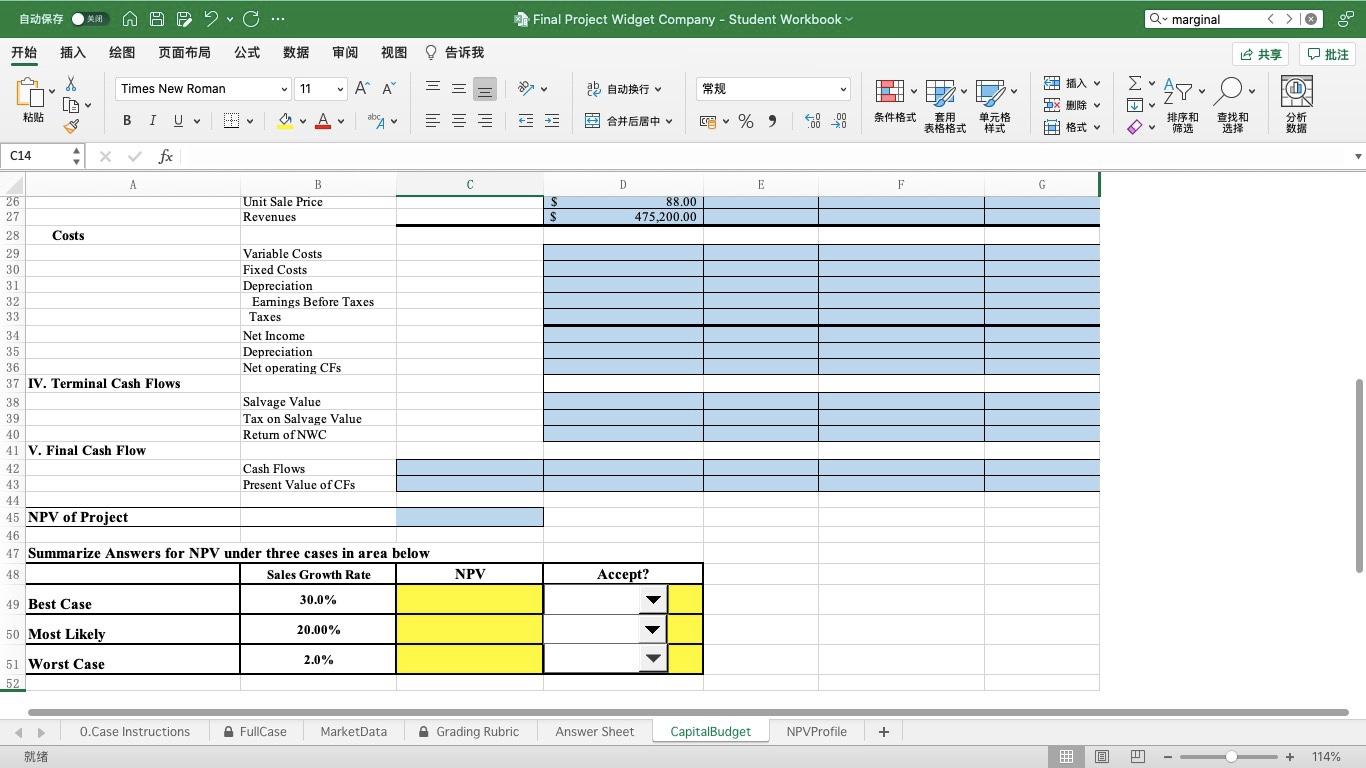

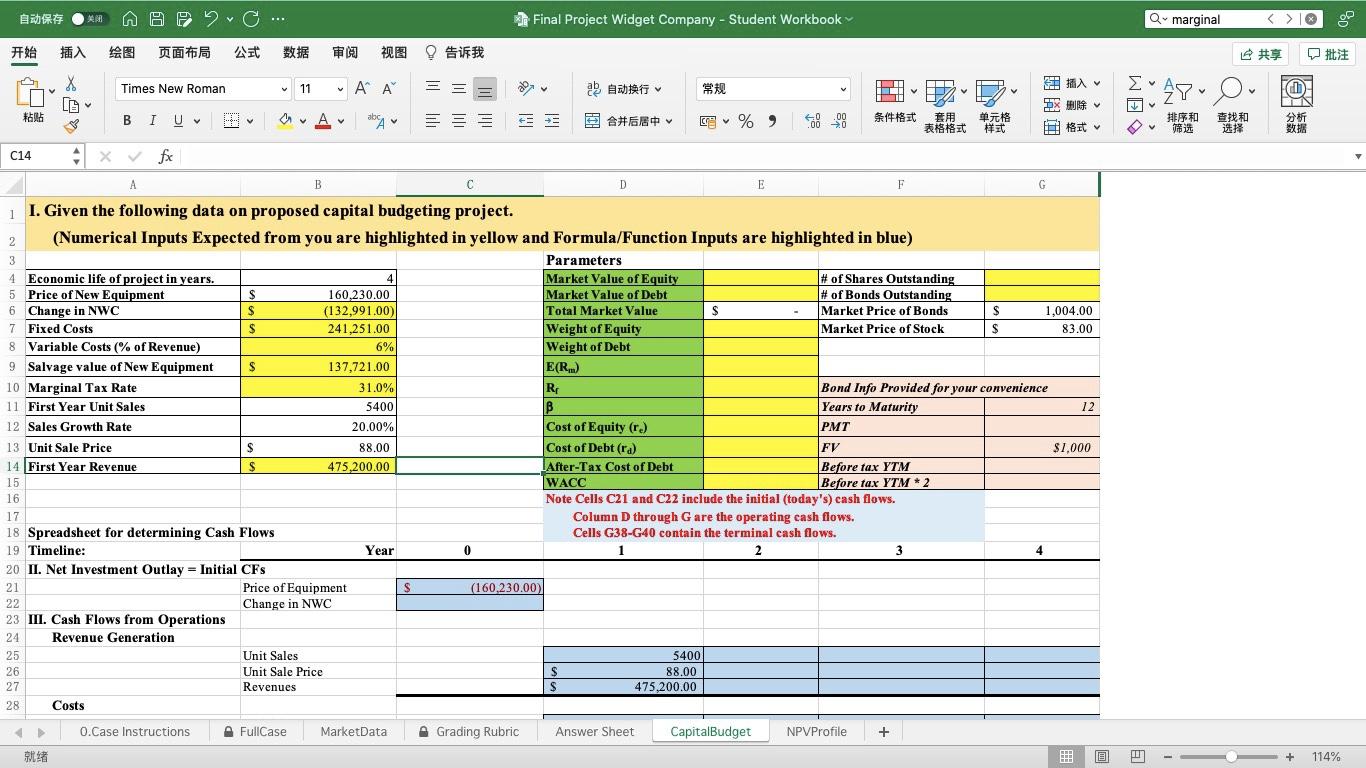

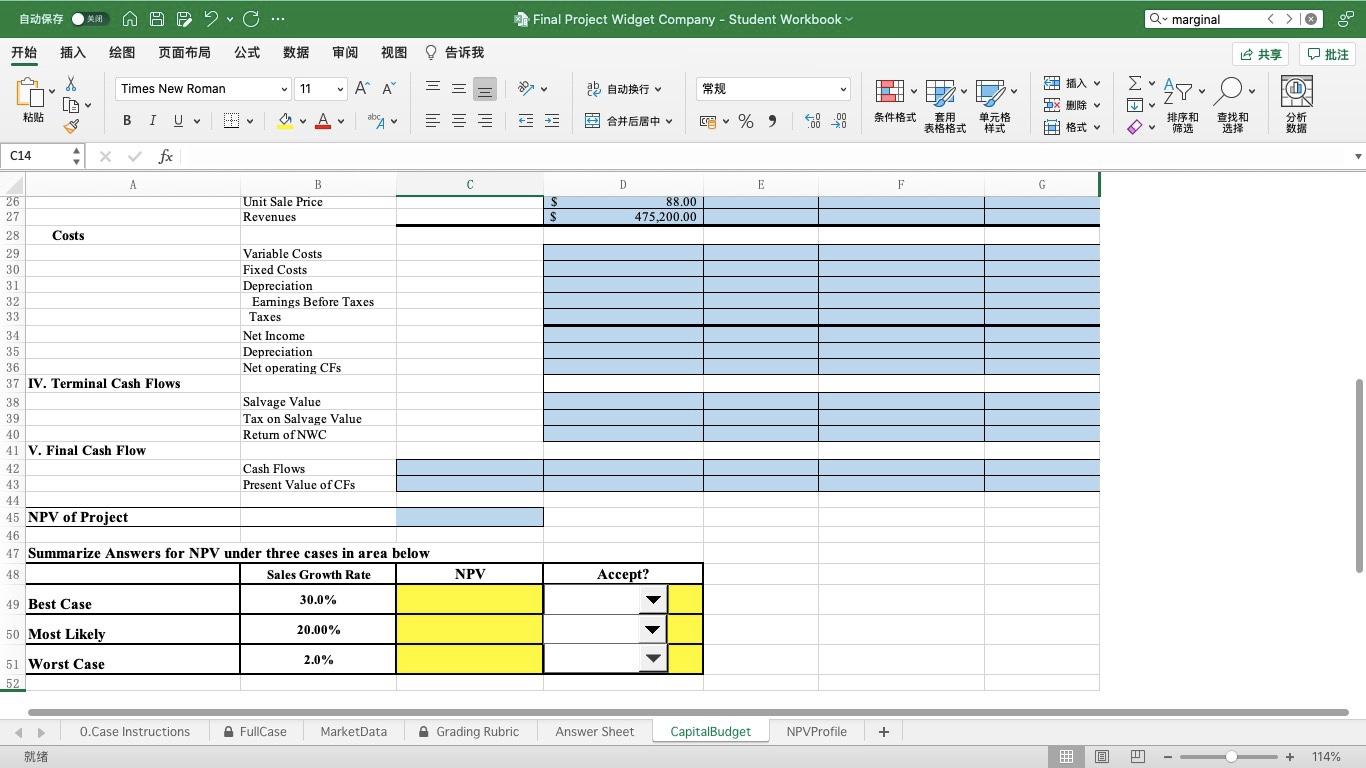

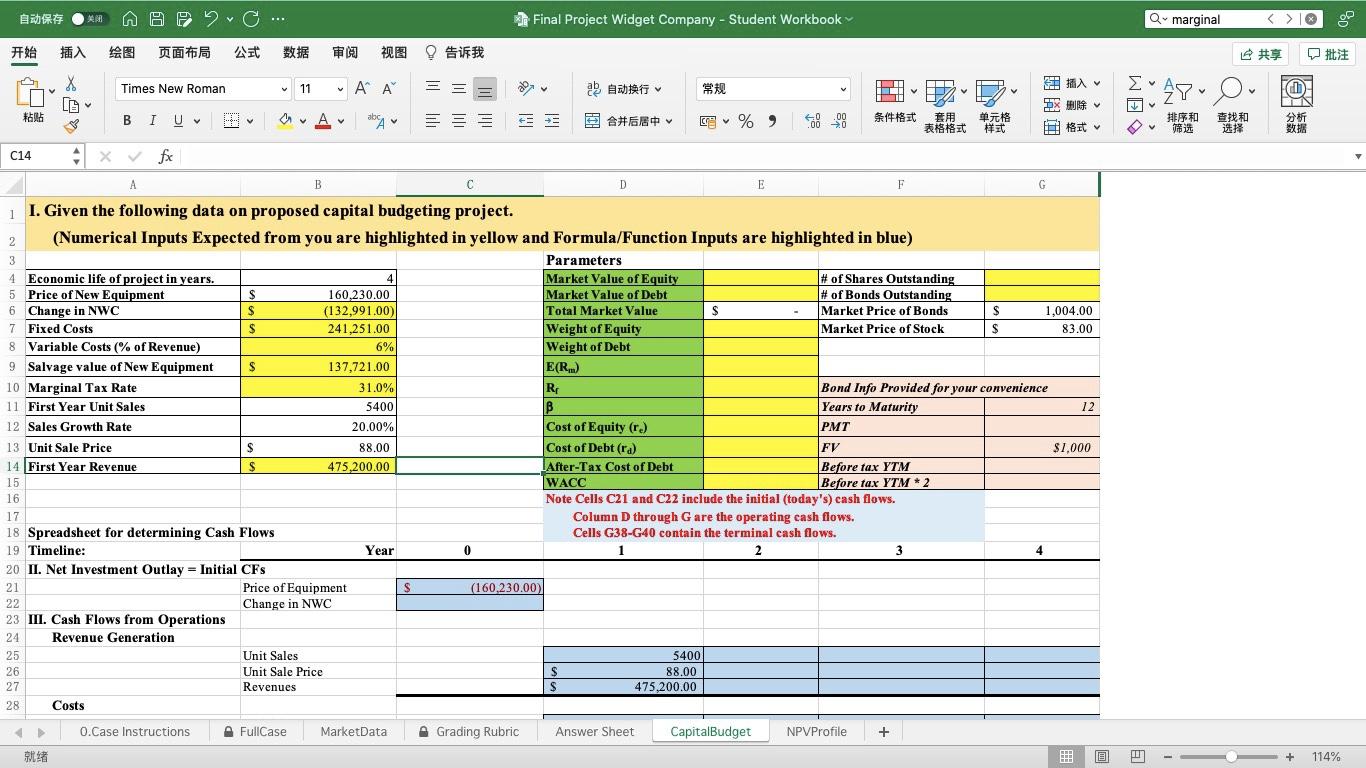

Dvd Final Project Widget Company - Student Workbook Q- marginal S 9 9 X Times New Roman y 11 A*A* = v Y D) y , v y | BIU * Why A A .00 V tigav y C % C14 I fx C D E F G 5 88.00 475,200.00 A B B 26 Unit Sale Price 27 Revenues 28 Costs 29 Variable Costs 30 Fixed Costs 31 Depreciation 32 Earnings Before Taxes 33 Taxes 34 Net Income 35 Depreciation 36 Net operating CFS 37 IV. Terminal Cash Flows 38 Salvage Value 39 Tax on Salvage Value 40 Return of NWC 41 V. Final Cash Flow 42 Cash Flows 43 Present Value of CFS 44 45 NPV of Project 46 47 Summarize Answers for NPV under three cases in area below 48 Sales Growth Rate NPV Accept? 49 Best Case 30.0% 50 Most Likely 20.00% 2.0% 51 Worst Case 52 0.Case Instructions A FullCase Market Data Grading Rubric Answer Sheet CapitalBudget NPVProfile + | + 114% @r... Final Project Widget Company - Student Workbook Q- marginal 0 9 # Times New Roman 11 ' ' = V X LO * y , DX it WE > > > AYO I U 00 V a. Av obav y A#18 FE CAP 8 % % C14 fx S A B D D E F G 1 I. Given the following data on proposed capital budgeting project. 2 (Numerical Inputs Expected from you are highlighted in yellow and Formula/Function Inputs are highlighted in blue) 3 Parameters Economic life of project in years. Market Value of Equity # of Shares Outstanding Price of New Equipment $ 160,230.00 Market Value of Debt # of Bonds Outstanding 6 Change in NWC S (132,991.00) Total Market Value Market Price of Bonds S 1,004.00 7 Fixed Costs $ 241,251.00 Weight of Equity Market Price of Stock $ 83.00 8 Variable Costs (% of Revenue) 6% Weight of Debt 9 Salvage value of New Equipment $ 137,721.00 E(R) 10 Marginal Tax Rate 31.0% R Bond Info Provided for your convenience 11 First Year Unit Sales 5400 B Years to Maturity 12 12 Sales Growth Rate 20.00% Cost of Equity (r.) PMT 13 Unit Sale Price S 88.00 Cost of Debt (ra) FV $1,000 14 First Year Revenue $ 475,200.00 After-Tax Cost of Debt Before tax YTM 15 WACC Before tax YTM + 2 16 Note Cells C21 and C22 include the initial (today's) cash flows. 17 Column D through G are the operating cash flows. 18 Spreadsheet for determining Cash Flows Cells G38-640 contain the terminal cash flows. 19 Timeline: Year 0 1 2 3 4 20 II. Net Investment Outlay = Initial CFS 21 Price of Equipment s (160,230.00) 22 Change in NWC 23 III. Cash Flows from Operations 24 Revenue Generation 25 Unit Sales 54001 26 Unit Sale Price S 88.00 27 Revenues 475,200.00 28 Costs 0.Case Instructions FullCase Market Data Grading Rubric Answer Sheet CapitalBudget NPVProfile + 2 + 114% Dvd Final Project Widget Company - Student Workbook Q- marginal S 9 9 X Times New Roman y 11 A*A* = v Y D) y , v y | BIU * Why A A .00 V tigav y C % C14 I fx C D E F G 5 88.00 475,200.00 A B B 26 Unit Sale Price 27 Revenues 28 Costs 29 Variable Costs 30 Fixed Costs 31 Depreciation 32 Earnings Before Taxes 33 Taxes 34 Net Income 35 Depreciation 36 Net operating CFS 37 IV. Terminal Cash Flows 38 Salvage Value 39 Tax on Salvage Value 40 Return of NWC 41 V. Final Cash Flow 42 Cash Flows 43 Present Value of CFS 44 45 NPV of Project 46 47 Summarize Answers for NPV under three cases in area below 48 Sales Growth Rate NPV Accept? 49 Best Case 30.0% 50 Most Likely 20.00% 2.0% 51 Worst Case 52 0.Case Instructions A FullCase Market Data Grading Rubric Answer Sheet CapitalBudget NPVProfile + | + 114% @r... Final Project Widget Company - Student Workbook Q- marginal 0 9 # Times New Roman 11 ' ' = V X LO * y , DX it WE > > > AYO I U 00 V a. Av obav y A#18 FE CAP 8 % % C14 fx S A B D D E F G 1 I. Given the following data on proposed capital budgeting project. 2 (Numerical Inputs Expected from you are highlighted in yellow and Formula/Function Inputs are highlighted in blue) 3 Parameters Economic life of project in years. Market Value of Equity # of Shares Outstanding Price of New Equipment $ 160,230.00 Market Value of Debt # of Bonds Outstanding 6 Change in NWC S (132,991.00) Total Market Value Market Price of Bonds S 1,004.00 7 Fixed Costs $ 241,251.00 Weight of Equity Market Price of Stock $ 83.00 8 Variable Costs (% of Revenue) 6% Weight of Debt 9 Salvage value of New Equipment $ 137,721.00 E(R) 10 Marginal Tax Rate 31.0% R Bond Info Provided for your convenience 11 First Year Unit Sales 5400 B Years to Maturity 12 12 Sales Growth Rate 20.00% Cost of Equity (r.) PMT 13 Unit Sale Price S 88.00 Cost of Debt (ra) FV $1,000 14 First Year Revenue $ 475,200.00 After-Tax Cost of Debt Before tax YTM 15 WACC Before tax YTM + 2 16 Note Cells C21 and C22 include the initial (today's) cash flows. 17 Column D through G are the operating cash flows. 18 Spreadsheet for determining Cash Flows Cells G38-640 contain the terminal cash flows. 19 Timeline: Year 0 1 2 3 4 20 II. Net Investment Outlay = Initial CFS 21 Price of Equipment s (160,230.00) 22 Change in NWC 23 III. Cash Flows from Operations 24 Revenue Generation 25 Unit Sales 54001 26 Unit Sale Price S 88.00 27 Revenues 475,200.00 28 Costs 0.Case Instructions FullCase Market Data Grading Rubric Answer Sheet CapitalBudget NPVProfile + 2 + 114%