Answered step by step

Verified Expert Solution

Question

1 Approved Answer

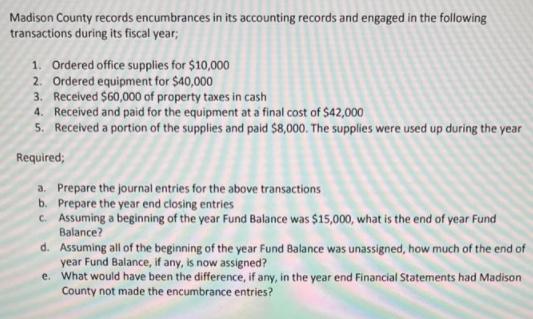

Madison County records encumbrances in its accounting records and engaged in the following transactions during its fiscal year; 1. Ordered office supplies for $10,000

Madison County records encumbrances in its accounting records and engaged in the following transactions during its fiscal year; 1. Ordered office supplies for $10,000 2. Ordered equipment for $40,000 3. Received $60,000 of property taxes in cash 4. Received and paid for the equipment at a final cost of $42,000 5. Received a portion of the supplies and paid $8,000. The supplies were used up during the year Required; a. Prepare the journal entries for the above transactions b. Prepare the year end closing entries c. Assuming a beginning of the year Fund Balance was $15,000, what is the end of year Fund Balance? d. Assuming all of the beginning of the year Fund Balance was unassigned, how much of the end of year Fund Balance, if any, is now assigned? e. What would have been the difference, if any, in the year end Financial Statements had Madison County not made the encumbrance entries?

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a i No Entry because transactions will be recorded when the cash will be involved ii No Entry becaus...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started