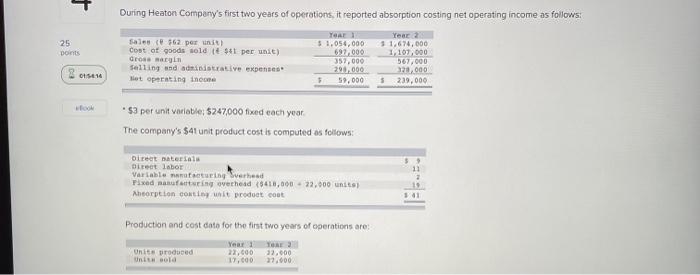

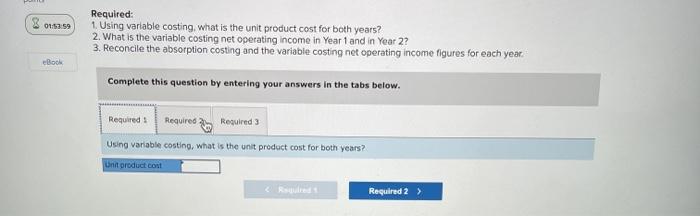

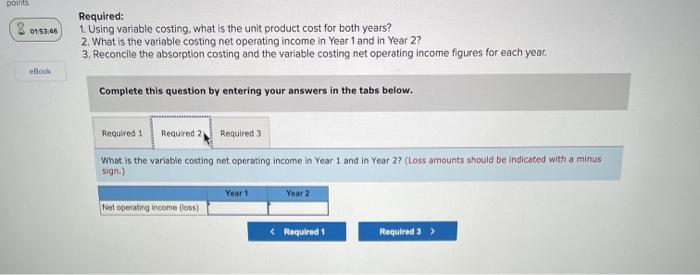

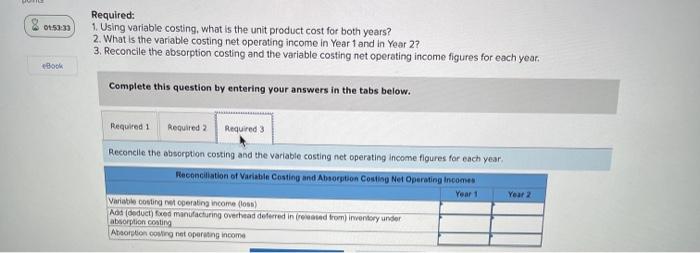

During Heaton Company's first two years of operations, it reported absorption costing net operating income as follows: ponts Sale 562 per unit) cost of goods sold 1941 per unit) Cross selling and distrative expenses Hot operating income Year $ 1.056,000 697.000 357,000 290,000 5 59.000 Year 2 11,674,000 1,107,000 567.000 328,000 239,000 ROOM $3 per unit variable: $247,000 fixed each year The company's $41 unit product cost is computed as follows: Direet materia Direct labor Variable naturing the Fixed an overhead (6418,000 - 22.000 unite Absorption continuit product coot 10 Production and cost date for the first two years of operations are YA 1 22,000 17,000 TORE 32,000 Units produced Unit o 01:53:59 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year. eBook Complete this question by entering your answers in the tabs below. Required Required Required 3 Using variable costing, what is the unit product cost for both years? Unit product cont Required 2 > points 03 01:53 45 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year B Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 What is the variable costing net operating Income in Year 1 and in Year 27 (Loss amounts should be indicated with a minus sign) Yeart Year 2 Net operating Income 101 Required 1 Required 3 > 01:50:35 Required: 1. Using variable costing, what is the unit product cost for both years? 2. What is the variable costing net operating income in Year 1 and in Year 2? 3. Reconcile the absorption costing and the variable costing net operating income figures for each year, Book Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Reconelle the absorption costing and the variable costing net operating Income figures for each year Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Year 1 Year 2 Variable costing net operating income (1) Aos (educt) fed manufacturing overhead deferred in red from inventory under absorption costing Abortion sing net operating income