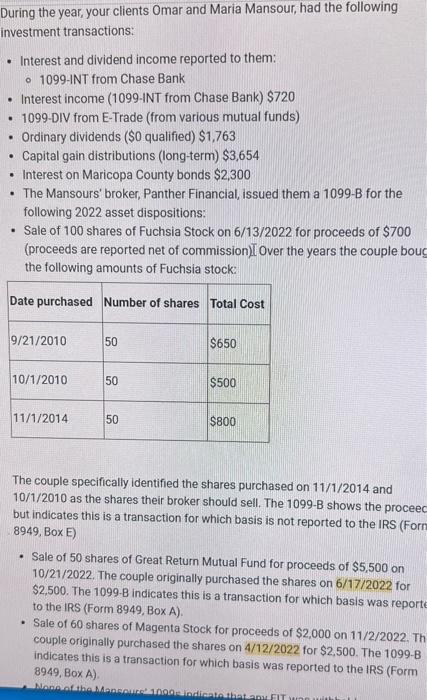

During the year, your clients Omar and Maria Mansour, had the following investment transactions: - Interest and dividend income reported to them: - 1099-INT from Chase Bank - Interest income (1099-INT from Chase Bank) \$720 - 1099-DIV from E-Trade (from various mutual funds) - Ordinary dividends (\$0 qualified) $1,763 - Capital gain distributions (long-term) $3,654 - Interest on Maricopa County bonds $2,300 - The Mansours' broker, Panther Financial, issued them a 1099-B for the following 2022 asset dispositions: - Sale of 100 shares of Fuchsia Stock on 6/13/2022 for proceeds of $700 (proceeds are reported net of commission)] Over the years the couple bouc the following amounts of Fuchsia stock: The couple specifically identified the shares purchased on 11/1/2014 and 10/1/2010 as the shares their broker should sell. The 1099-B shows the proceec but indicates this is a transaction for which basis is not reported to the IRS (Forn 8949, Box E) - Sale of 50 shares of Great Return Mutual Fund for proceeds of $5,500 on 10/21/2022. The couple originally purchased the shares on 6/17/2022 for \$2.500. The 1099-B indicates this is a transaction for which basis was reporte to the IRS (Form 8949, Box A). - Sale of 60 shares of Magenta Stock for proceeds of $2,000 on 11/2/2022. Th couple originally purchased the shares on 4/12/2022 for $2,500. The 1099-B indicates this is a transaction for which basis was reported to the IRS (Form 8949, Box A). - None of the Mansours' 1099 s indicate that any FIT was withheld. - Assume the Mansours have $150,000 of wage income during the year. DIRECTIONS: - Go to the IRS web site (www.IRS.gov .) and download the most current version of Form 8949 and Form 1040 Schedule D. Use Form 8949 and page 1 of Schedule D to compute net long-term and short-term capital gains. - Complete all relevant boxes on Form 8949 and page 1 of Schedule D and submit PDFs or pictures of your completed forms to Canvas. - Include the taxpayer's name ("Omar and Maria Mansour") on all relevant forms, but leave the box for SSN blank. - Use the tax rate tables and the individual income tax formula to compute the Mansours' taxable income and tax liability for the year (ignoring the alternative minimum tax and any phase-out provisions) assuming the couple files a joint return, has no dependents, and has itemized deductions totaling $30,000. - Submit your solution to Canvas. - Make sure to show all your work (i.e., the formula and numbers you used to calculate taxable income and tax liability). You do not need to submit any additional tax forms. - Clearly label your answer for taxable income and tax liability. During the year, your clients Omar and Maria Mansour, had the following investment transactions: - Interest and dividend income reported to them: - 1099-INT from Chase Bank - Interest income (1099-INT from Chase Bank) \$720 - 1099-DIV from E-Trade (from various mutual funds) - Ordinary dividends (\$0 qualified) $1,763 - Capital gain distributions (long-term) $3,654 - Interest on Maricopa County bonds $2,300 - The Mansours' broker, Panther Financial, issued them a 1099-B for the following 2022 asset dispositions: - Sale of 100 shares of Fuchsia Stock on 6/13/2022 for proceeds of $700 (proceeds are reported net of commission)] Over the years the couple bouc the following amounts of Fuchsia stock: The couple specifically identified the shares purchased on 11/1/2014 and 10/1/2010 as the shares their broker should sell. The 1099-B shows the proceec but indicates this is a transaction for which basis is not reported to the IRS (Forn 8949, Box E) - Sale of 50 shares of Great Return Mutual Fund for proceeds of $5,500 on 10/21/2022. The couple originally purchased the shares on 6/17/2022 for \$2.500. The 1099-B indicates this is a transaction for which basis was reporte to the IRS (Form 8949, Box A). - Sale of 60 shares of Magenta Stock for proceeds of $2,000 on 11/2/2022. Th couple originally purchased the shares on 4/12/2022 for $2,500. The 1099-B indicates this is a transaction for which basis was reported to the IRS (Form 8949, Box A). - None of the Mansours' 1099 s indicate that any FIT was withheld. - Assume the Mansours have $150,000 of wage income during the year. DIRECTIONS: - Go to the IRS web site (www.IRS.gov .) and download the most current version of Form 8949 and Form 1040 Schedule D. Use Form 8949 and page 1 of Schedule D to compute net long-term and short-term capital gains. - Complete all relevant boxes on Form 8949 and page 1 of Schedule D and submit PDFs or pictures of your completed forms to Canvas. - Include the taxpayer's name ("Omar and Maria Mansour") on all relevant forms, but leave the box for SSN blank. - Use the tax rate tables and the individual income tax formula to compute the Mansours' taxable income and tax liability for the year (ignoring the alternative minimum tax and any phase-out provisions) assuming the couple files a joint return, has no dependents, and has itemized deductions totaling $30,000. - Submit your solution to Canvas. - Make sure to show all your work (i.e., the formula and numbers you used to calculate taxable income and tax liability). You do not need to submit any additional tax forms. - Clearly label your answer for taxable income and tax liability