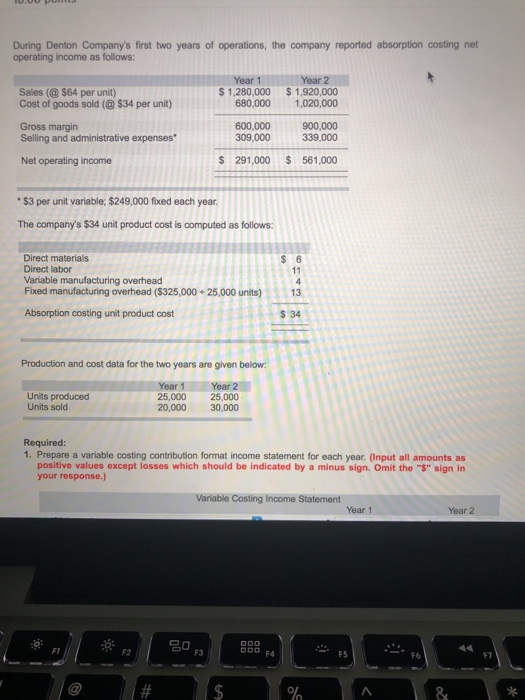

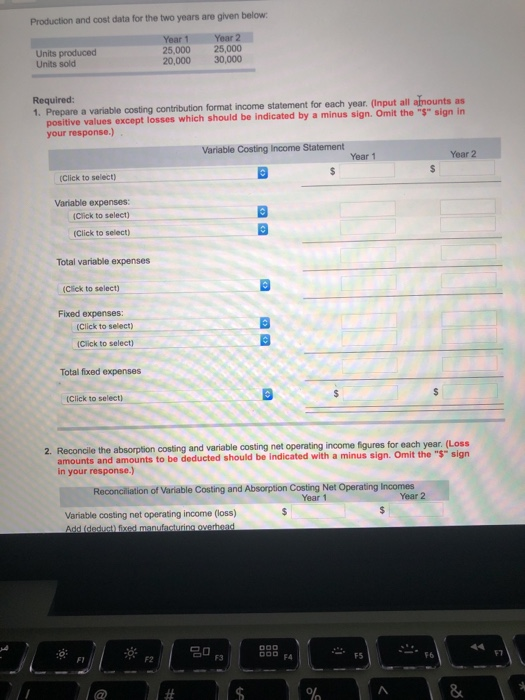

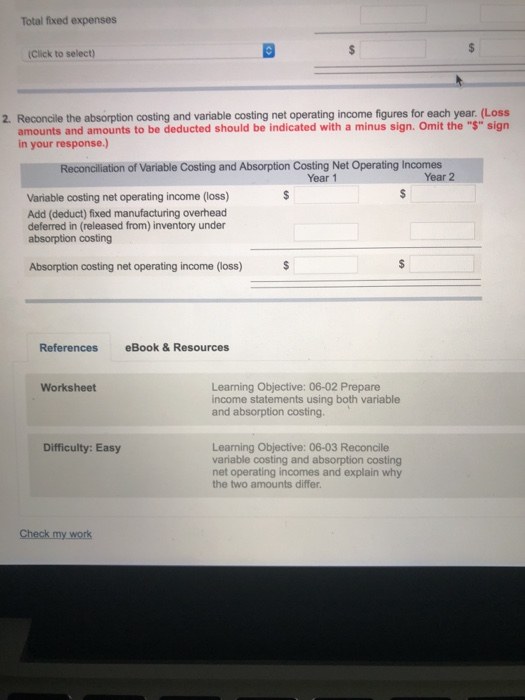

During Denton Company's first two years of operations, the company reported absorption costing net operating income as follows: Year 1 Year 2 Sales (@ $64 per unit) Cost of goods sold (@ $34 per unit) $ 1,280,000 $1,920,000 680,000 1,020,000 Gross margin Selling and administrative expenses 600,000 309,000 900,000 339,000 Net operating income $ 291,000 $561,000 $3 per unit variable: $249,000 fixed each year. The company's $34 unit product cost is computed as follows Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead ($325,000 25,000 units)13 Absorption costing unit product cost $ 34 Production and cost data for the two years are given Year 2 25,000 25,000 20,000 30,000 Year 1 1 Units produced Units sold Required: 1. Prepare a variable costing contribution format income statement for each year. (Input all amounts as positive values except losses which should be indicated by a minus sign. Omit the "$" sign in your response.) Variable Costing Income Statement Year 1 Year 2 FI F2 F3 FA F5 F7 Production and cost data for the two years are given below Units produced Units sold Year 1 Year 2 25,000 25,000 20,000 30,000 Required 1. Prepare a variable costing contribution format income statement for each year. (Input all atnounts as positive values except losses which should be indicated by a minus sign. Omit the "$" sign in your response.) Variable Costing Income Statement Year 1 Year 2 (Click to select) Variable expenses: Click to select) (Click to select) Total variable expenses (Click to select) Fixed expenses: (Click to select) (Click to select) Total fixed expenses Click to select) 2. Reconcile the absorption costing and variable costing net operating income figures for each year. (Loss hould be indicated with a minus sign. Omit the "s" sign amounts and amounts to be deducted s in your response.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Variable costing net operating income (loss) au F3 FS F6 F7 Total fixed expenses (Click to select) 2. Reconcile the absorption costing and variable costing net operating income figures for each year. (Loss amounts and amounts to be deducted should be indicated with a minus sign. Omit the "$" sign in your response.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Variable costing net operating income (loss) Add (deduct) fixed manufacturing overhead deferred in (released from) inventory under absorption costing Absorption costing net operating income (loss) References eBook & Resources Learning Objective: 06-02 Prepare income statements using both variable and absorption costing Worksheet Difficulty: Easy Learning Objective: 06-03 Reconcile variable costing and absorption costing net operating incomes and explain why the two amounts differ. Check my work