Answered step by step

Verified Expert Solution

Question

1 Approved Answer

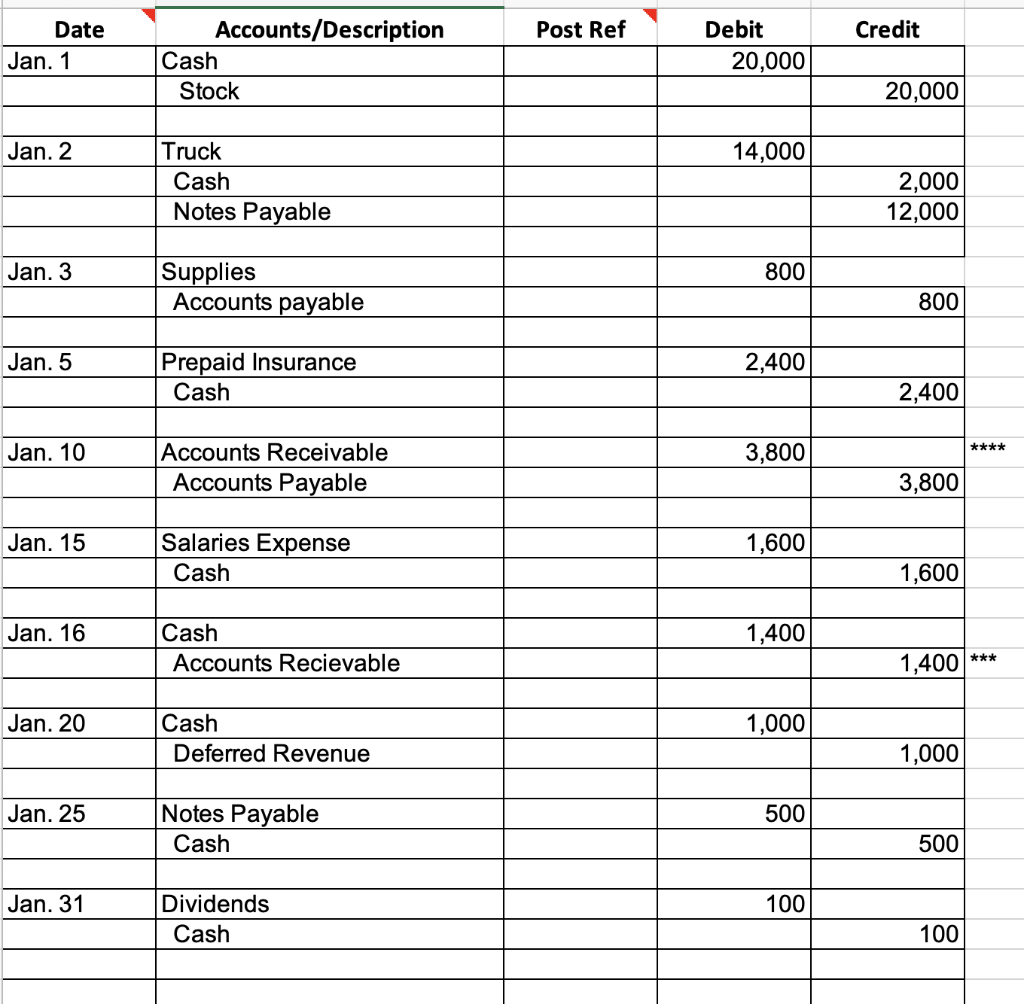

During January, the following transactions were completed for Kennesaw Cleaners, Inc (KCI). On January 1, KCI issued stock in exchange for $20,000 cash. On January

During January, the following transactions were completed for Kennesaw Cleaners, Inc (KCI).

- On January 1, KCI issued stock in exchange for $20,000 cash.

- On January 2, KCI purchased a truck for $14,000, paying $2,000 cash down and signing a 5-year, 2% note for the remaining $12,000.

- On January 3, KCI purchased cleaning supplies for $800 on account to be used over several months.

- On January 5, KCI prepaid $2,400 for a one-year insurance policy. Coverage began on January 1.

- On January 10, KCI sent invoices to customers amounting to $3,800 for completed cleaning services.

- On January 15, KCI paid $1,600 for employee salaries for work performed in January.

- On January 16, KCI collected $1,400 from customers billed on January 10.

- On January 20, KCI collected $1,000 in advance from a customer for February cleaning services.

- On January 25, KCI makes a cash payment on truck note for $500.

- On January 31, KCI paid a cash dividend of $100.

Prepare the monthly journal entries, post to the general ledger (t-accounts) and prepare an unadjusted trial balance sheet.

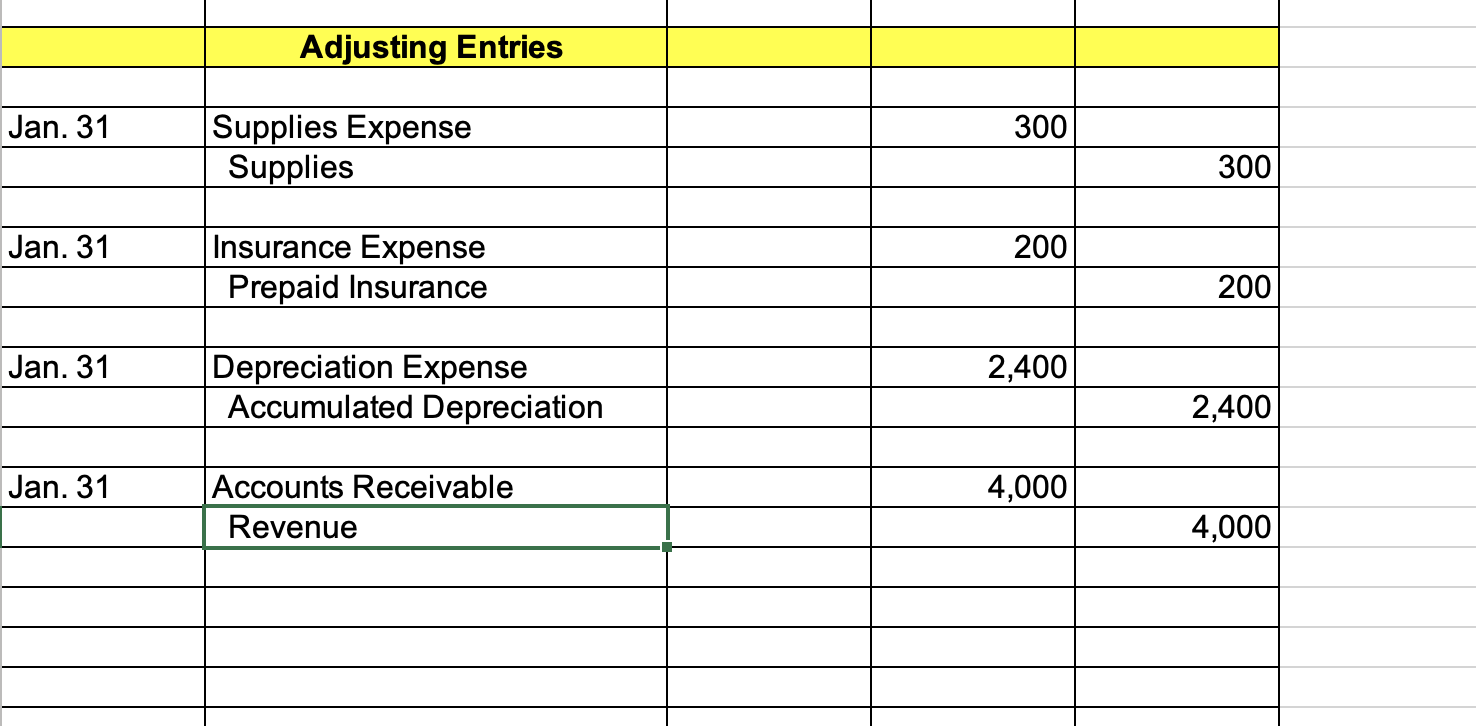

At the end of January, KCI analyzed the following transactions for which journal entries have not yet been prepared.

- An inventory count at the close of business on January 31 reveals that $300 of the supplies are still on hand.

- Insurance of $200 ($2,400/12) expires each month.

- The truck has a useful life of 5 years (60 months) and has a salvage value of $2,000.

- Completed cleaning services for customers for a total of $4,000 but have not yet sent out the invoices.

Please help me with these journal entries. My adjusted balance sheet is messed up I think transaction 4 isn't right for the adjusted trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started