Question

PHILIPPINE TAX 1. How much is the claimable input VAT in June presuming the purchases are prior to 2022? 2. How much is the claimable

PHILIPPINE TAX

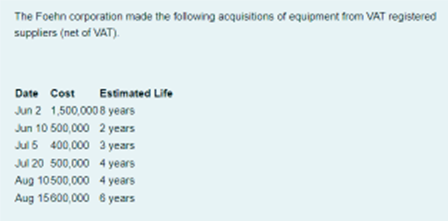

1. How much is the claimable input VAT in June presuming the purchases are prior to 2022?

2. How much is the claimable input VAT in July presuming the purchases are prior to 2022?

3. How much is the claimable input VAT in August presuming the purchases are prior to 2022?

4. How much is the claimable input VAT in June presuming the purchases are during 2022?

5. How much is the claimable input VAT in July presuming the purchases are during 2022?

6.. How much is the claimable input VAT in August presuming the purchases are during 2022?

The Foehn corporation made the following acquisitions of equipment from VAT registered suppliers (net of VAT). Date Cost Estimated Life Jun 2 1,500,000 8 years Jun 10 500,000 2 years Jul 5 400,000 3 years Jul 20 500,000 4 years Aug 10500,000 4 years Aug 15600,000 6 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Engineering Economics

Authors: Chan S. Park

3rd edition

132775425, 132775427, 978-0132775427

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App