Question

During January 2018, the following transactions occur: January 2. Sold gift cards totaling $8,400. The cards are redeemable for merchandise within one year of the

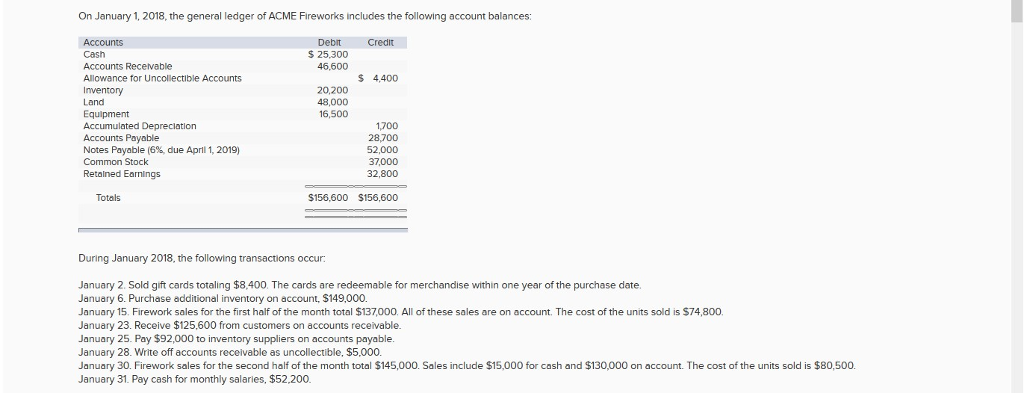

During January 2018, the following transactions occur: January 2. Sold gift cards totaling $8,400. The cards are redeemable for merchandise within one year of the purchase date. January 6. Purchase additional inventory on account, $149,000. January 15. Firework sales for the first half of the month total $137,000. All of these sales are on account. The cost of the units sold is $74,800. January 23. Receive $125,600 from customers on accounts receivable. January 25. Pay $92,000 to inventory suppliers on accounts payable. January 28. Write off accounts receivable as uncollectible, $5,000. January 30. Firework sales for the second half of the month total $145,000. Sales include $15,000 for cash and $130,000 on account. The cost of the units sold is $80,500. January 31. Pay cash for monthly salaries, $52,200.

Please prepare an adjusted trial balance and a multi step income statement for the above.

On January 1, 2018, the general ledger of ACME Fireworks includes the following account balances: Debit Credit $ 25,300 Accounts Recevable 46,600 S 4,400 Inventory Land Equipment 20,200 48,000 16,500 Accounts Payable Notes Payable (6%, due April 1, 2019) Common Stock Retolned Earnings 1,700 28,700 52,000 37,000 32,800 Totals $156,600 S156,600 During January 2018, the following transactions occur January 2. Sold gift cards totaling $8.400. The cards are redeemable for merchandise within one year of the purchase date January 6. Purchase additional inventory on account, $149,000. January 15. Firework sales for the first half of the month total $137,000. All of these sales are on account. The cost of the units sold is $74,800 January 23. Receive $125,600 from customers on accounts receivable January 25. Pay $92,000 to inventory suppliers on accounts payable January 28. Write off accounts receivable as uncollectible, $5,000. January 30. Firework sales for the second half of the month total $145,000. Sales include $15,000 for cash and $130,000 on account. The cost of the units sold is $80,500. January 31. Pay cash for monthly salaries, $52,200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started