Answered step by step

Verified Expert Solution

Question

1 Approved Answer

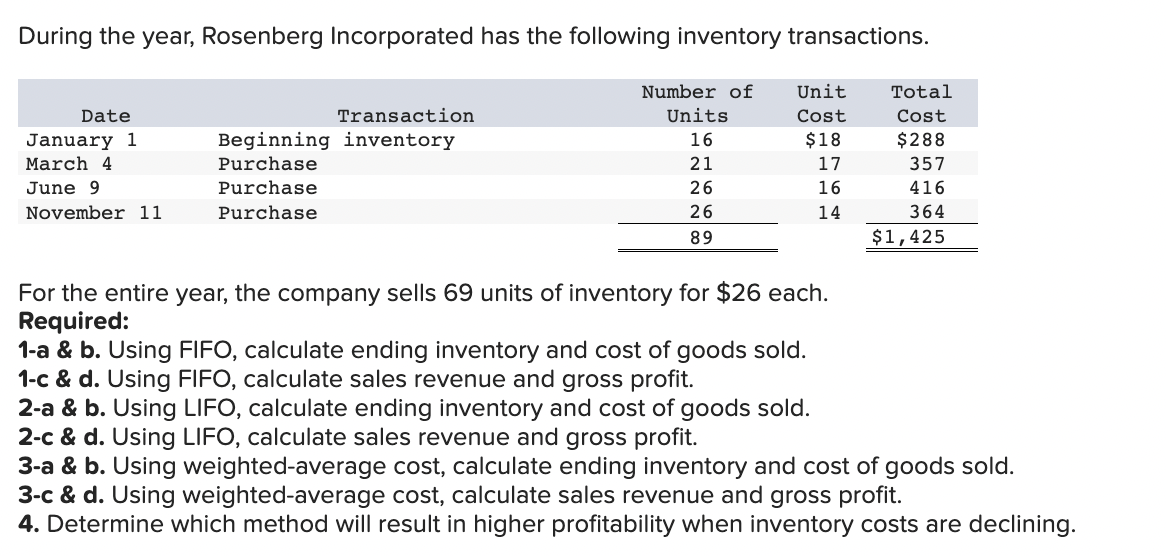

During the year, Rosenberg Incorporated has the following inventory transactions. Date January 1 Transaction Beginning inventory March 4 Purchase June 9 Purchase November 11

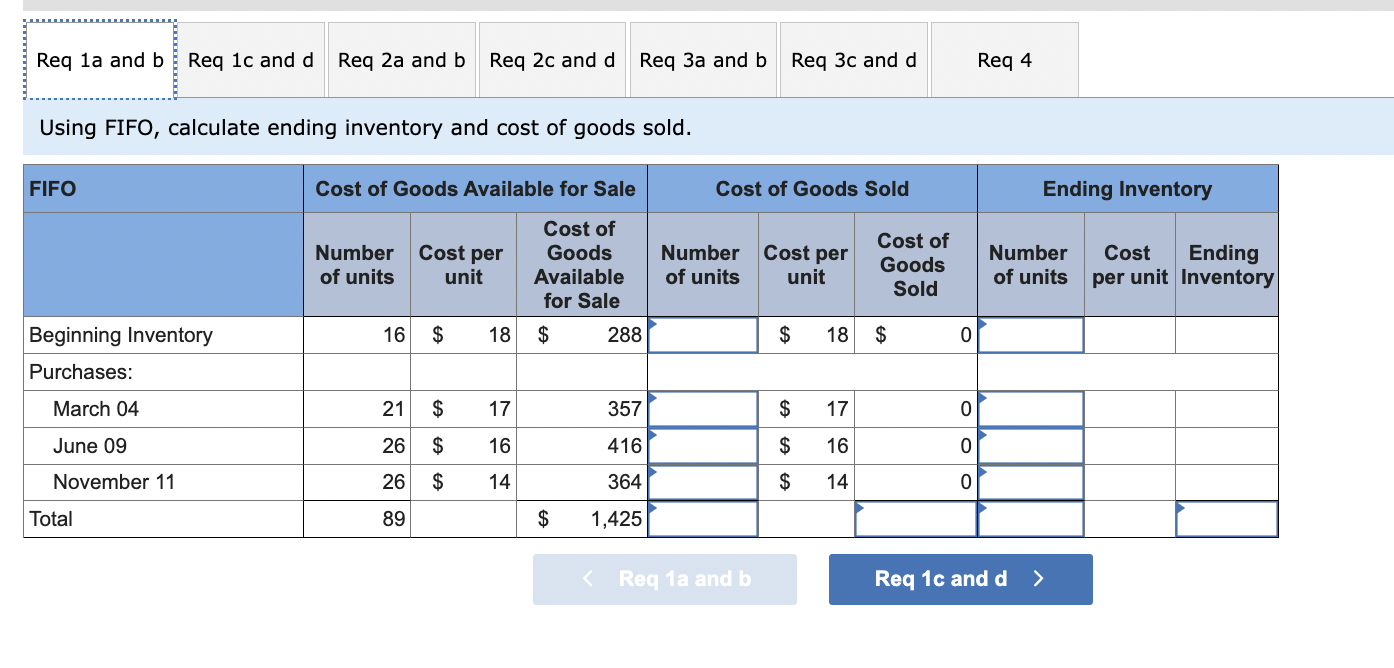

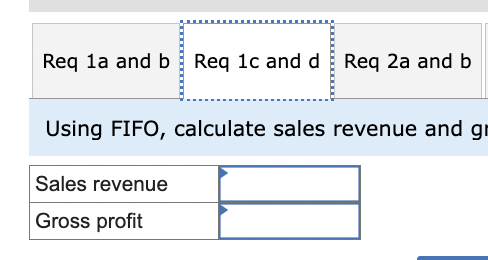

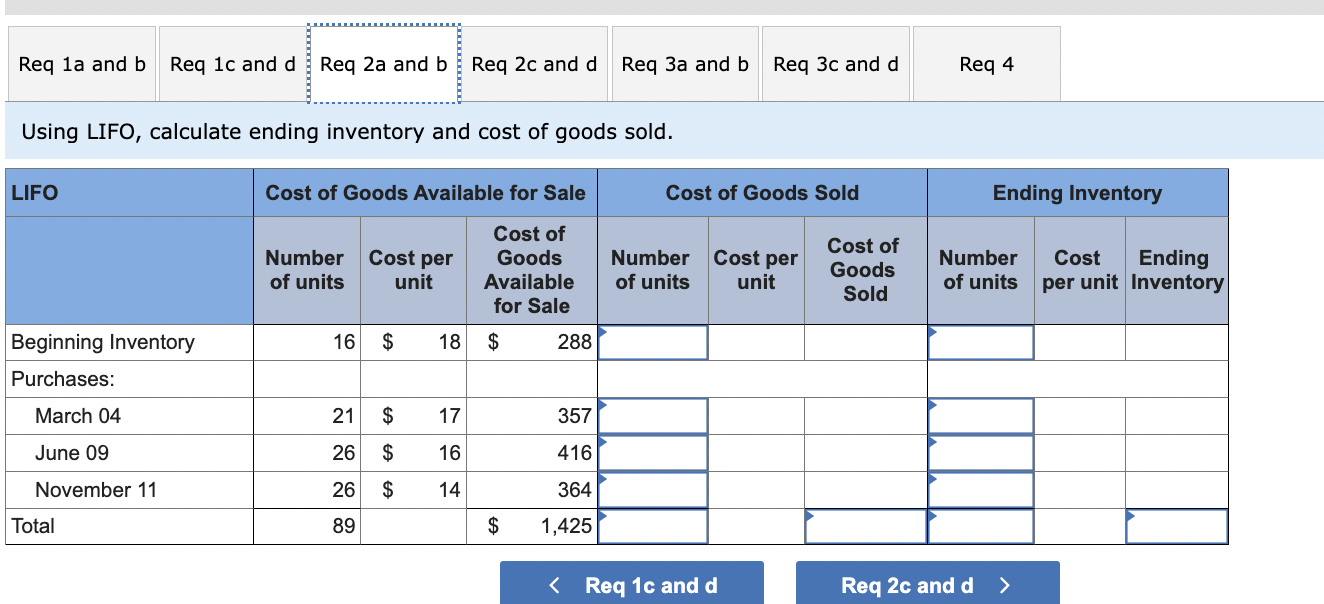

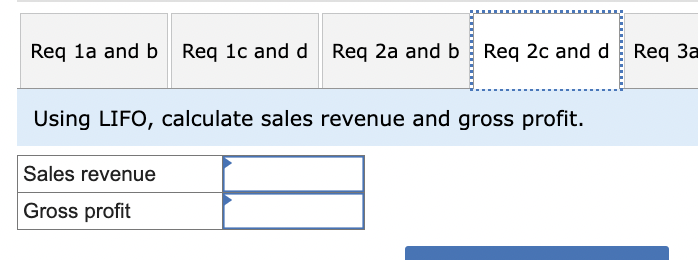

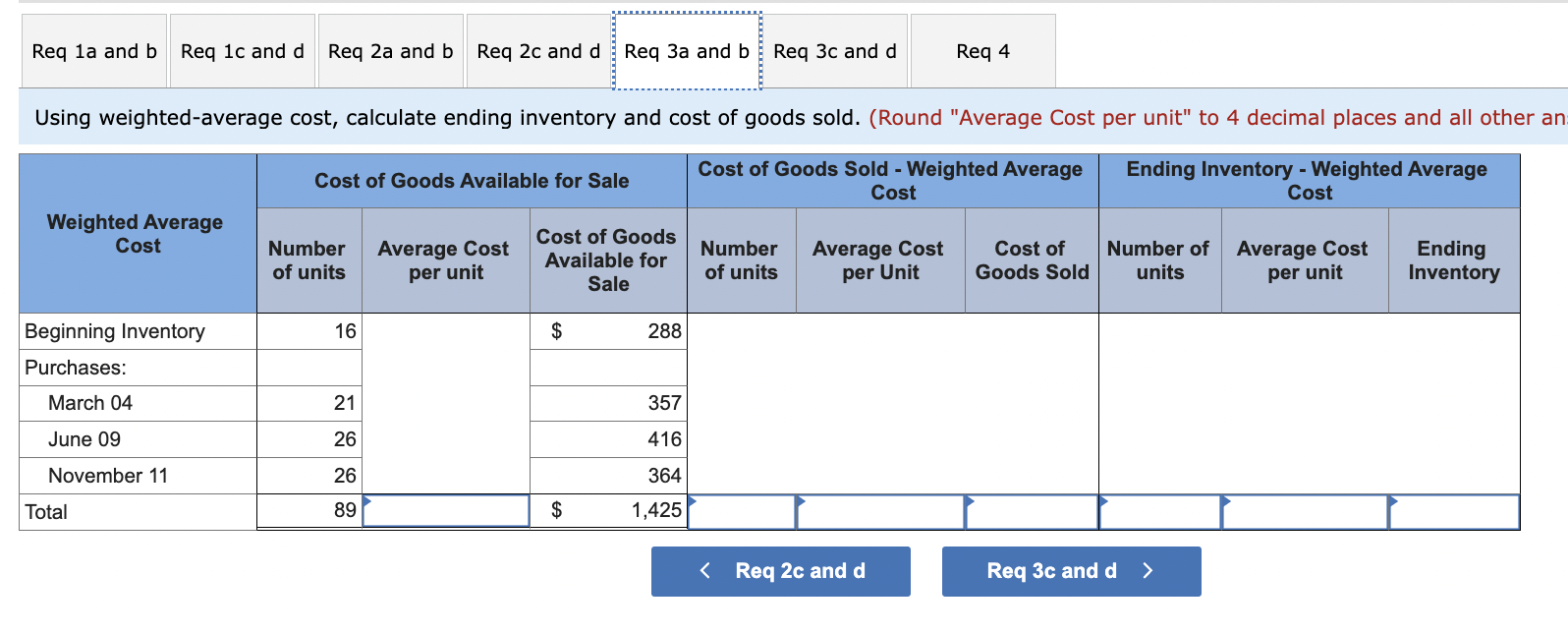

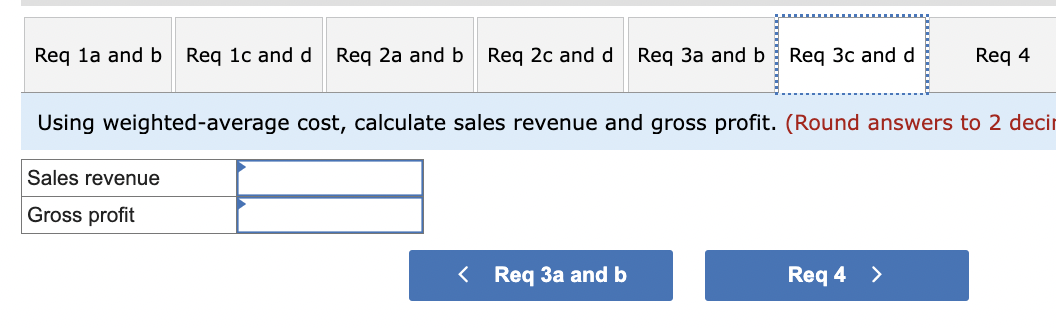

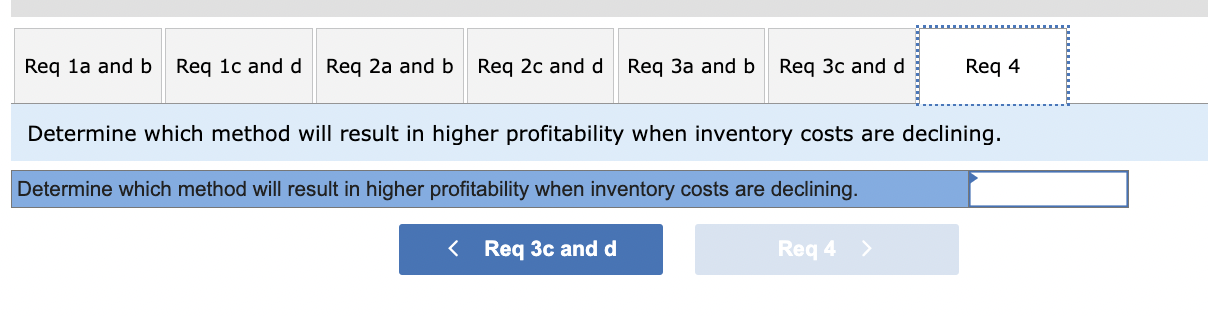

During the year, Rosenberg Incorporated has the following inventory transactions. Date January 1 Transaction Beginning inventory March 4 Purchase June 9 Purchase November 11 Purchase Number of Unit Total Units Cost Cost 16 $18 $288 21 17 357 26 16 416 26 14 364 89 $1,425 For the entire year, the company sells 69 units of inventory for $26 each. Required: 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue and gross profit. 2-a & b. Using LIFO, calculate ending inventory and cost of goods sold. 2-c & d. Using LIFO, calculate sales revenue and gross profit. 3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c & d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are declining. Req 1a and b Req 1c and d Req 2a and b Req 2c and d Req 3a and b Req 3c and d Using FIFO, calculate ending inventory and cost of goods sold. FIFO Beginning Inventory Purchases: Cost of Goods Available for Sale Cost of Goods Available Number Req 4 Cost of Goods Sold Ending Inventory Number of units Cost per unit of units Cost per unit Cost of Goods Number Cost Ending of units per unit Inventory Sold for Sale 16 $ 18 $ 288 $ 18 $ 0 March 04 21 $ EA 17 357 EA $ 17 0 June 09 26 $ 16 November 11 26 $ 14 64 416 364 SASA $ 16 $ 14 64 0 0 Total 89 $ 1,425 Req 1a and b Req 1c and d Req 2a and b Using FIFO, calculate sales revenue and gr Sales revenue Gross profit Req 1a and b Req 1c and d Req 2a and b Req 2c and d Req 3a and b Req 3c and d Req 4 Using LIFO, calculate ending inventory and cost of goods sold. LIFO Beginning Inventory Cost of Goods Available for Sale Cost of Goods Sold Number of units Cost per unit Cost of Goods Available Number of units Cost per unit Cost of Goods Sold for Sale 16 $ 18 $ 288 Ending Inventory Number Cost Ending of units per unit Inventory Purchases: March 04 21 $ June 09 26 $ 16 November 11 26 $ 764 17 357 416 14 364 Total 89 $ 1,425 Req 1a and b Req 1c and d Req 2a and b Req 2c and d Req 3a Using LIFO, calculate sales revenue and gross profit. Sales revenue Gross profit Req 1a and b Req 1c and d Req 2a and b Req 2c and d Req 3a and b Req 3c and d Req 4 Using weighted-average cost, calculate ending inventory and cost of goods sold. (Round "Average Cost per unit" to 4 decimal places and all other an Ending Inventory - Weighted Average Weighted Average Cost Beginning Inventory Cost of Goods Available for Sale Cost of Goods Sold - Weighted Average Cost Cost Number of units Average Cost per unit Cost of Goods Available for Number of units Sale Average Cost per Unit Cost of Goods Sold Number of units Average Cost per unit Ending Inventory 16 $ 288 Purchases: March 04 21 357 June 09 26 416 November 11 26 364 Total 89 $ 1,425 < Req 2c and d Req 3c and d > Req 1a and b Req 1c and d Req 2a and b Req 2c and d Req 3a and b Req 3c and d Req 4 Using weighted-average cost, calculate sales revenue and gross profit. (Round answers to 2 decir Sales revenue Gross profit < Req 3a and b Req 4 > Req 1a and b Req 1c and d Req 2a and b Req 2c and d Req 3a and b Req 3c and d Req 4 Determine which method will result in higher profitability when inventory costs are declining. Determine which method will result in higher profitability when inventory costs are declining. < Req 3c and d Req 4 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started