Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the 2022 year, Ricky has net employment income of $53,000 and interest income of $6,000. Capital gains for the year total $39,400, while capital

During the 2022 year, Ricky has net employment income of $53,000 and interest income of $6,000. Capital gains for the year total $39,400, while capital losses are realized in the amount of $8,726. He has deductible child care costs of $1,200 and he is able to make a $5,000 deductible RRSP contribution. He also has a business loss of $181,000.

Required: Calculate Ricky's 2022 Net Income for Tax Purposes (Division B income). Indicate the amount and type of any loss carry overs that would be available at the end of the year.

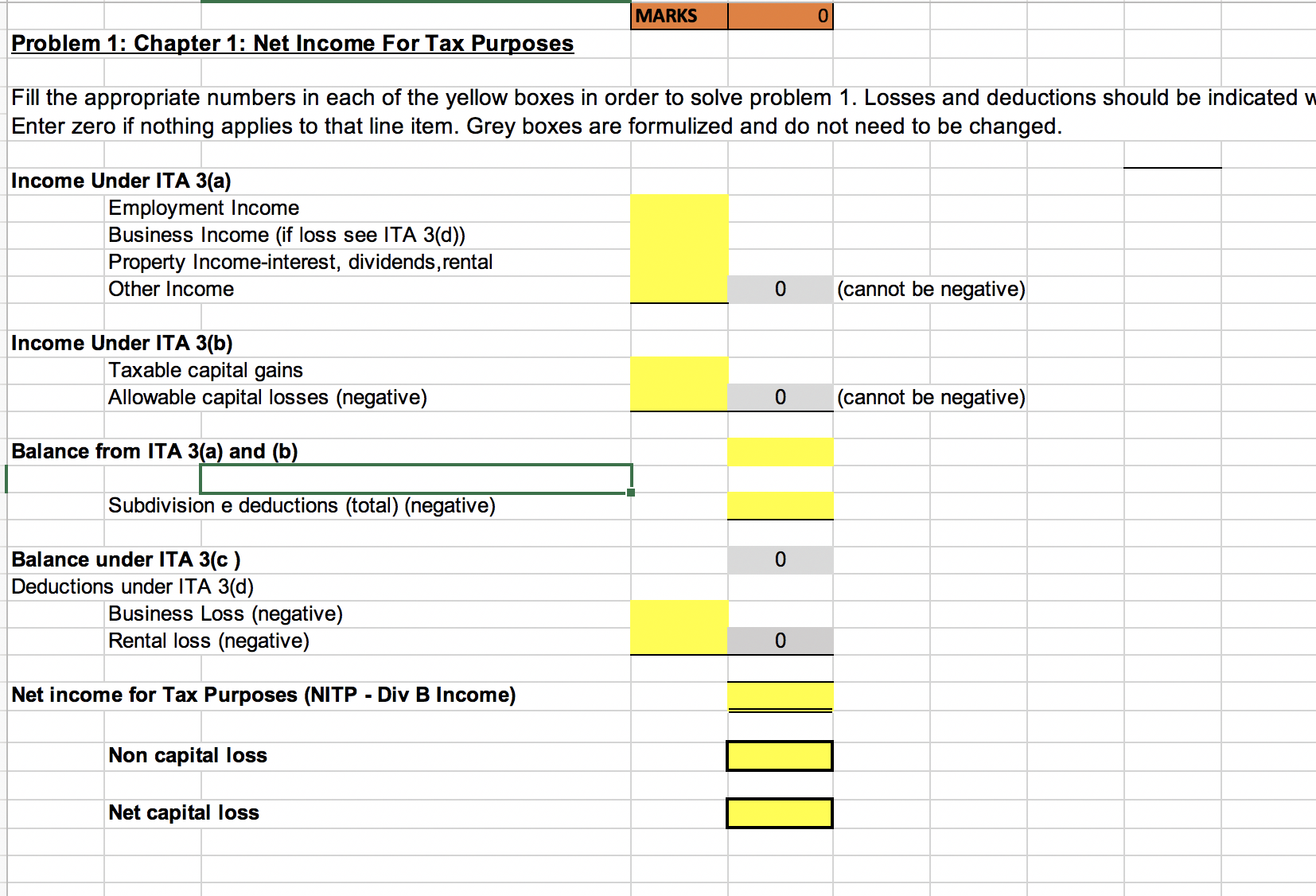

Problem 1: Chapter 1: Net Income For Tax Purposes Fill the appropriate numbers in each of the yellow boxes in order to solve problem 1. Losses and deductions should be indicated Enter zero if nothing applies to that line item. Grey boxes are formulized and do not need to be changed. Income Under ITA 3(a) Employment Income Business Income (if loss see ITA 3(d)) Property Income-interest, dividends, rental Other Income MARKS 0

Problem 1: Chapter 1: Net Income For Tax Purposes Fill the appropriate numbers in each of the yellow boxes in order to solve problem 1. Losses and deductions should be indicated Enter zero if nothing applies to that line item. Grey boxes are formulized and do not need to be changed. Income Under ITA 3(a) Employment Income Business Income (if loss see ITA 3(d)) Property Income-interest, dividends, rental Other Income MARKS 0 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started