Answered step by step

Verified Expert Solution

Question

1 Approved Answer

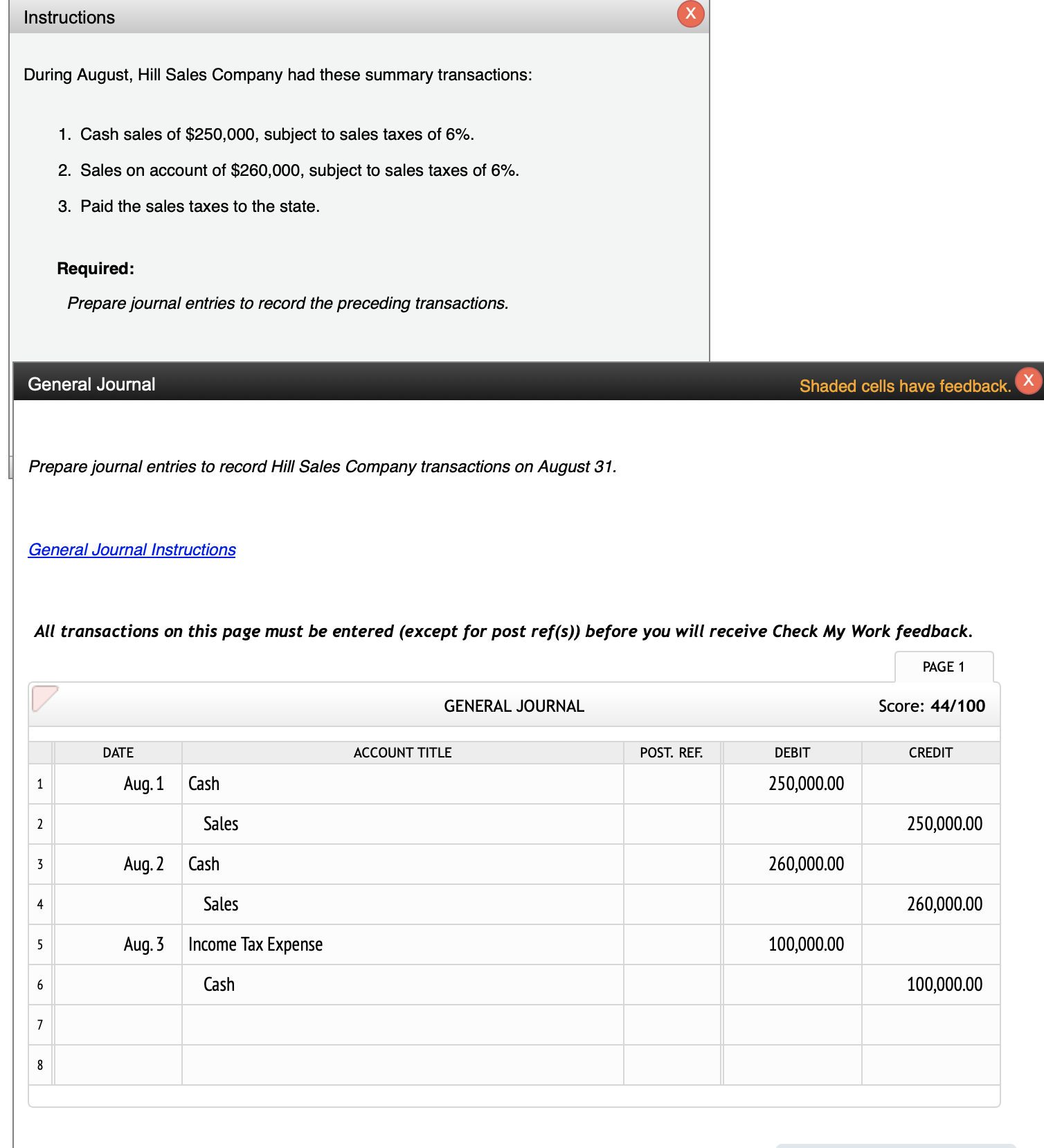

During August, Hill Sales Company had these summary transactions: 1. Cash sales of $250,000, subject to sales taxes of 6%. 2. Sales on account of

During August, Hill Sales Company had these summary transactions: 1. Cash sales of $250,000, subject to sales taxes of 6%. 2. Sales on account of $260,000, subject to sales taxes of 6%. 3. Paid the sales taxes to the state. Required: Prepare journal entries to record the preceding transactions. General Journal Shaded cells have feedbr Prepare journal entries to record Hill Sales Company transactions on August 31. General Journal Instructions All transactions on this page must be entered (except for post ref(s)) before you will receive Check My Work feedback

During August, Hill Sales Company had these summary transactions: 1. Cash sales of $250,000, subject to sales taxes of 6%. 2. Sales on account of $260,000, subject to sales taxes of 6%. 3. Paid the sales taxes to the state. Required: Prepare journal entries to record the preceding transactions. General Journal Shaded cells have feedbr Prepare journal entries to record Hill Sales Company transactions on August 31. General Journal Instructions All transactions on this page must be entered (except for post ref(s)) before you will receive Check My Work feedback Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started