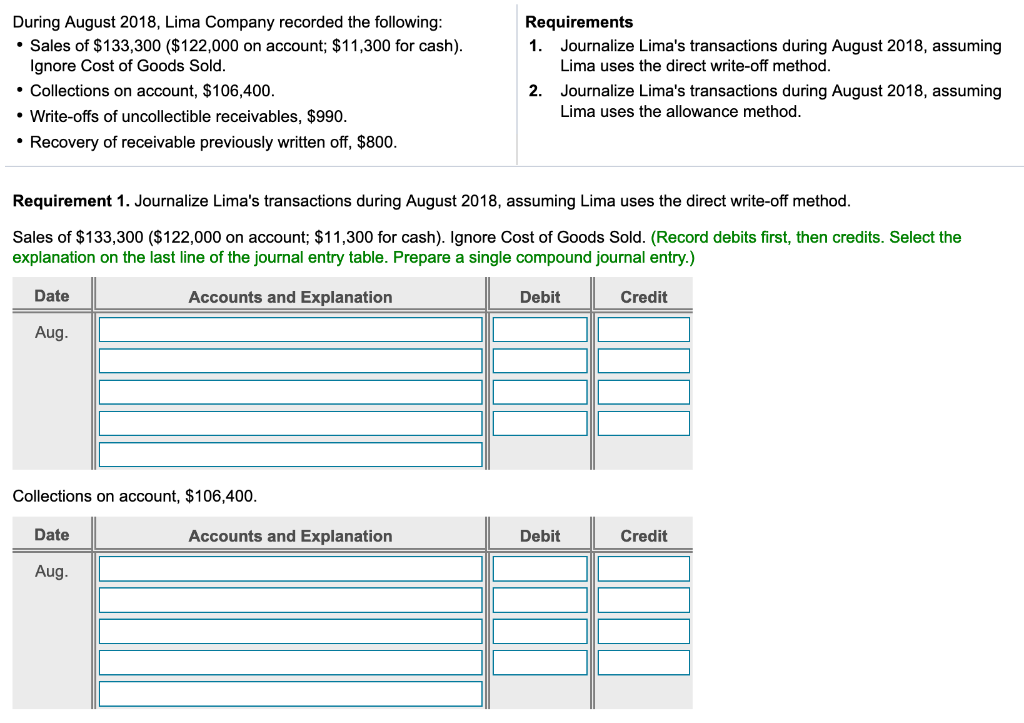

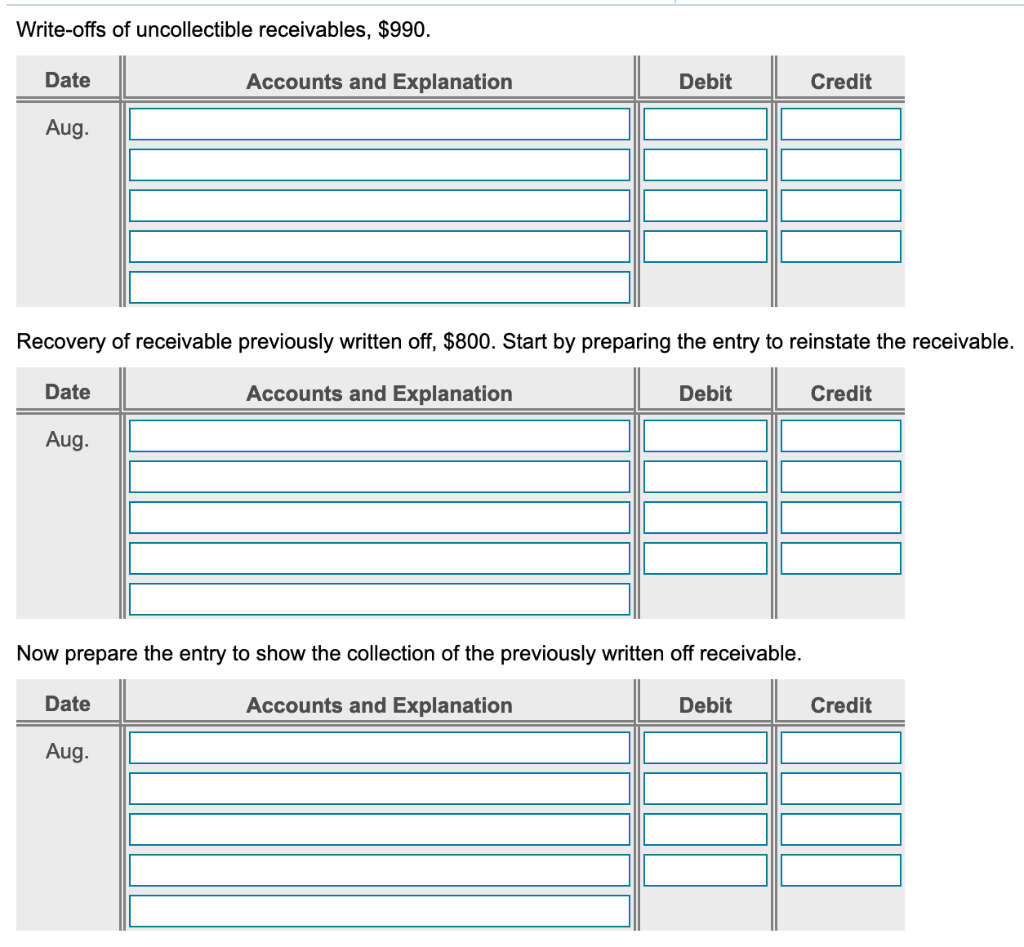

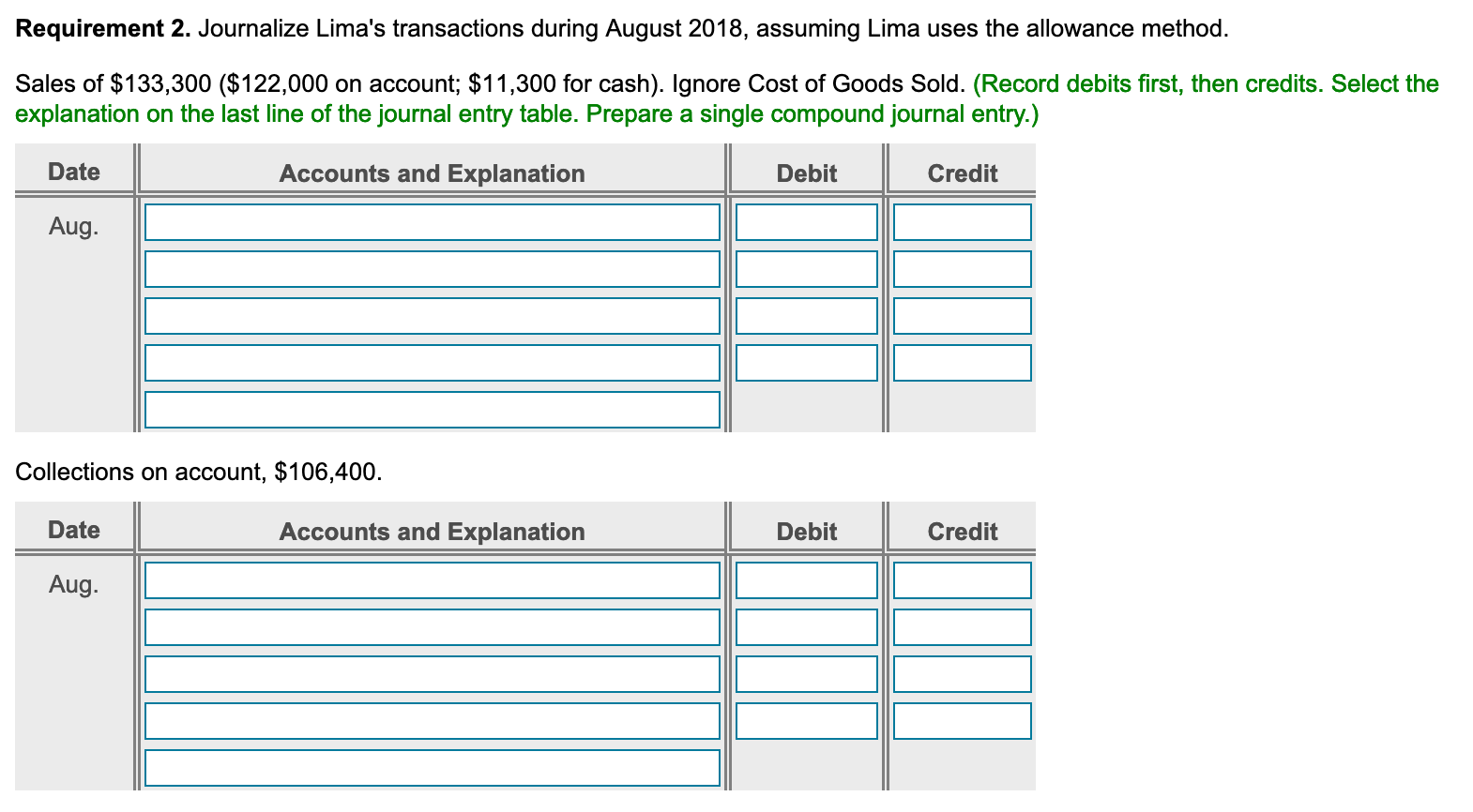

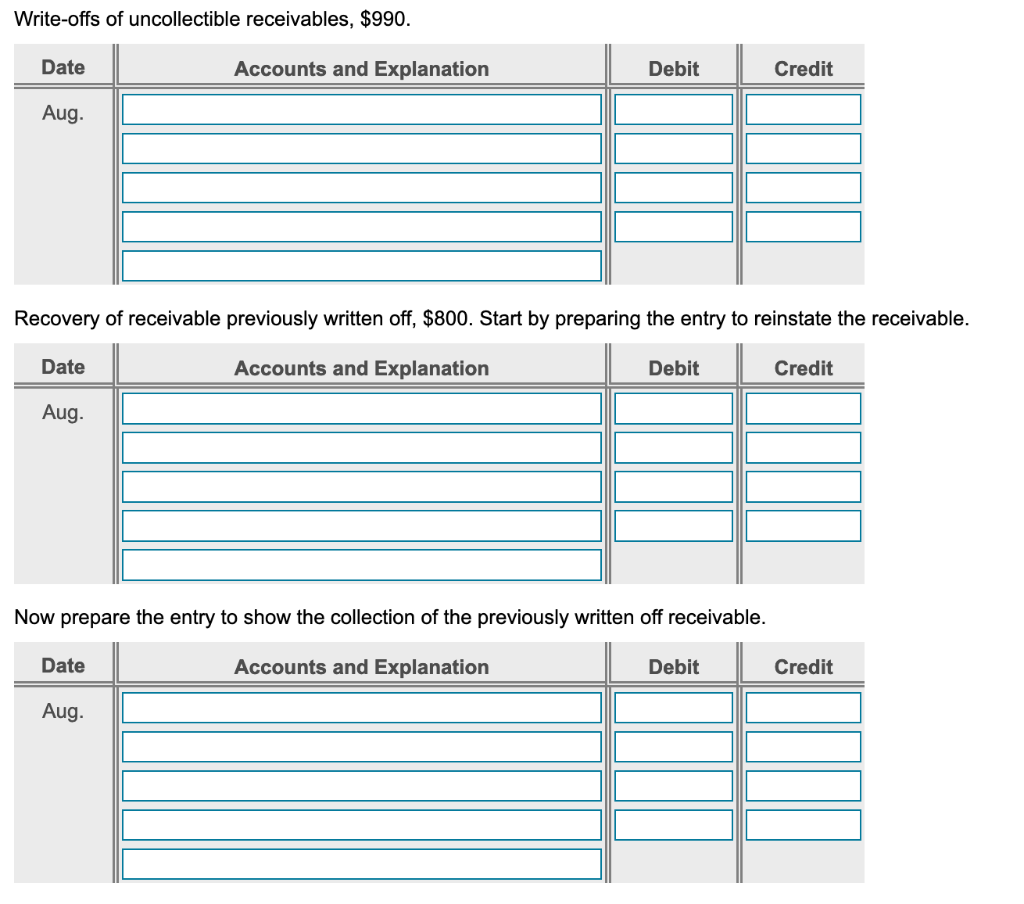

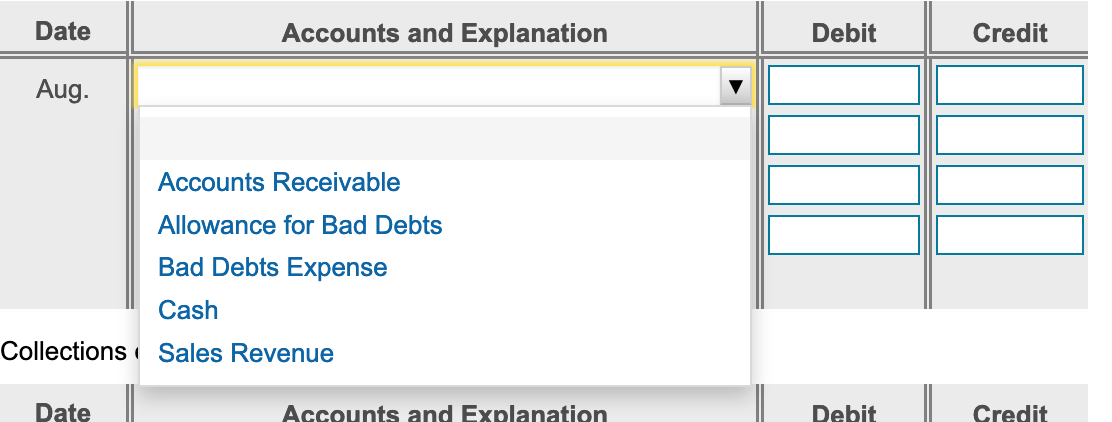

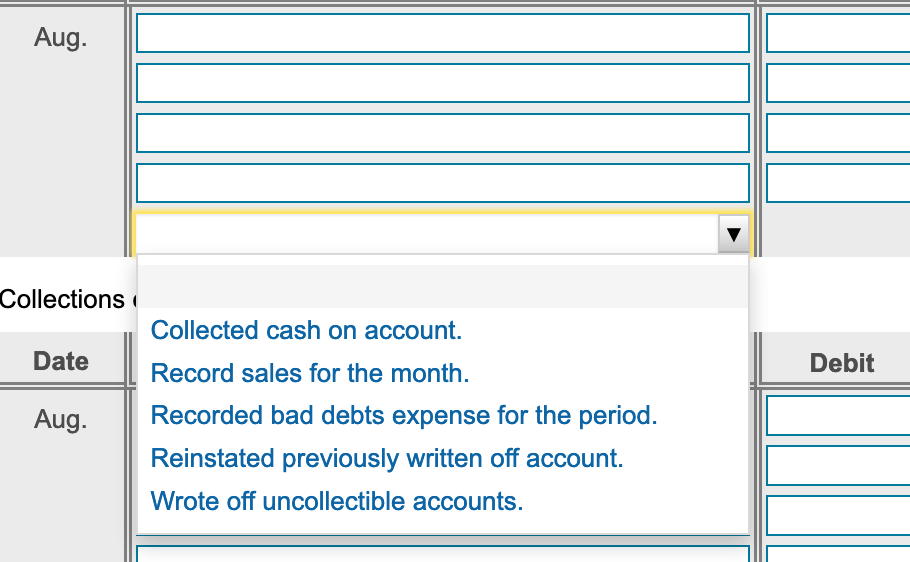

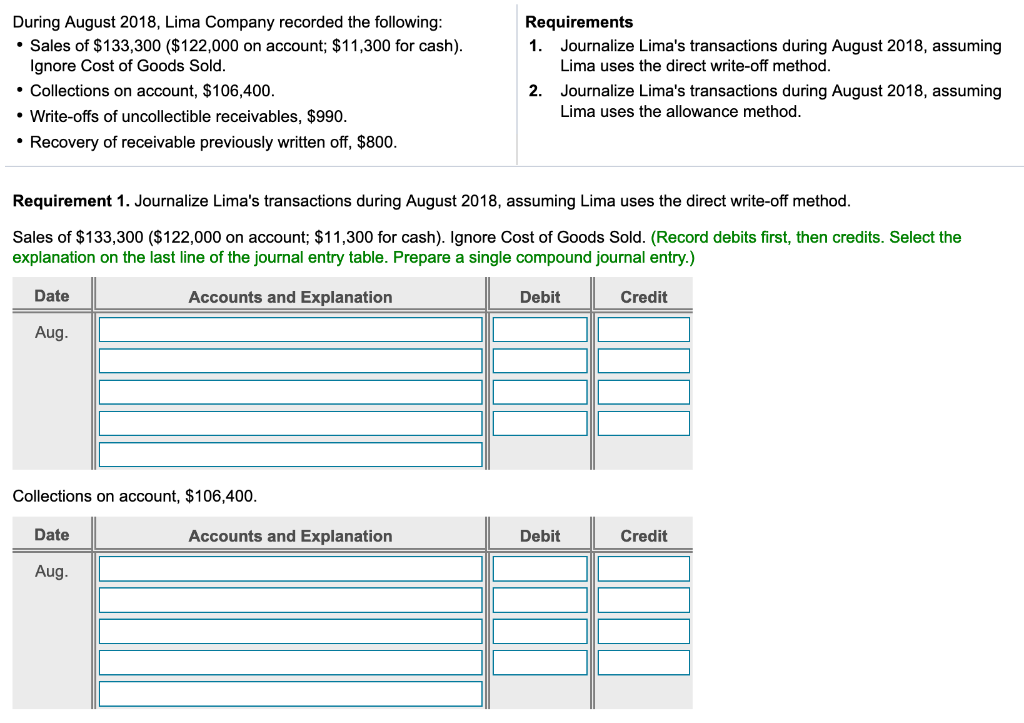

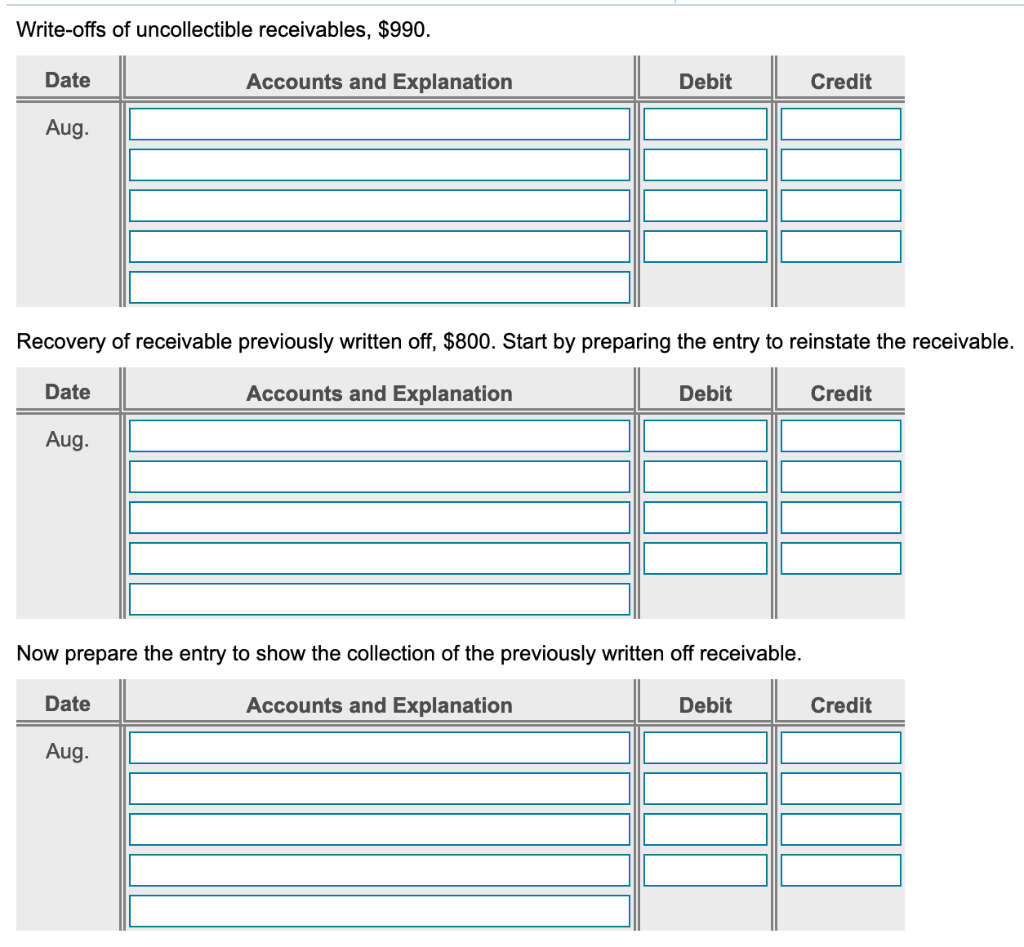

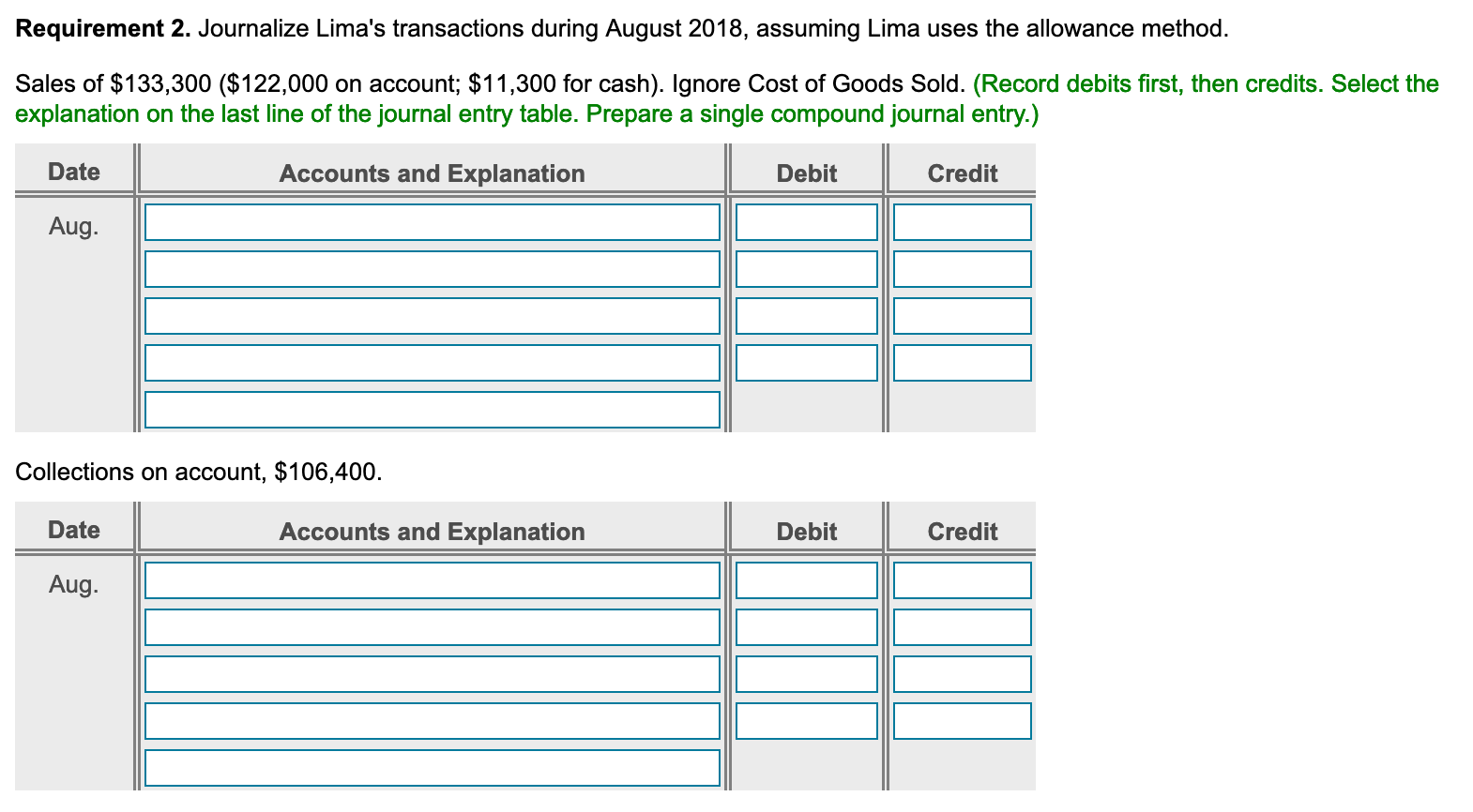

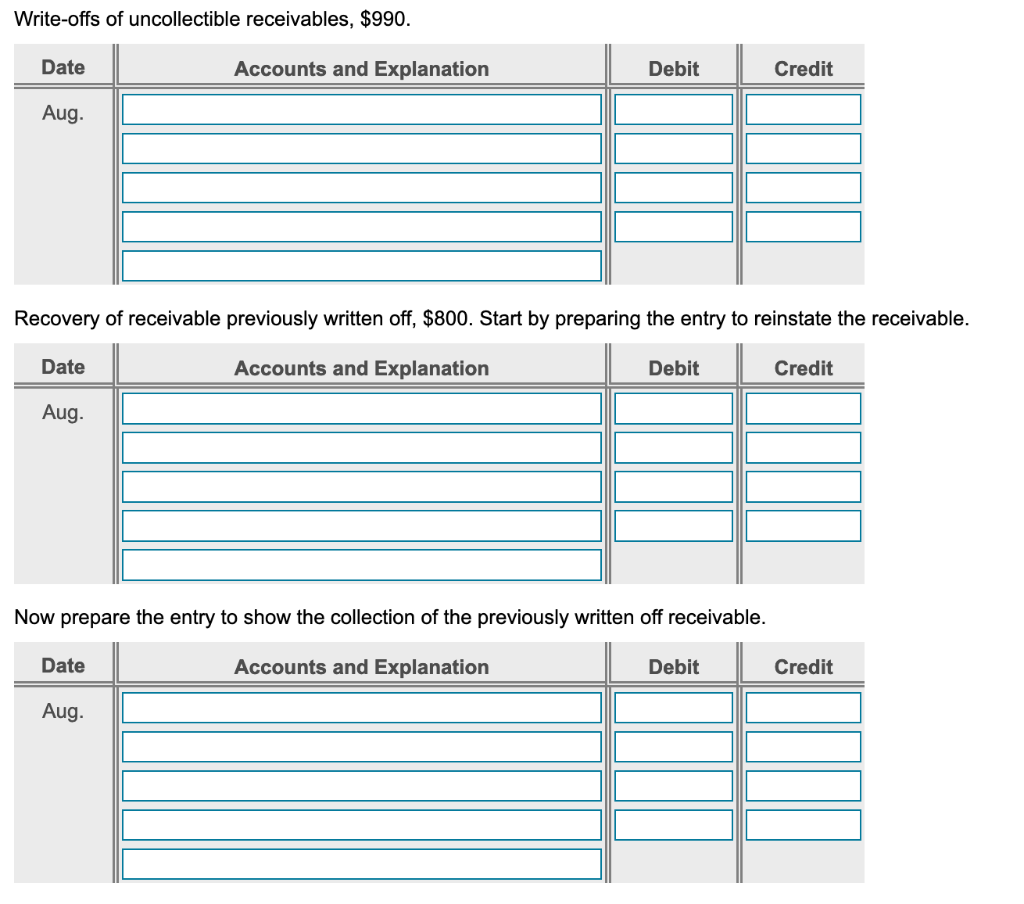

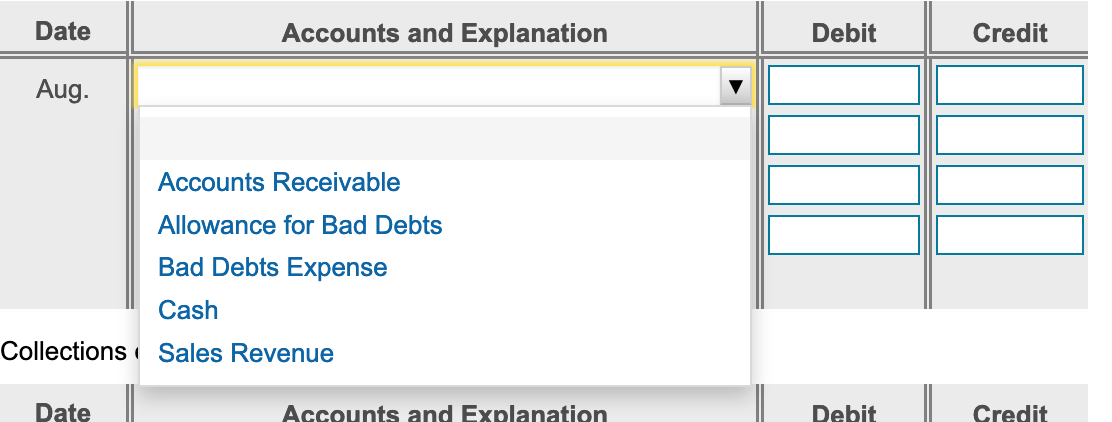

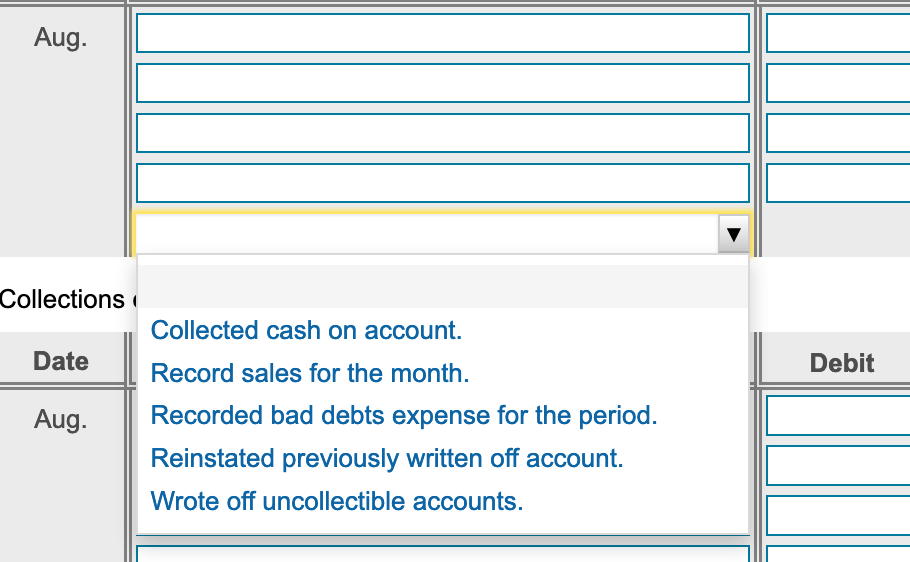

During August 2018, Lima Company recorded the following: Sales of $133,300 ($122,000 on account; $11,300 for cash). Ignore Cost of Goods Sold. Collections on account, $106,400. Write-offs of uncollectible receivables, $990. Recovery of receivable previously written off, $800. Requirements 1. Journalize Lima's transactions during August 2018, assuming Lima uses the direct write-off method. 2. Journalize Lima's transactions during August 2018, assuming Lima uses the allowance method. Requirement 1. Journalize Lima's transactions during August 2018, assuming Lima uses the direct write-off method. Sales of $133,300 ($122,000 on account; $11,300 for cash). Ignore Cost of Goods Sold. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. Prepare a single compound journal entry.) Date Accounts and Explanation Debit Credit Aug. Collections on account, $106,400. Date Accounts and Explanation Debit Credit Aug. Write-offs of uncollectible receivables, $990. Date Accounts and Explanation Debit Credit Aug. Recovery of receivable previously written off, $800. Start by preparing the entry to reinstate the receivable. Date Accounts and Explanation Debit Credit Aug. Now prepare the entry to show the collection of the previously written off receivable. Date Accounts and Explanation Debit Credit Aug. Requirement 2. Journalize Lima's transactions during August 2018, assuming Lima uses the allowance method. Sales of $133,300 ($122,000 on account; $11,300 for cash). Ignore Cost of Goods Sold. (Record debits first, then credits. Select the explanation on the last line of the journal entry table. Prepare a single compound journal entry.) Date Accounts and Explanation Debit Credit Aug. Collections on account, $106,400. Date Accounts and Explanation Debit Credit Aug. Write-offs of uncollectible receivables, $990. Date Accounts and Explanation Debit Credit Aug. Recovery of receivable previously written off, $800. Start by preparing the entry to reinstate the receivable. Date Accounts and Explanation Debit Credit Aug. Now prepare the entry to show the collection of the previously written off receivable. Date Accounts and Explanation Debit Credit Aug. Date Accounts and Explanation Debit Credit Aug. Accounts Receivable Allowance for Bad Debts Bad Debts Expense Cash Collections Sales Revenue Date Accounts and Explanation Debit Credit Aug. Collections Collected cash on account. Date Debit Aug. Record sales for the month. Recorded bad debts expense for the period. Reinstated previously written off account. Wrote off uncollectible accounts