Answered step by step

Verified Expert Solution

Question

1 Approved Answer

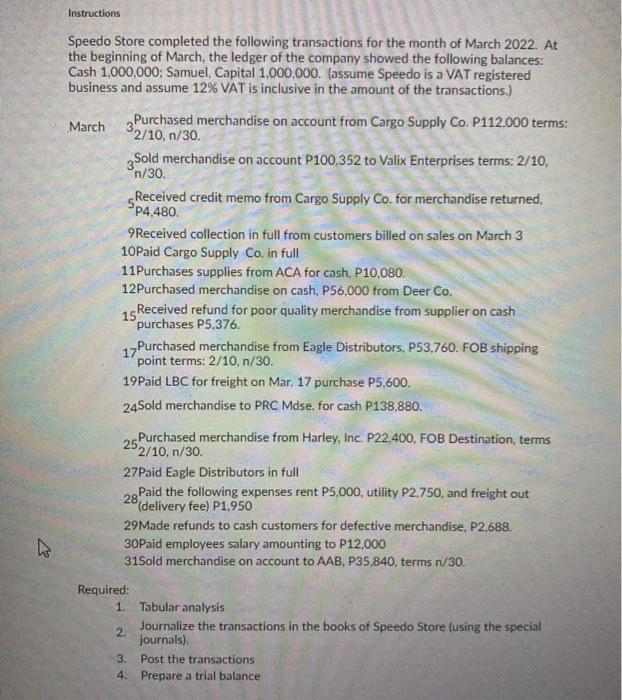

Speedo Store completed the following transactions for the month of March 2022. At the beginning of March, the ledger of the company showed the following

Speedo Store completed the following transactions for the month of March 2022. At

the beginning of March, the ledger of the company showed the following balances:

Cash 1,000,000; Samuel, Capital 1,000,000. (assume Speedo is a VAT registered

business and assume 12% VAT is inclusive in the amount of the transactions.)

March

3)y I chased, merchandise on account from Cargo Supply Co. P112,000 terms:

g Sold merchandise on account P100,352 to Valix Enterprises terms: 2/10,

n/30.

spe-cived credit memo from Cargo Supply Co, for merchandise returned

Received collection in full from customers billed on sales on March 3

10Paid Cargo Supply Co. in full

11Purchases supplies from ACA for cash, P10,080.

12Purchased merchandise on cash, P56,000 from Deer Co.

15 Received refund for poor quality merchandise from supplier on cash

purchases P5.376.

17 Purchased merchandise from Eagle Distributors, P53,760. FOB shipping

point terms: 2/10, n/30.

19Paid LBC for freight on Mar, 17 purchase P5,600.

24Sold merchandise to PRC Mdse. for cash P138.880.

Purchased merchandise from Harley, Inc. P22,400, FOB Destination, terms

252/10. n/30.

27 Paid Eagle Distributors in full

28

Paid the following expenses rent P5,000, utility P2,750, and freight out

(delivery fee) P1,950

29 Made refunds to cash customers for defective merchandise, P2,688.

30Paid employees salary amounting to P12,000

31Sold merchandise on account to AB, P35,840, terms n/30.

Required:

1. Tabular analysis

2. Journalize the transactions in the books of Speedo Store (using the special

journals).

3. Post the transactions

4. Prepare a trial balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started