Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During January and February of the current year, Wow Talent LLP incurs $52,500 in travel, feasibility studies, and legal expenses to investigate the feasibility

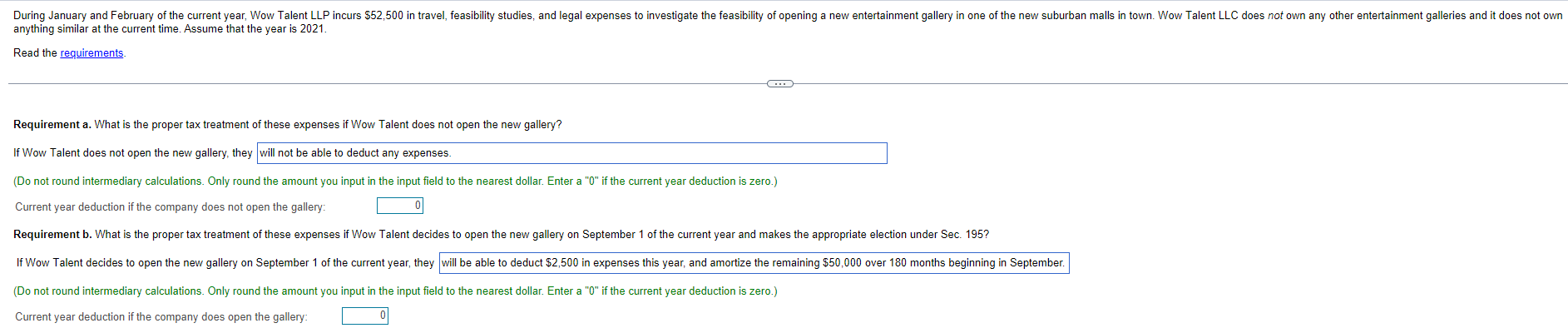

During January and February of the current year, Wow Talent LLP incurs $52,500 in travel, feasibility studies, and legal expenses to investigate the feasibility of opening a new entertainment gallery in one of the new suburban malls in town. Wow Talent LLC does not own any other entertainment galleries and it does not own anything similar at the current time. Assume that the year is 2021. Read the requirements. C Requirement a. What is the proper tax treatment of these expenses if Wow Talent does not open the new gallery? If Wow Talent does not open the new gallery, they will not be able to deduct any expenses. (Do not round intermediary calculations. Only round the amount you input in the input field to the nearest dollar. Enter a "0" if the current year deduction is zero.) Current year deduction if the company does not open the gallery: Requirement b. What is the proper tax treatment of these expenses if Wow Talent decides to open the new gallery on September 1 of the current year and makes the appropriate election under Sec. 195? If Wow Talent decides to open the new gallery on September 1 of the current year, they will be able to deduct $2,500 in expenses this year, and amortize the remaining $50,000 over 180 months beginning in September. (Do not round intermediary calculations. Only round the amount you input in the input field to the nearest dollar. Enter a "0" if the current year deduction is zero.) Current year deduction if the company does open the gallery:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started