Write short answers to the following 6 questions. Please use the readings available to you. You can use outside sources but focus your attention

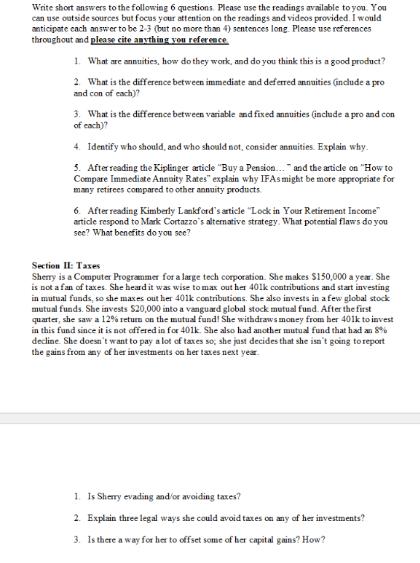

Write short answers to the following 6 questions. Please use the readings available to you. You can use outside sources but focus your attention on the readings and videos provided. I would anticipate each answer to be 2-3 (but no more than 4) sentences long. Please use references throughout and please cite anything you reference 1. What are annuities, how do they work, and do you think this is a good product? 2. What is the difference between immediate and deferred annuities (include a pro and con of each)? 3. What is the difference between variable and fixed annuities (include a pro and con of each)? 4. Identify who should, and who should not, consider annuities. Explain why. 5. After reading the Kiplinger article "Buy a Pension... and the article on "How to Compare Immediate Annuity Rates" explain why IFAs might be more appropriate for many retirees compared to other annuity products. 6. After reading Kimberly Lankford's article Lock in Your Retirement Income" article respond to Mark Cortazzo's alternative strategy. What potential flaws do you see? What benefits do you see? Section II: Taxes Sherry is a Computer Programmer for a large tech corporation. She makes $150,000 a year. She is not a fan of taxes. She heard it was wise to max out her 401k contributions and start investing in mutual funds, so she maxes out her 401k contributions. She also invests in a few global stock mutual funds. She invests $20,000 into a vanguard global stock mutual fund. After the first quarter, she saw a 12% return on the mutual fund! She withdraws money from her 401k to invest in this fund since it is not offered in for 401k. She also had another mutual fund that had an 8% decline. She doesn't want to pay a lot of taxes so; she just decides that she isn't going to report the gains from any of her investments on her taxes next year. 1. Is Sherry evading and/or avoiding taxes? 2. Explain three legal ways she could avoid taxes on any of her investments? 3. Is there a way for her to offset some of her capital gains? How?

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1Annuities are financial products designed to provide a steady stream of income for a set period or the lifetime of the annuitant They work by exchanging a lump sum or a series of payments for regular ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started