Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the audit of the fixed assets of PT Taruma for the financial year ended December 31, 2002, the following are found: Question: Explain the

During the audit of the fixed assets of PT Taruma for the financial year ended December 31, 2002, the following are found:

Question: Explain the act of what to do an auditor?

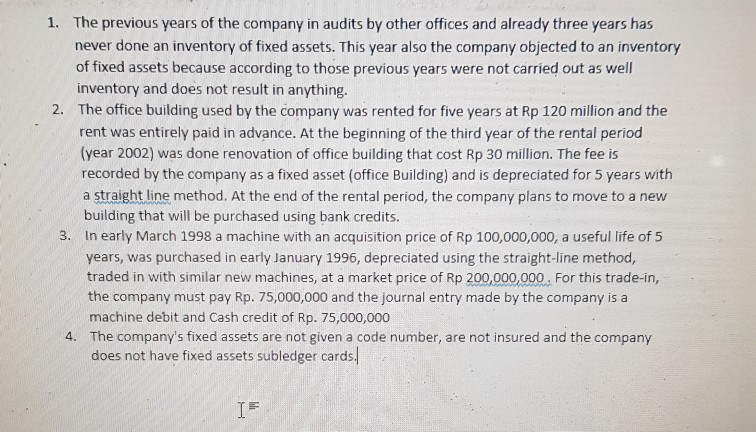

1. The previous years of the company in audits by other offices and already three years has never done an inventory of fixed assets. This year also the company objected to an inventory of fixed assets because according to those previous years were not carried out as well inventory and does not result in anything. 2. The office building used by the company was rented for five years at Rp 120 million and the rent was entirely paid in advance. At the beginning of the third year of the rental period (year 2002) was done renovation of office building that cost Rp 30 million. The fee is recorded by the company as a fixed asset (office Building) and is depreciated for 5 years with a straight line method. At the end of the rental period, the company plans to move to a new building that will be purchased using bank credits. 3. In early March 1998 a machine with an acquisition price of Rp 100,000,000, a useful life of 5 years, was purchased in early January 1996, depreciated using the straight-line method, traded in with similar new machines, at a market price of Rp 200,000,000. For this trade-in, the company must pay Rp. 75,000,000 and the journal entry made by the company is a machine debit and Cash credit of Rp. 75,000,000 The company's fixed assets are not given a code number, are not insured and the company does not have fixed assets subledger cards. I=Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started