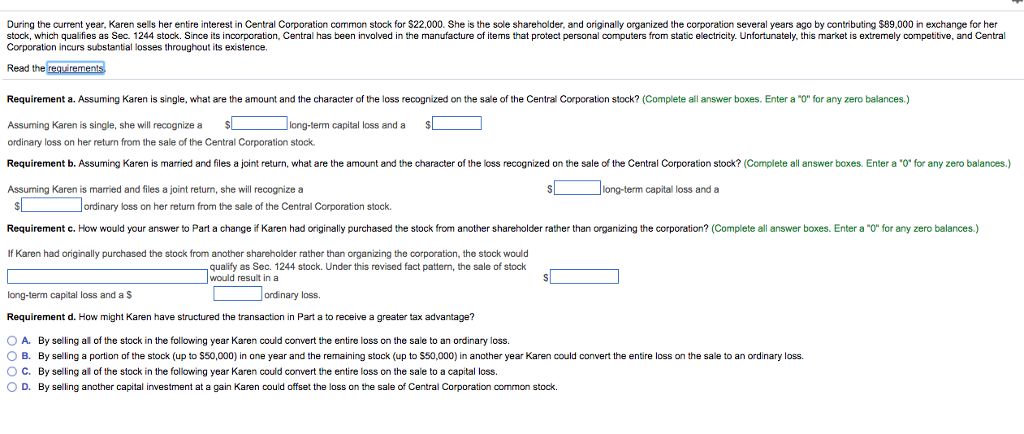

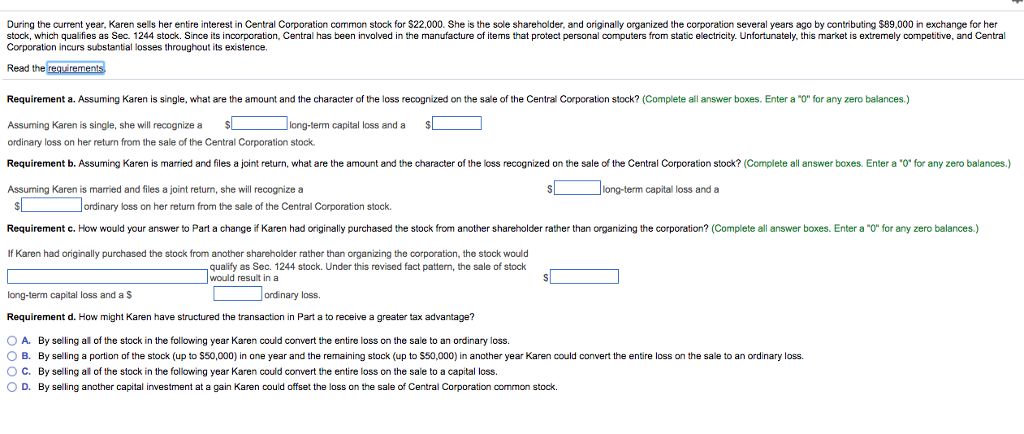

During the current year, Karen sells her entire interest in Central Corporation common stock for $22,000. She is the sole shareholder, and originally organized the corporation several years ago by contributing $89,000 in exchange for her stock, which qualifies as Sec. 1244 stock. Since its incorporation, Central has been involved in the manufacture of items that protect personal computers from static electricity. Unfortunately, this market is extremely competitive, and Central Corporation incurs substantial losses throughout its existence. Read the Requirement a. Assuming Karen is single, what are the amount and the character of the loss recognized on the sale of the Central Corporation stock? (Complete all answer boxes. Enter a " Assuming Karen is single, she will recognizea S ordinary loss on her return from the sale of the Central Corporation stock. Requirement b. Assuming Karen is married and files a joint return, what are the amount and the character of the loss recognized on the sale of the Central Assuming Karen is married and files a joint return, she will recognize a for any zero balances.) long-term capital loss and a S n stock? (Complete all answer boxes. Enter a '0 for any zero balances.) long-term capital loss and a ordinary loss on her return from the sale of the Central Corporation stock. Requirement c. How would your answer to Part a change if Karen had originally purchased the stock from another shareholder rather than organizing the ? (Complete all answer boxes. Enter a "O" for any zero balances.) If Karen had originally purchased the stock from another shareholder rather than organizing the corporation, the stock would qualify as Sec. 1244 stock. Under this revised fact pattern, the sale of stock would result in a long-term capital loss and a S ordinary loss. Requirement d. How might Karen have structured the transaction in Part a to receive a greater tax advantage? O A. By selling all of the stock in the following year Karen could convert the entire loss on the sale to an ordinary loss. 0 B. By selling a portion of the stock (up to S50 000) in one year and the remaining stock (up to S50,000) in another year Karen could convert the entire loss on the sale to an ordinary loss. O C. By selling al of the stock in the following year Karen could convert the entire loss on the sale to a capital loss. 0 D. By selling another capital investment at a gain Karen could offset the loss on the sale of Central Corporation common stock