Answered step by step

Verified Expert Solution

Question

1 Approved Answer

During the period May 1,2022 through December 31, 2022, Matilda earned salary of $124,000. Of these earnings, $120,125 was paid during this period with

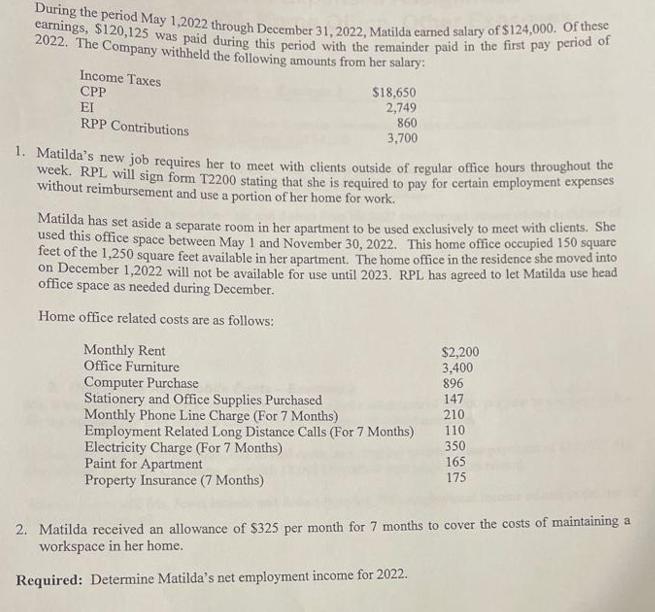

During the period May 1,2022 through December 31, 2022, Matilda earned salary of $124,000. Of these earnings, $120,125 was paid during this period with the remainder paid in the first pay period of 2022. The Company withheld the following amounts from her salary: Income Taxes CPP EI RPP Contributions $18,650 2,749 860 3,700 1. Matilda's new job requires her to meet with clients outside of regular office hours throughout the week. RPL will sign form T2200 stating that she is required to pay for certain employment expenses without reimbursement and use a portion of her home for work. Matilda has set aside a separate room in her apartment to be used exclusively to meet with clients. She used this office space between May 1 and November 30, 2022. This home office occupied 150 square feet of the 1,250 square feet available in her apartment. The home office in the residence she moved into on December 1,2022 will not be available for use until 2023. RPL has agreed to let Matilda use head office space as needed during December. Home office related costs are as follows: Monthly Rent Office Furniture Computer Purchase Stationery and Office Supplies Purchased Monthly Phone Line Charge (For 7 Months) Employment Related Long Distance Calls (For 7 Months) Electricity Charge (For 7 Months) Paint for Apartment Property Insurance (7 Months) $2,200 3,400 896 147 210 110 350 165 175 2. Matilda received an allowance of $325 per month for 7 months to cover the costs of maintaining a workspace in her home. Required: Determine Matilda's net employment income for 2022.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Solution To determine Matildas net employment income for 2022 we need to calculate her gross employment income and subtract her employment expenses an...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started