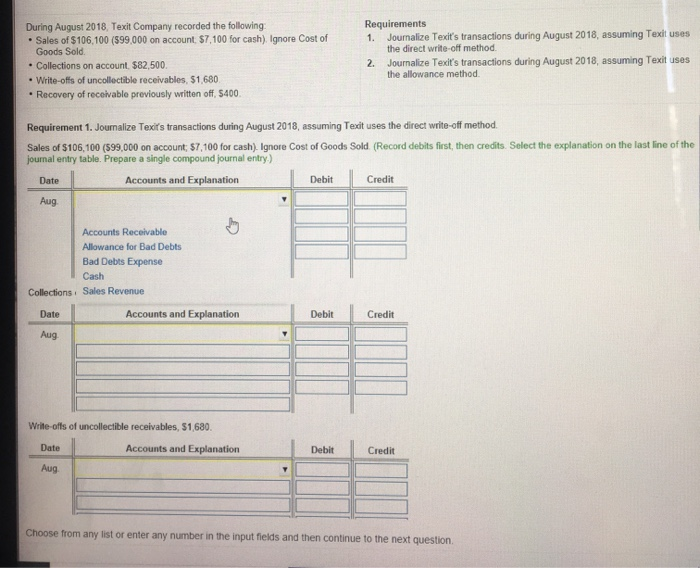

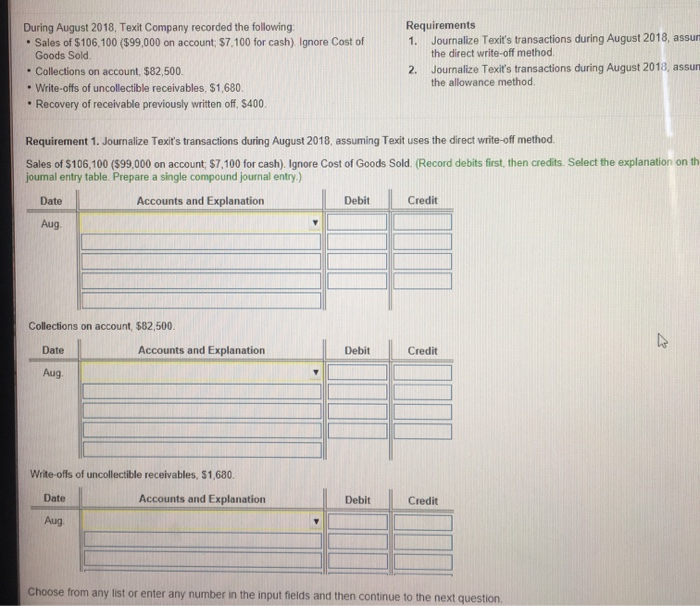

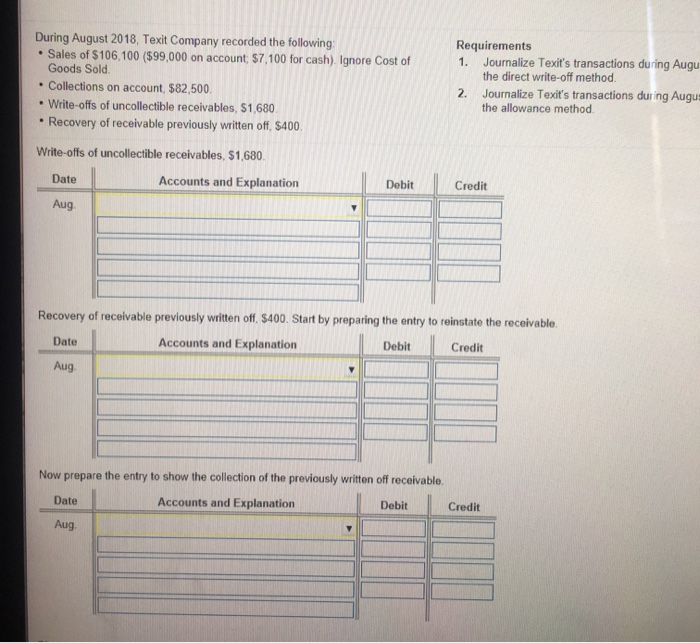

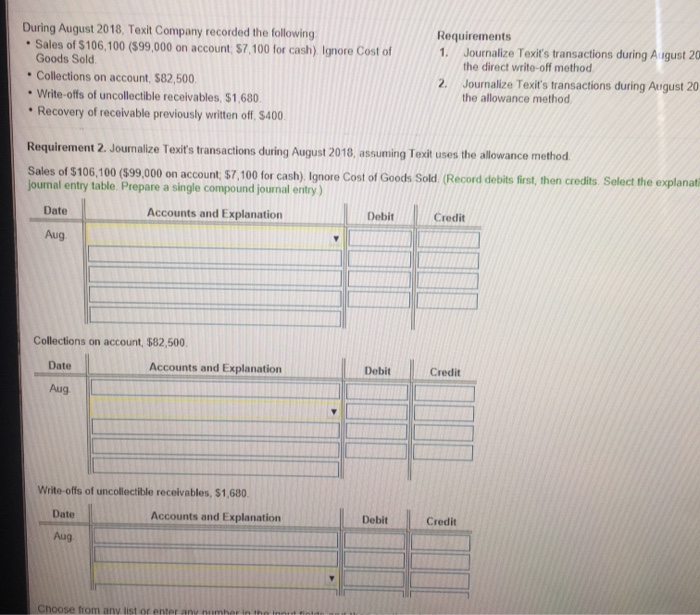

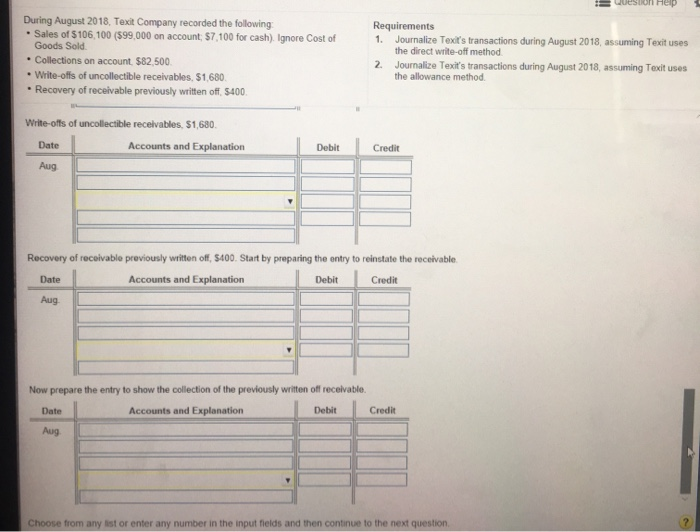

During August 2018, Texit Company recorded the following Sales of $106,100 (599,000 on account. $7,100 for cash), Ignore Cost of Goods Sold Collections on account. $82,500. Write-offs of uncollectible receivables, $1680 Recovery of receivable previously written off, 5400 Requirements 1. Journalize Texit's transactions during August 2018, assuming Texit uses the direct write-off method. 2. Journalize Texit's transactions during August 2018, assuming Texit uses the allowance method. Requirement 1. Journalize Texit's transactions during August 2018, assuming Text uses the direct write-off method Sales of $106,100 (599,000 on account: $7,100 for cash). Ignore Cost of Goods Sold (Record debits first, then credits. Select the explanation on the last line of the journal entry table. Prepare a single compound journal entry) Accounts and Explanation Debit Credit Aug Accounts Receivable Allowance for Bad Debts Bad Debts Expense Cash Collections: Sales Revenue Date Accounts and Explanation Credit Aug Write-offs of uncollectible receivables, 51,680. Date Accounts and Explanation Debit Credit Aug Choose from any list or enter any number in the input fields and then continue to the next question During August 2018, Texit Company recorded the following: Sales of $106,100 ($99,000 on account: $7,100 for cash) Ignore Cost of Goods Sold Collections on account. $82,500 Write-offs of uncollectible receivables, $1,680. Recovery of receivable previously written off $400 Requirements 1. Journalize Texit's transactions during August 2018, assur the direct write-off method. 2. Journalize Texit's transactions during August 2018, assum the allowance method. Requirement 1. Journalize Texit's transactions during August 2018, assuming Texit uses the direct write-off method. Sales of $106,100 (599,000 on account: $7,100 for cash). Ignore Cost of Goods Sold. (Record debits first, then credits. Select the explanation on th journal entry table. Prepare a single compound journal entry) Date Accounts and Explanation Debit Credit Aug Collections on account $82,500. Date Accounts and Explanation Debit Credit Aug Write-offs of uncollectible receivables, S1,680. Date Accounts and Explanation Debit Credit Aug Choose from any list or enter any number in the input fields and then continue to the next question. During August 2018, Texit Company recorded the following Sales of $106,100 ($99,000 on account: $7,100 for cash). Ignore Cost of Goods Sold Collections on account, $82,500 Write-offs of uncollectible receivables, 51,680 Recovery of receivable previously written off, $400. Requirements 1. Journalize Texit's transactions during Augu the direct write-off method. 2. Journalize Texit's transactions during Augu: the allowance method. Write-offs of uncollectible receivables, $1,680. Date Accounts and Explanation Debit Credit Aug Recovery of receivable previously written off, $400. Start by preparing the entry to reinstate the receivable Date Accounts and Explanation Debit Credit Aug Now prepare the entry to show the collection of the previously written off receivable. Date Accounts and Explanation Debit Credit Aug During August 2018, Texit Company recorded the following Sales of $106,100 (599,000 on account: $7,100 for cash). Ignore Cost of Goods Sold . Collections on account, $82,500 Write-offs of uncollectible receivables, $1.680 Recovery of receivable previously written off $400 Requirements 1. Journalize Texit's transactions during August 20 the direct write-off method 2. Journalize Texit's transactions during August 20 the allowance method. Requirement 2. Journalize Texit's transactions during August 2018, assuming Texit uses the allowance method Sales of $106,100 ($99,000 on account: $7,100 for cash). Ignore Cost of Goods Sold (Record debits first, then credits. Select the explanati journal entry table. Prepare a single compound journal entry) Date Accounts and Explanation Debit Credit Aug Collections on account, $82,500 Date Accounts and Explanation Debit Credit Aug Write-offs of uncollectible receivables, $1,680 Date Accounts and Explanation Debit Credit Aug Choose from any list or enter any number in the innut itt wuestion Help During August 2018. Texit Company recorded the following Sales of $106,100 (599.000 on account: $7.100 for cash). Ignore Cost of Goods Sold Collections on account. $82,500 Write-offs of uncollectible receivables. $1.680 Recovery of receivable previously written off $400 Requirements 1. Journalize Texit's transactions during August 2018, assuming Texit uses the direct write-off method 2. Journalize Texit's transactions during August 2018, assuming Toxit uses the allowance method. Write-offs of uncollectible receivables. $1,680. Date Accounts and Explanation Debit Credit Aug Recovery of receivable previously written off, $400. Start by preparing the entry to reinstate the receivable Date Accounts and Explanation Debit Credit Aug Now prepare the entry to show the collection of the previously written off receivable. Date Accounts and Explanation Debit Credit Aug Choose from any list or enter any number in the input fields and then continue to the next