Question

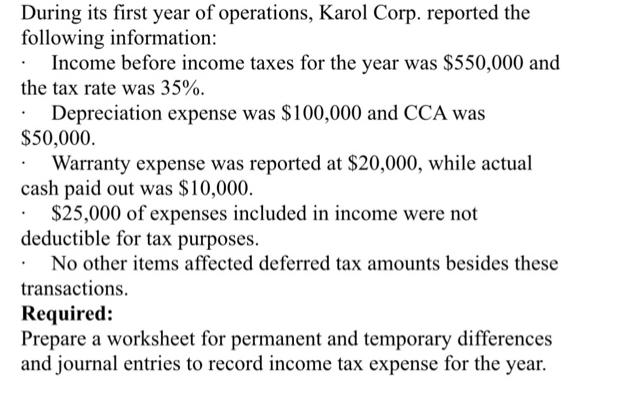

During its first year of operations, Karol Corp. reported the following information: Income before income taxes for the year was $550,000 and the tax

During its first year of operations, Karol Corp. reported the following information: Income before income taxes for the year was $550,000 and the tax rate was 35%. Depreciation expense was $100,000 and CCA was $50,000. Warranty expense was reported at $20,000, while actual cash paid out was $10,000. $25,000 of expenses included in income were not deductible for tax purposes. No other items affected deferred tax amounts besides these transactions. Required: Prepare a worksheet for permanent and temporary differences and journal entries to record income tax expense for the year.

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Temporary difference are those which arise in one period and capable of reversing in subsequent peri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cornerstones of Financial and Managerial Accounting

Authors: Rich, Jeff Jones, Dan Heitger, Maryanne Mowen, Don Hansen

2nd edition

978-0538473484, 538473487, 978-1111879044

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App