Answered step by step

Verified Expert Solution

Question

1 Approved Answer

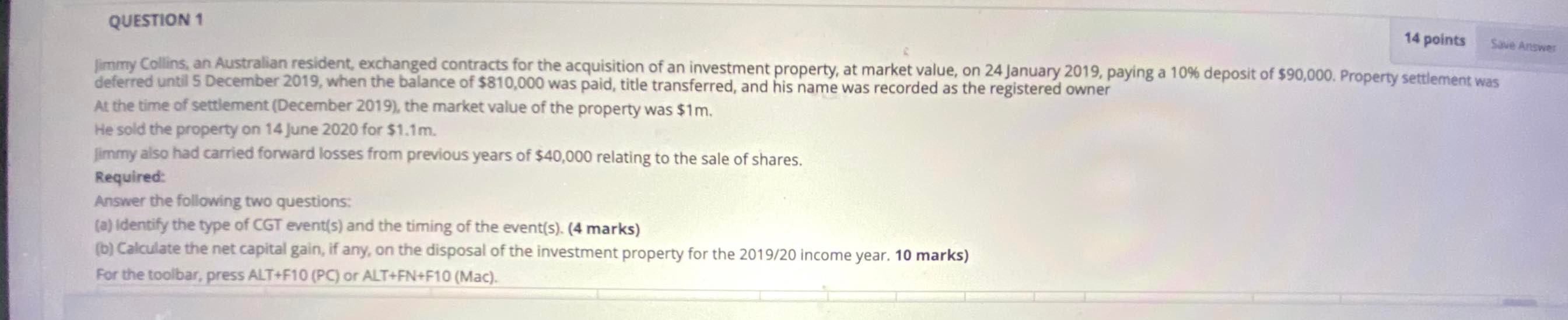

QUESTION 1 14 points Save Answer Jimmy Collins, an Australian resident, exchanged contracts for the acquisition of an investment property, at market value, on

QUESTION 1 14 points Save Answer Jimmy Collins, an Australian resident, exchanged contracts for the acquisition of an investment property, at market value, on 24 January 2019, paying a 10% deposit of $90,000. Property settlement was deferred until 5 December 2019, when the balance of $810,000 was paid, title transferred, and his name was recorded as the registered owner At the time of settlement (December 2019), the market value of the property was $1m. He sold the property on 14 June 2020 for $1.1m. Jimmy also had carried forward losses from previous years of $40,000 relating to the sale of shares. Required: Answer the following two questions: (a) Identify the type of CGT event(s) and the timing of the event(s). (4 marks) (b) Calculate the net capital gain, if any, on the disposal of the investment property for the 2019/20 income year. 10 marks) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started