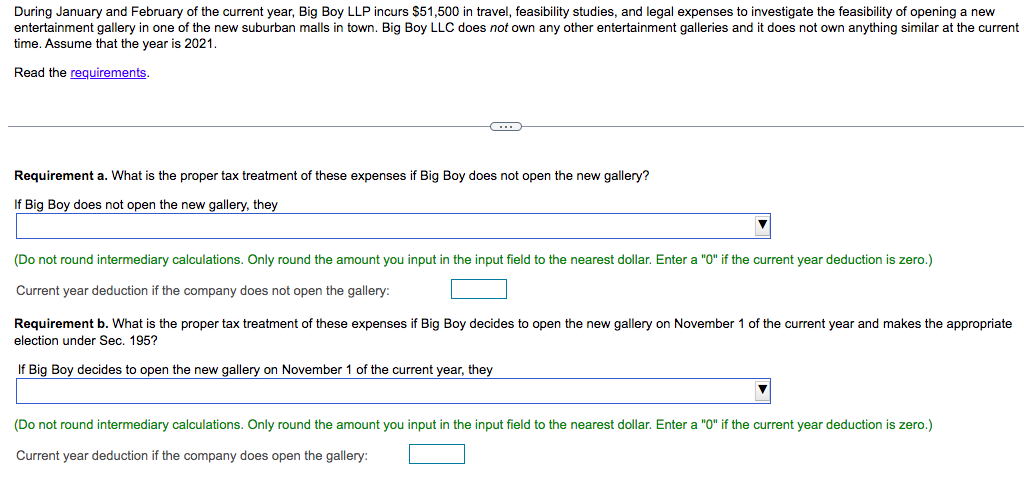

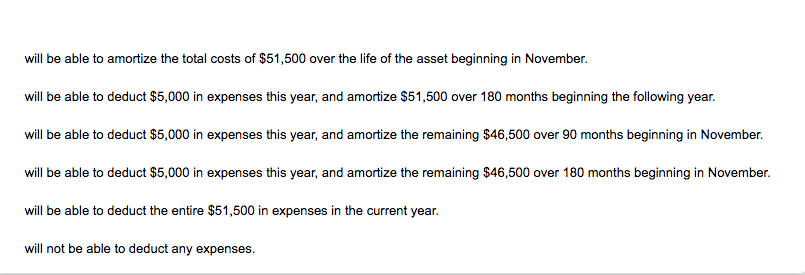

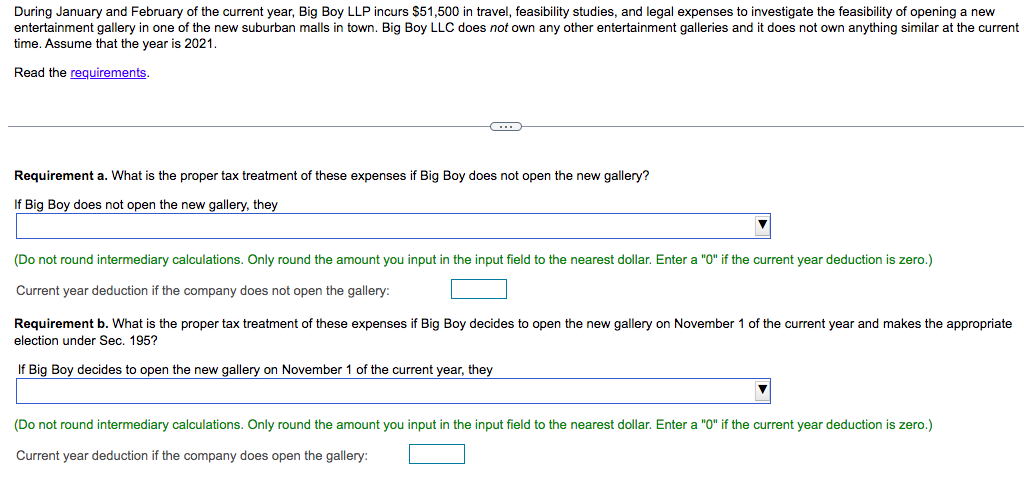

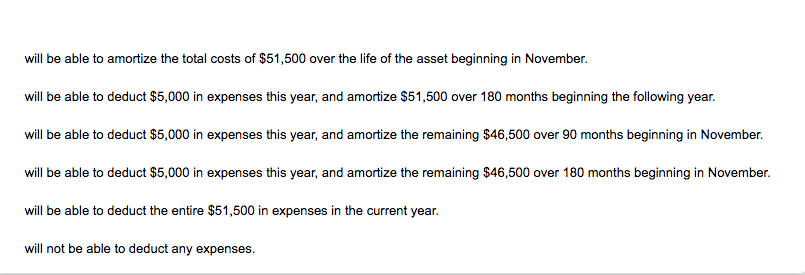

During January and February of the current year, Big Boy LLP incurs $51,500 in travel, feasibility studies, and legal expenses to investigate the feasibility of opening a new entertainment gallery in one of the new suburban malls in town. Big Boy LLC does not own any other entertainment galleries and it does not own anything similar at the current time. Assume that the year is 2021. Read the requirements. Requirement a. What is the proper tax treatment of these expenses if Big Boy does not open the new gallery? If Big Boy does not open the new gallery, they (Do not round intermediary calculations. Only round the amount you input in the input field to the nearest dollar. Enter a "0" if the current year deduction is zero.) Current year deduction if the company does not open the gallery: Requirement b. What is the proper tax treatment of these expenses if Big Boy decides to open the new gallery on November 1 of the current election under Sec. 195 ? If Big Boy decides to open the new gallery on November 1 of the current year, they (Do not round intermediary calculations. Only round the amount you input in the input field to the nearest dollar. Enter a "0" if the current year deduction is zero.) Current year deduction if the company does open the gallery: will be able to amortize the total costs of $51,500 over the life of the asset beginning in November. will be able to deduct $5,000 in expenses this year, and amortize $51,500 over 180 months beginning the following year. will be able to deduct $5,000 in expenses this year, and amortize the remaining $46,500 over 90 months beginning in November. will be able to deduct $5,000 in expenses this year, and amortize the remaining $46,500 over 180 months beginning in November. will be able to deduct the entire $51,500 in expenses in the current year. will not be able to deduct any expenses. During January and February of the current year, Big Boy LLP incurs $51,500 in travel, feasibility studies, and legal expenses to investigate the feasibility of opening a new entertainment gallery in one of the new suburban malls in town. Big Boy LLC does not own any other entertainment galleries and it does not own anything similar at the current time. Assume that the year is 2021. Read the requirements. Requirement a. What is the proper tax treatment of these expenses if Big Boy does not open the new gallery? If Big Boy does not open the new gallery, they (Do not round intermediary calculations. Only round the amount you input in the input field to the nearest dollar. Enter a "0" if the current year deduction is zero.) Current year deduction if the company does not open the gallery: Requirement b. What is the proper tax treatment of these expenses if Big Boy decides to open the new gallery on November 1 of the current election under Sec. 195 ? If Big Boy decides to open the new gallery on November 1 of the current year, they (Do not round intermediary calculations. Only round the amount you input in the input field to the nearest dollar. Enter a "0" if the current year deduction is zero.) Current year deduction if the company does open the gallery: will be able to amortize the total costs of $51,500 over the life of the asset beginning in November. will be able to deduct $5,000 in expenses this year, and amortize $51,500 over 180 months beginning the following year. will be able to deduct $5,000 in expenses this year, and amortize the remaining $46,500 over 90 months beginning in November. will be able to deduct $5,000 in expenses this year, and amortize the remaining $46,500 over 180 months beginning in November. will be able to deduct the entire $51,500 in expenses in the current year. will not be able to deduct any expenses