Answered step by step

Verified Expert Solution

Question

1 Approved Answer

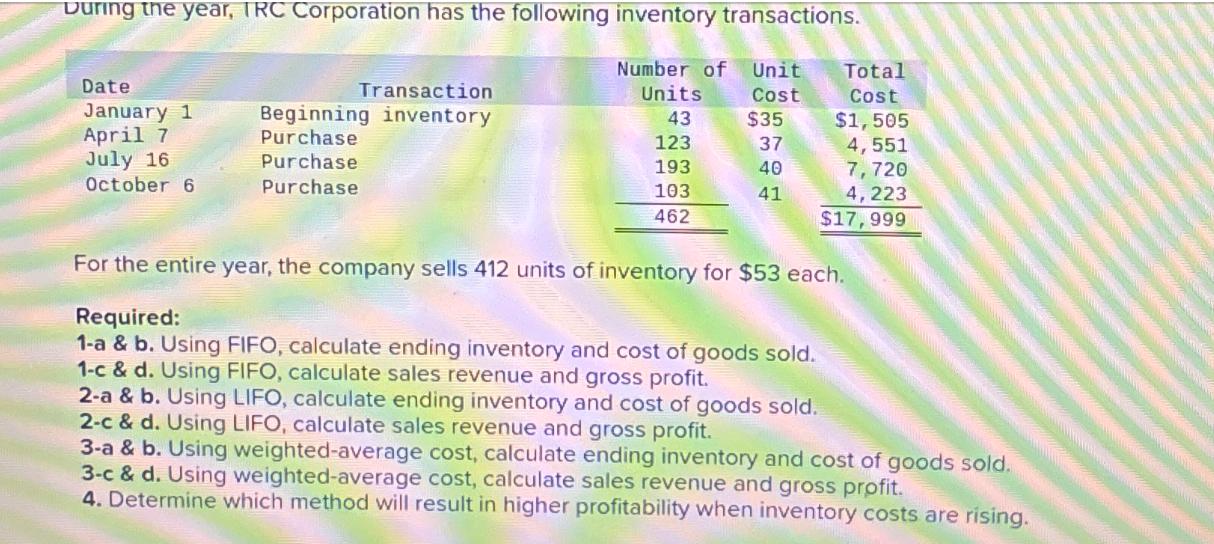

During the year, TRC Corporation has the following inventory transactions. Date January 1 Transaction Beginning inventory April 7 Purchase July 16 Purchase October 6

During the year, TRC Corporation has the following inventory transactions. Date January 1 Transaction Beginning inventory April 7 Purchase July 16 Purchase October 6 Purchase Number of Unit Total Units Cost Cost 43 $35 $1,505 123 37 4,551 193 40 7,720 103 41 4,223 462 $17,999 For the entire year, the company sells 412 units of inventory for $53 each. Required: 1-a & b. Using FIFO, calculate ending inventory and cost of goods sold. 1-c & d. Using FIFO, calculate sales revenue and gross profit. 2-a & b. Using LIFO, calculate ending inventory and cost of goods sold. 2-c & d. Using LIFO, calculate sales revenue and gross profit. 3-a & b. Using weighted-average cost, calculate ending inventory and cost of goods sold. 3-c & d. Using weighted-average cost, calculate sales revenue and gross profit. 4. Determine which method will result in higher profitability when inventory costs are rising.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate ending inventory cost of goods sold sales revenue and gross profit using different inventory costing methods FIFO LIFO and weightedaverage cost well follow the given inventory transaction...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started