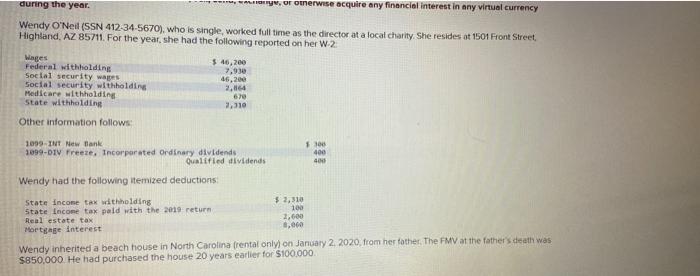

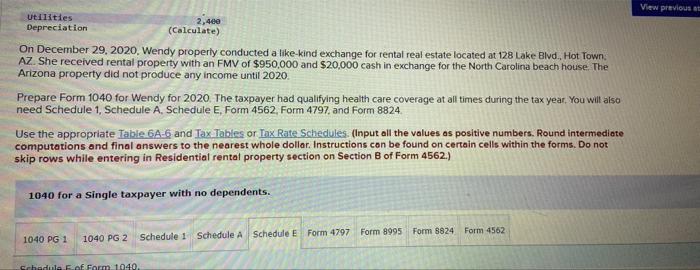

during the year. *****y, or otherwise acquire any financial interest in any virtual currency Wendy O'Neil (SSN 412-34-5670), who is single worked full time as the director at a local charity. She resides at 1501 Front Street Highland, AZ 85711. For the year, she had the following reported on her W-2 Wages Federal withholding Social security wages Social security withholding Medicare withholding State withholding $46,200 7,930 46,200 2,064 2,310 Other information follows: 1099-INT New Blank 1999-01V Freeze, Incorporated Ordinary dividends Qualified dividends 1300 400 400 Wendy had the following itemized deductions State Income tax withholding $ 2,310 State Income tax paid with the 2019 return 100 Real estate tax 2.600 Mortgage interest 8.000 Wendy inherited a beach house in North Carolina frental only on January 2, 2020 from her father. The FMV at the father's death was $850,000 He had purchased the house 20 years earlier for $100.000 View previous Utikties 2,400 Depreciation (Calculate) On December 29, 2020, Wendy properly conducted a like kind exchange for rental real estate located at 128 Lake Blvd., Hot Town AZ. She received rental property with an FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2020. Prepare Form 1040 for Wendy for 2020 The taxpayer had qualifying health care coverage at all times during the tax year. You will also need Schedule 1, Schedule A Schedule E, Form 4562, Form 4797, and Form 8824 Use the appropriate Table GA-6 and Tax Tables or Tax Rate Schedules (Input all the values as positive numbers. Round intermediate computations and final answers to the nearest whole dollar. Instructions can be found on certain cells within the forms. Do not skip rows while entering in Residential rental property section on Section of Form 4562.) 1040 for a single taxpayer with no dependents. 1040 PG 1 1040 PG 2 Schedule 1 Schedule A Schedule E Form 4797 Form 8995 Form 8824 Form 4562 Schedule of Form 1040 during the year. *****y, or otherwise acquire any financial interest in any virtual currency Wendy O'Neil (SSN 412-34-5670), who is single worked full time as the director at a local charity. She resides at 1501 Front Street Highland, AZ 85711. For the year, she had the following reported on her W-2 Wages Federal withholding Social security wages Social security withholding Medicare withholding State withholding $46,200 7,930 46,200 2,064 2,310 Other information follows: 1099-INT New Blank 1999-01V Freeze, Incorporated Ordinary dividends Qualified dividends 1300 400 400 Wendy had the following itemized deductions State Income tax withholding $ 2,310 State Income tax paid with the 2019 return 100 Real estate tax 2.600 Mortgage interest 8.000 Wendy inherited a beach house in North Carolina frental only on January 2, 2020 from her father. The FMV at the father's death was $850,000 He had purchased the house 20 years earlier for $100.000 View previous Utikties 2,400 Depreciation (Calculate) On December 29, 2020, Wendy properly conducted a like kind exchange for rental real estate located at 128 Lake Blvd., Hot Town AZ. She received rental property with an FMV of $950,000 and $20,000 cash in exchange for the North Carolina beach house. The Arizona property did not produce any income until 2020. Prepare Form 1040 for Wendy for 2020 The taxpayer had qualifying health care coverage at all times during the tax year. You will also need Schedule 1, Schedule A Schedule E, Form 4562, Form 4797, and Form 8824 Use the appropriate Table GA-6 and Tax Tables or Tax Rate Schedules (Input all the values as positive numbers. Round intermediate computations and final answers to the nearest whole dollar. Instructions can be found on certain cells within the forms. Do not skip rows while entering in Residential rental property section on Section of Form 4562.) 1040 for a single taxpayer with no dependents. 1040 PG 1 1040 PG 2 Schedule 1 Schedule A Schedule E Form 4797 Form 8995 Form 8824 Form 4562 Schedule of Form 1040