Answered step by step

Verified Expert Solution

Question

1 Approved Answer

can you explain how you got your answer? expected to resut during each sture of nature by its probabtity of ocrumence. ronsider the followitig case:

can you explain how you got your answer?

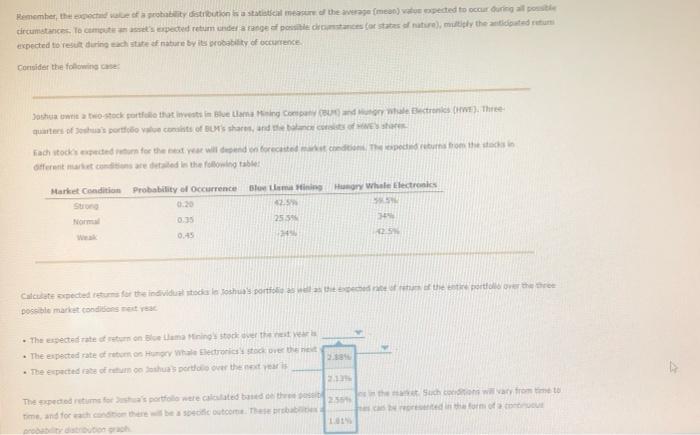

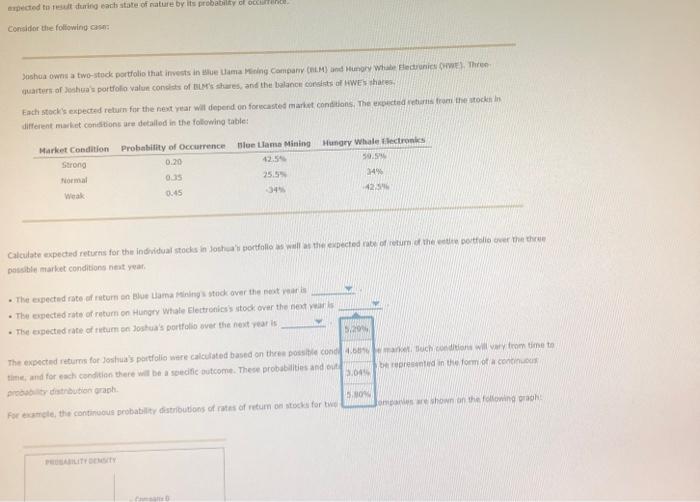

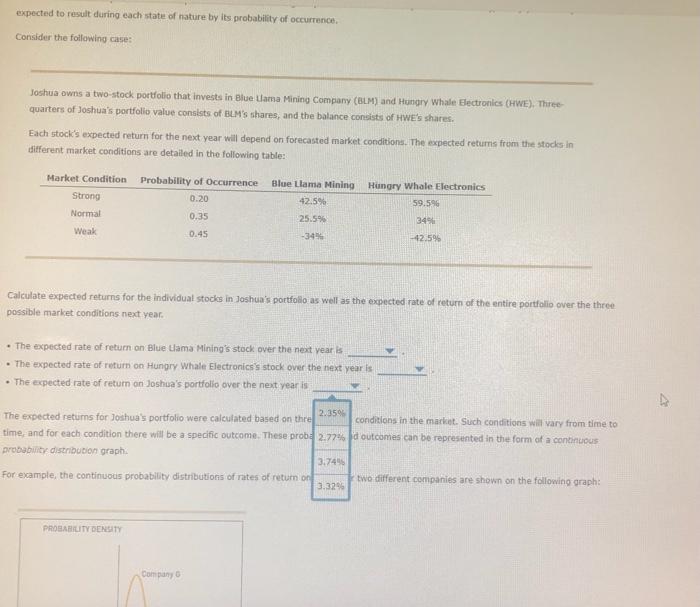

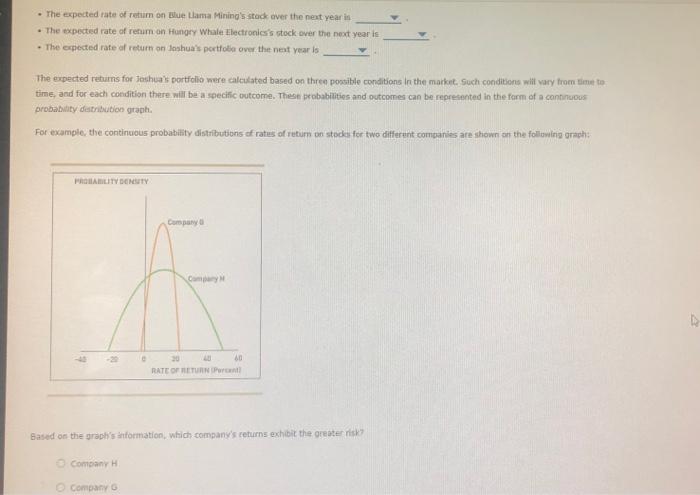

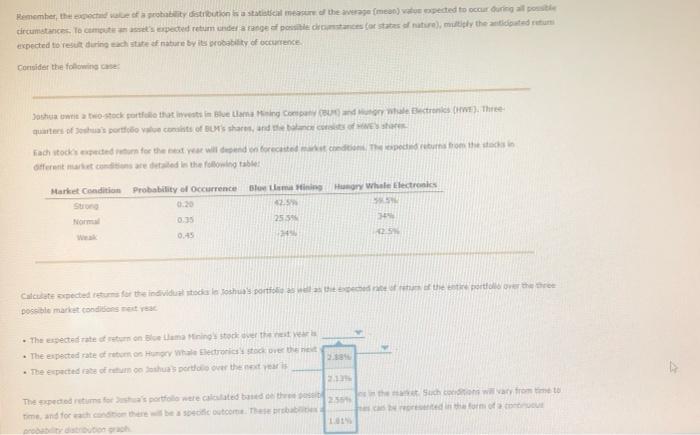

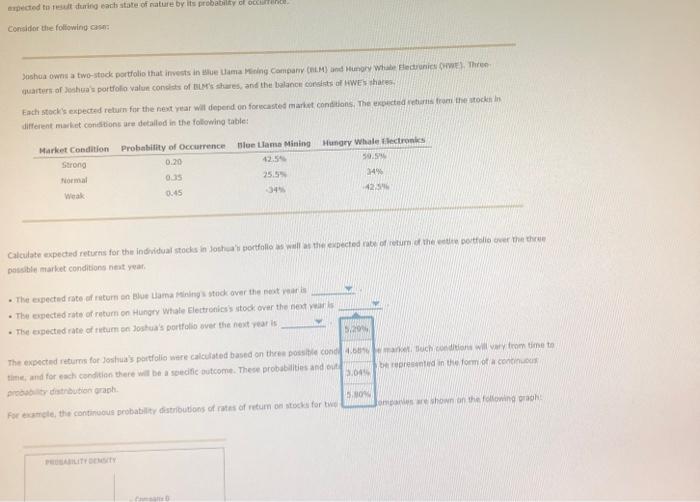

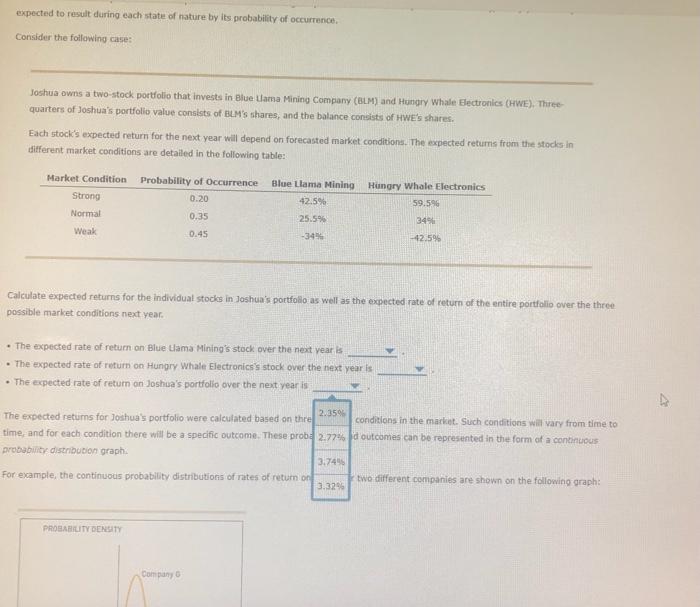

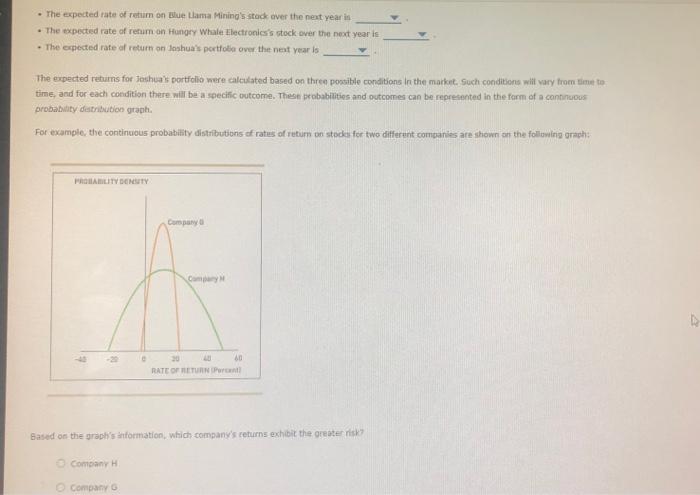

expected to resut during each sture of nature by its probabtity of ocrumence. ronsider the followitig case: o4ferent muske constions are tetaled lis the folloming tablet poskible market condibans reit rese. posouse tr distrouben prich Considor the following cast: Each stock's expected return for the nest rear wal depend oo focecastes market conditions, The explected retiris from the atockin ins different market contstibons are detalled in the following table: possible market condibions niest yeat. - The epected rate of riturn on Bhut Lama Minings studk over the poot nein is probest to diatrbution qraph. For exancle, the continucus probatilly distroutions of rates of retum on atoeki for twel expected to result during each state of nature by its probability of occurrence. Consider the following case: Joshua owns a two-stock portfolio that invests in Blue Uarna Mining Company (BLM) and Hungiry Whale Electronics (HWE), Threequarters of Joshua's portfolio value consists of BLM's shares, and the balance consists of HWE's shares. Each stock's expected return for the next year will depend on forecasted market conditions. The expected returns from the stocks in different market conditions are detailed in the following table: Calculate expected returns for the individual stocks in Joshua's portfollo as well as the expected rate of return of the entire portfolio over the three possible market conditions next year. - The expected rate of return on Blue Ulama Mining's stock over the next vear is - The expected rate of retuirn on Hungry Whale Electronics 's stock over the next year is - The expected rate of return on Joshua's portfolio over the next year is - The expected rate of retiim on Elue tlana Mining's stock dver the next year in - The expected rate of renim on Hungey Whale Electronics's tock ever the next year is - The empected rate of return on foshua's portfola over the next year is The expected returns for Joshuais portfillo were calculated based on three possible conditions in the market. Such condibiens wiil vary from time to time, and for each conifition there will be a specific cutcome. These probabilities and outcomes can be represented in the farm of a cantinuows probability destribution graph. For example, the continuous probability distributions of rates of retum on stodes for two differment comparies are shiown an the following araph: Gased on the graph's 'nformation, which company's ceturns exhibic the greater risk? Compani H Compacy 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started