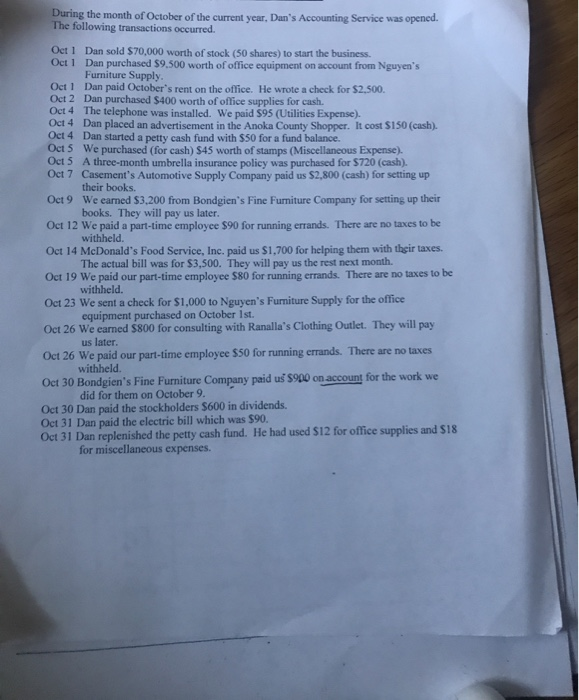

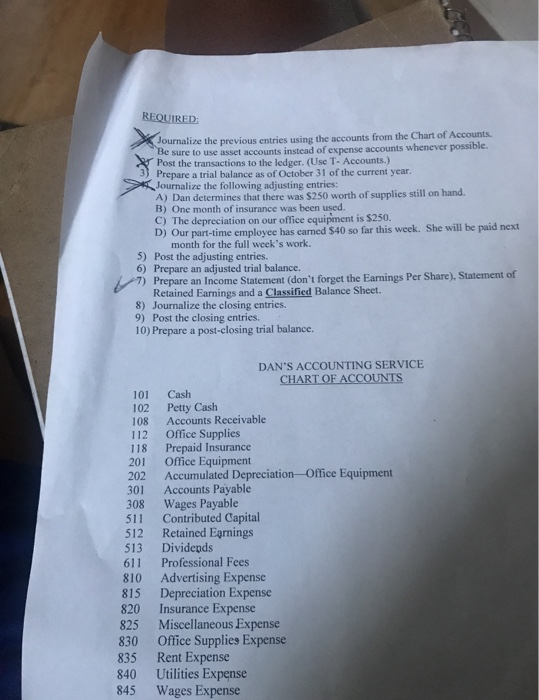

During the month of October of the current year, Dan's Accounting Service was The following transactions occurred opened. Oct 1 Dan sold $70,000 worth of stock (50 shares) to start the business. Oct 1 Dan purchased $9,500 worth of office equipment on account from Nguyen's Furniture Supply Oct 1 Dan paid October's rent on the office. He wrote a check for $2,500. Oct 2 Dan purchased $400 worth of office supplies for cash. Oct 4 The telephone was installed. We paid $95 (Utilities Expense). Oct 4 Dan placed an advertisement in the Anoka County Shopper. It cost $150 (cash). Oct 4 Dan started a petty cash fund with $50 for a fund balance. Oct 5 We purchased (for cash) $45 worth of stamps (Miscellaneous Expense). Oct 5 A three-month umbrella insurance policy was purchased for $720 (cash). Oct 7 Casement's Automotive Supply Company paid us $2,800 (cash) for setting up their books. We earned $3,200 from Bondgien's Fine Furniture Company for setting up their books. They will pay us later. Oct 9 Oct 12 We paid a part-time employee $90 for running errands. There are no taxes to be withheld. $1,700 for helping them with thgir taxes. us the rest next month. Oct 14 McDonald's Food Service, Inc. paid us The actual bill was for $3,500. They will pay Oct 19 We paid our part-time employee $80 for running errands. There are no taxes to be withheld. Oct 23 We sent a check for $1,000 to Nguyen's Furniture Supply for the office equipment purchased on October 1st. Oct 26 We earned $800 for consulting with Ranalla's Clothing Outlet. They will pay us later Oct 26 We paid our part-time employee $50 for running errands. There are no taxes withheld. Oct 30 Bondgien's Fine Furniture Company paid us $900 on account for the work we did for them on October 9. Oct 30 Dan paid the stockholders $600 in dividends, Oct 31 Dan paid the electric bill which was $90. Oct 31 Dan replenished the petty cash fund. He had used $12 for office supplies and $18 for miscellaneous expenses. REQUIRED Journalize the previous entries using the accounts from the Chart of Accounts Be sure to use asset accounts instead of expense accounts whenever possible. Post the transactions to the ledger. (Use T-Accounts.) Prepare a trial balance as of October 31 of the current year. Journalize the following adjusting entries: A) Dan determines that there was $250 worth of supplies still on hand. B) One month of insurance was been used. C) The depreciation on our office equipment is $250. D) Our part-time emplovee has carned $40 so far this week. She will be paid next month for the full week's work 5) Post the adjusting entries. 6) Prepare an adjusted trial balance. 71 Prepare an Income Statement (don't forget the Earnings Per Share), Statement of Retained Earnings and a Classified Balance Sheet. 8) Journalize the closing entries. 9) Post the closing entries. 10) Prepare a post-closing trial balance. DAN'S ACCOUNTING SERVICE CHART OF ACCOUNTS Cash 101 Petty Cash Accounts Receivable Office Supplies Prepaid Insurance Office Equipment Accumulated Depreciation-Office Equipment Accounts Payable Wages Payable Contributed Capital Retained Earnings Dividepds Professional Fees Advertising Expense Depreciation Expense Insurance Expense Miscellaneous Expense Office Supplies Expense Rent Expense Utilities Expense Wages Expense 102 108 112 118 201 202 301 308 511 512 513 611 810 815 820 825 830 835 840 845