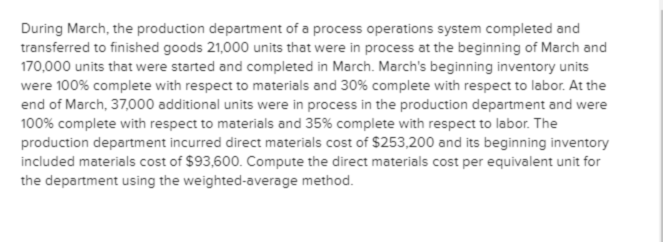

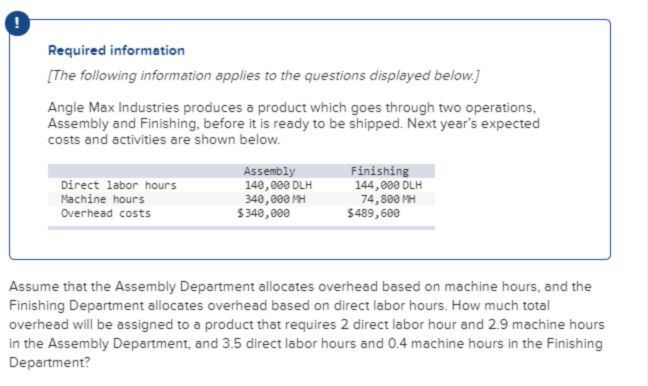

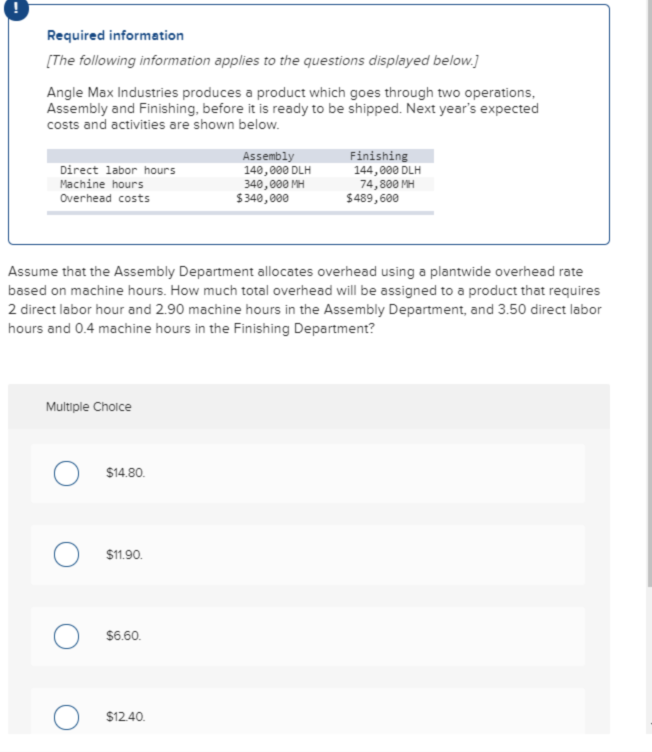

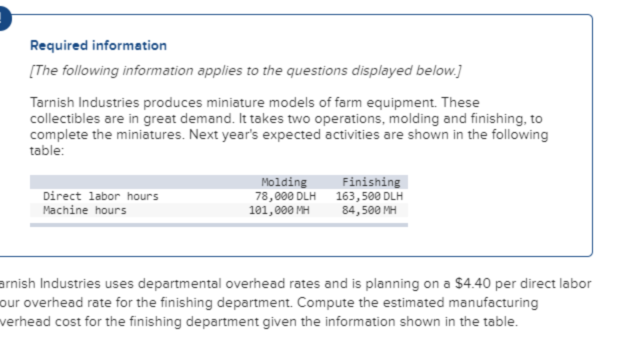

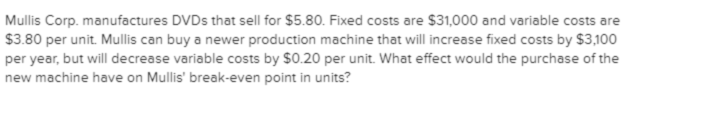

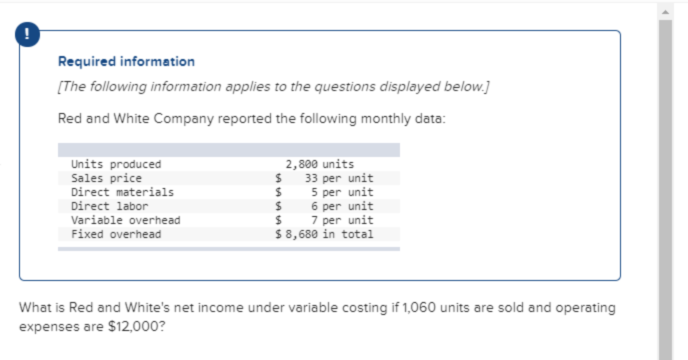

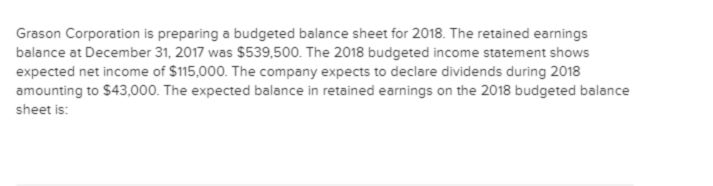

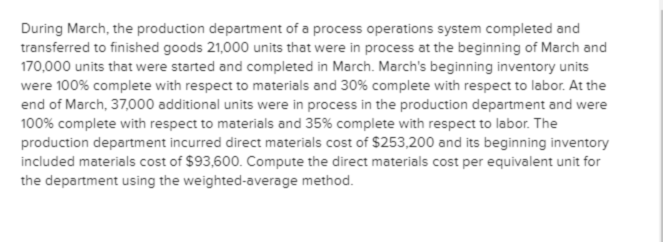

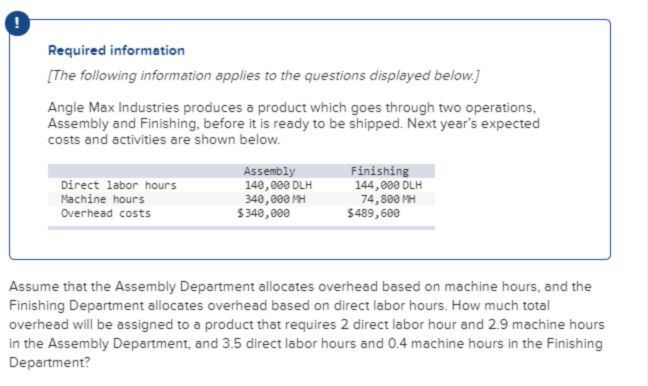

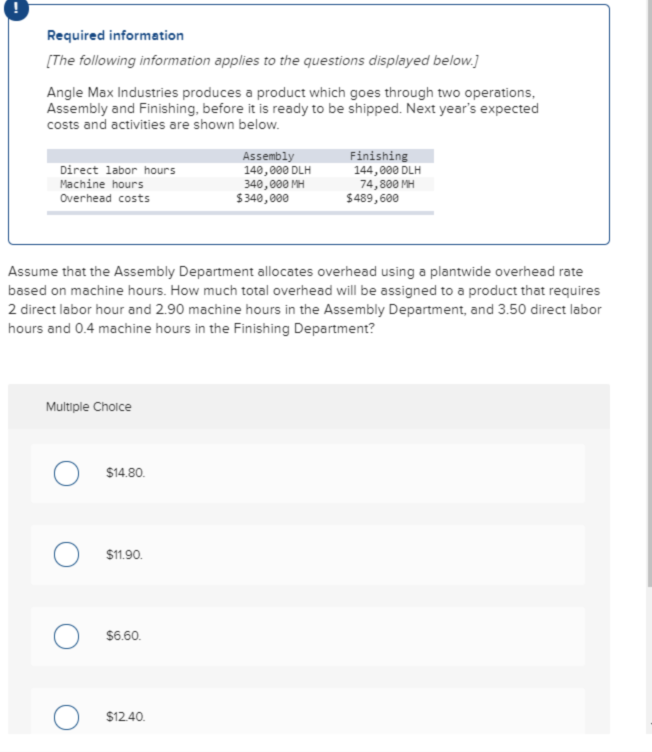

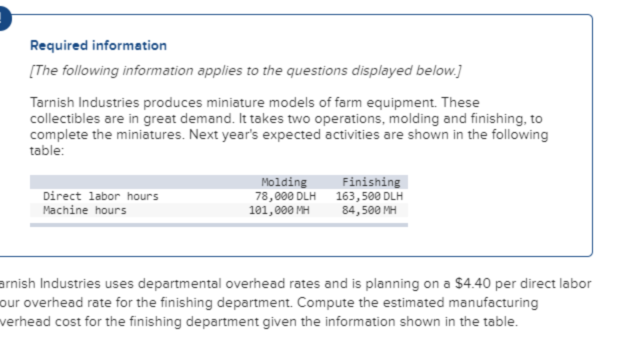

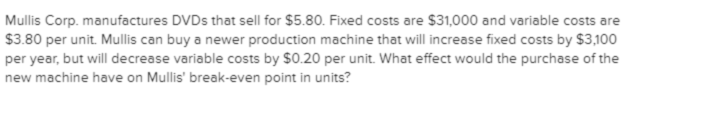

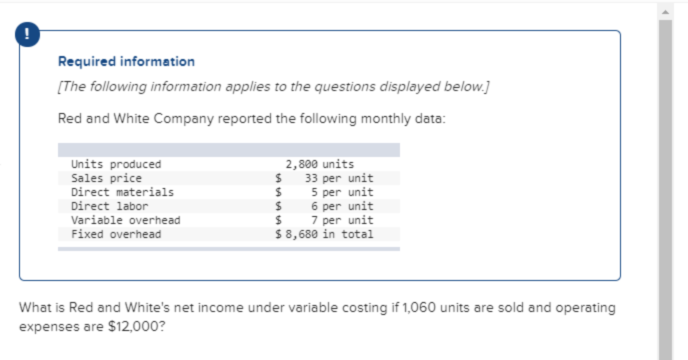

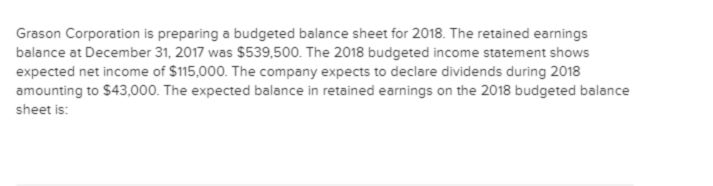

During March, the production department of a process operations system completed and transferred to finished goods 21,000 units that were in process at the beginning of March and 170,000 units that were started and completed in March. March's beginning inventory units were 100% complete with respect to materials and 30% complete with respect to labor. At the end of March, 37,000 additional units were in process in the production department and were 100% complete with respect to materials and 35% complete with respect to labor. The production department incurred direct materials cost of $253,200 and its beginning inventory included materials cost of $93,600. Compute the direct materials cost per equivalent unit for the department using the weighted average method. Required information The following information applies to the questions displayed below.] Angle Max Industries produces a product which goes through two operations, Assembly and Finishing, before it is ready to be shipped. Next year's expected costs and activities are shown below. Direct labor hours Machine hours Overhead costs Assembly 140,000 DLH 340,000 MH $ 340,000 Finishing 144,000 DLH 74,800 MH $489,600 Assume that the Assembly Department allocates overhead based on machine hours, and the Finishing Department allocates overhead based on direct labor hours. How much total overhead will be assigned to a product that requires 2 direct labor hour and 2.9 machine hours in the Assembly Department, and 3.5 direct labor hours and 0.4 machine hours in the Finishing Department? Required information [The following information applies to the questions displayed below. Angle Max Industries produces a product which goes through two operations, Assembly and Finishing, before it is ready to be shipped. Next year's expected costs and activities are shown below. Direct labor hours Machine hours Overhead costs Assembly 140,000 DLH 340,000 MH $340,000 Finishing 144,000 DLH 74,800 MH $489,600 Assume that the Assembly Department allocates overhead using a plantwide overhead rate based on machine hours. How much total overhead will be assigned to a product that requires 2 direct labor hour and 2.90 machine hours in the Assembly Department, and 3.50 direct labor hours and 0.4 machine hours in the Finishing Department? 0 0 0 0 Required information The following information applies to the questions displayed below.) Tarnish Industries produces miniature models of farm equipment. These collectibles are in great demand. It takes two operations, molding and finishing, to complete the miniatures. Next year's expected activities are shown in the following table: Direct labor hours Machine hours Molding 78,000 DLH 101,000 MH Finishing 163,500 DLH 84,500 MH arnish Industries uses departmental overhead rates and is planning on a $4.40 per direct labor our overhead rate for the finishing department. Compute the estimated manufacturing verhead cost for the finishing department given the information shown in the table. Mullis Corp. manufactures DVDs that sell for $5.80. Fixed costs are $31,000 and variable costs are $3.80 per unit. Mullis can buy a newer production machine that will increase fixed costs by $3,100 per year, but will decrease variable costs by $0.20 per unit. What effect would the purchase of the new machine have on Mullis' break-even point in units? Required information [The following information applies to the questions displayed below.) Red and White Company reported the following monthly data: Units produced Sales price Direct materials Direct labor Variable overhead Fixed overhead 2,800 units $ 33 per unit $ 5 per unit $ 6 per unit $ 7 per unit $ 8,680 in total What is Red and White's net income under variable costing if 1,060 units are sold and operating expenses are $12,000? Grason Corporation is preparing a budgeted balance sheet for 2018. The retained earnings balance at December 31, 2017 was $539,500. The 2018 budgeted income statement shows expected net income of $115,000. The company expects to declare dividends during 2018 amounting to $43,000. The expected balance in retained earnings on the 2018 budgeted balance sheet is