During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.) Please answer

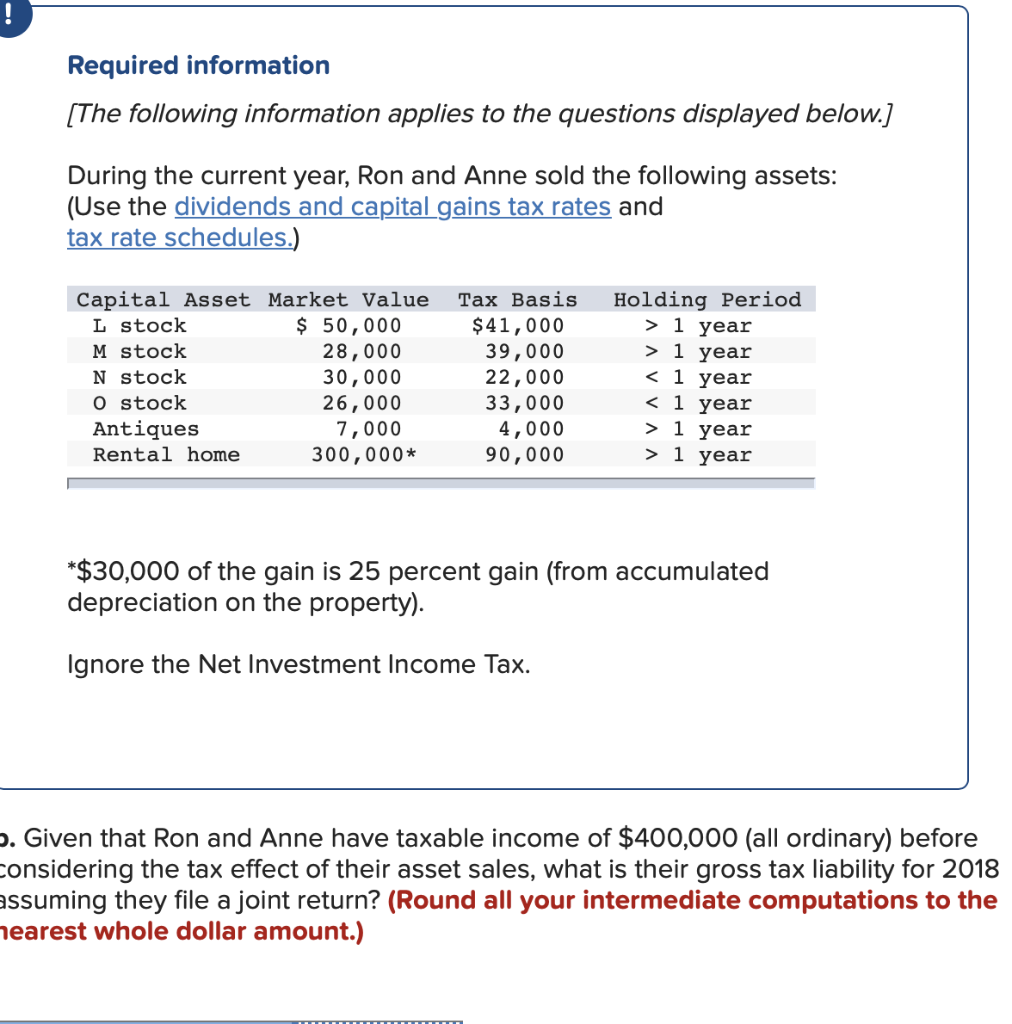

During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules.)

Please answer A & B;

a. Given that Ron and Anne have taxable income of only $20,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2018 assuming they file a joint return?

b. Given that Ron and Anne have taxable income of $400,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2018 assuming they file a joint return?

Required information The following information applies to the questions displayed below. During the current year, Ron and Anne sold the following assets: (Use the dividends and capital gains tax rates and tax rate schedules Capital Asset Market Value Tax Basis Holding Period $50,000 L stock M stock N stock o stock Antiques Rental home 28,000 30,000 26,000 7,000 300,000* $41,000 39,000 22,000 33,000 4,000 90,000 > 1 year > 1 year 1 year $30,000 of the gain is 25 percent gain (from accumulated depreciation on the property). Ignore the Net Investment Income Tax. . Given that Ron and Anne have taxable income of $400,000 (all ordinary) before onsidering the tax effect of their asset sales, what is their gross tax liability for 2018 ssuming they file a joint return? (Round all your intermediate computations to the earest whole dollar amount.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started