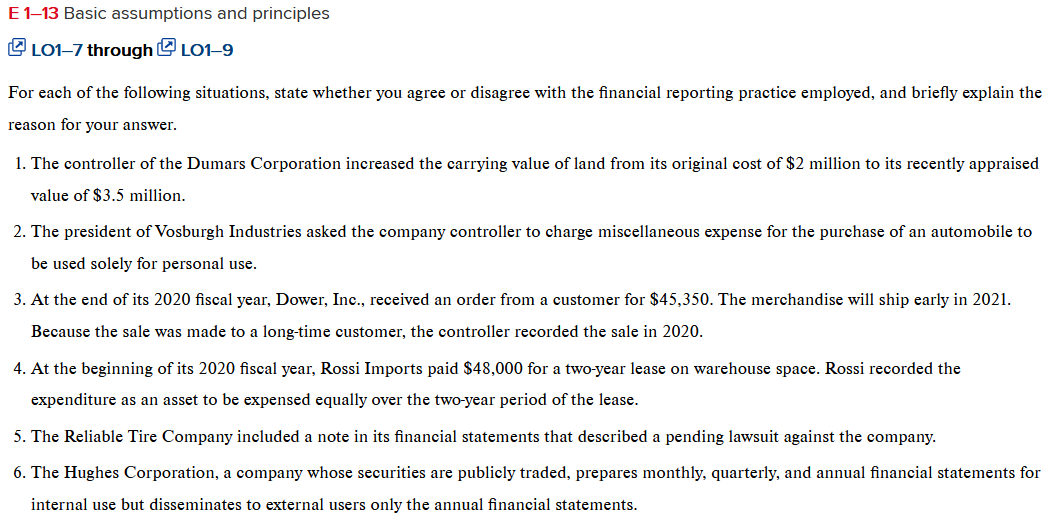

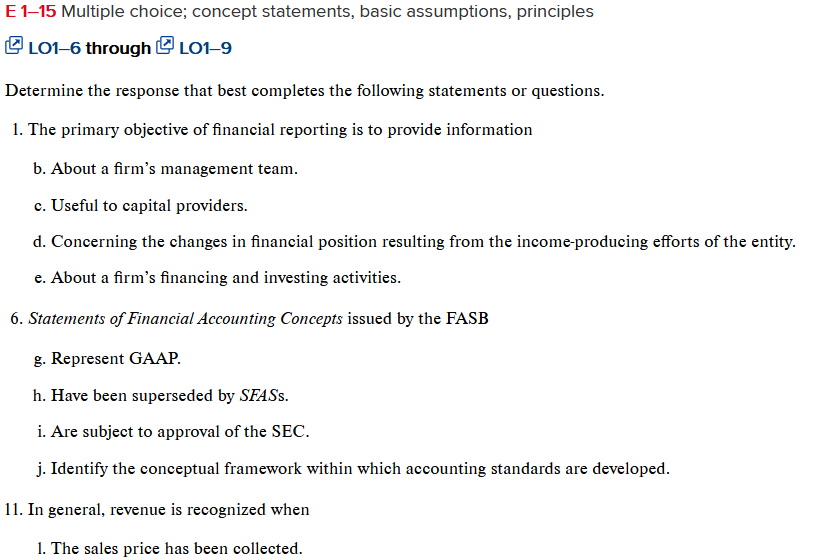

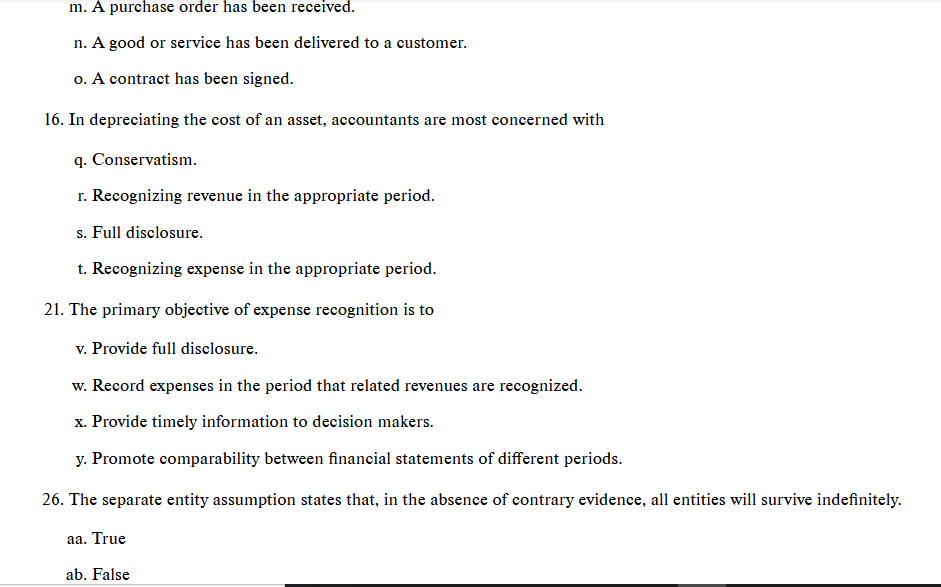

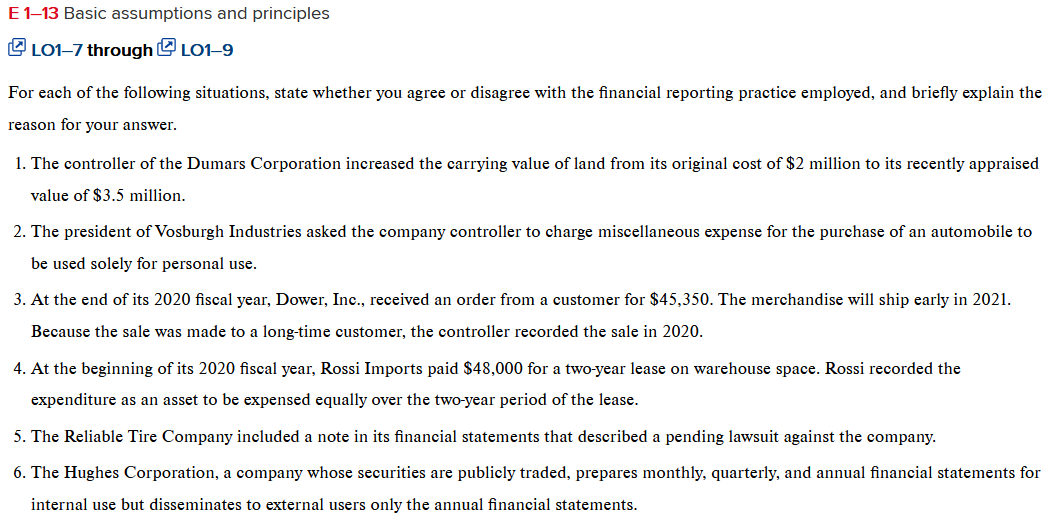

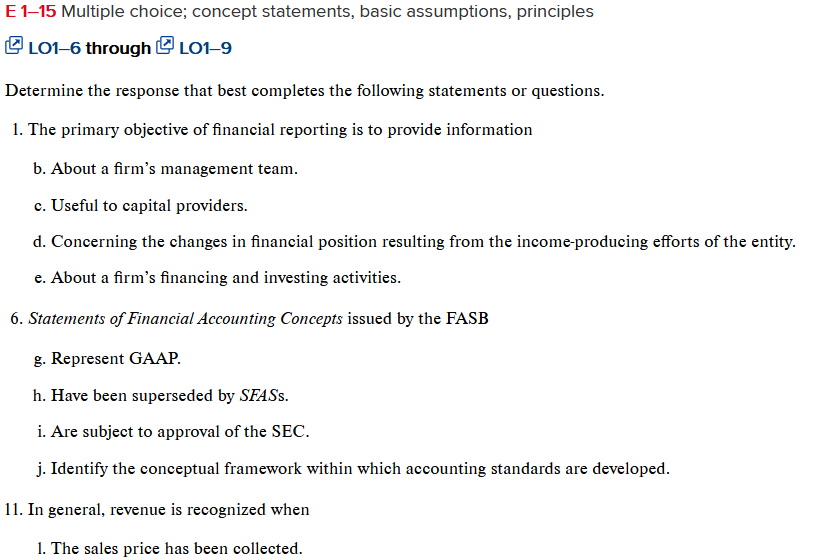

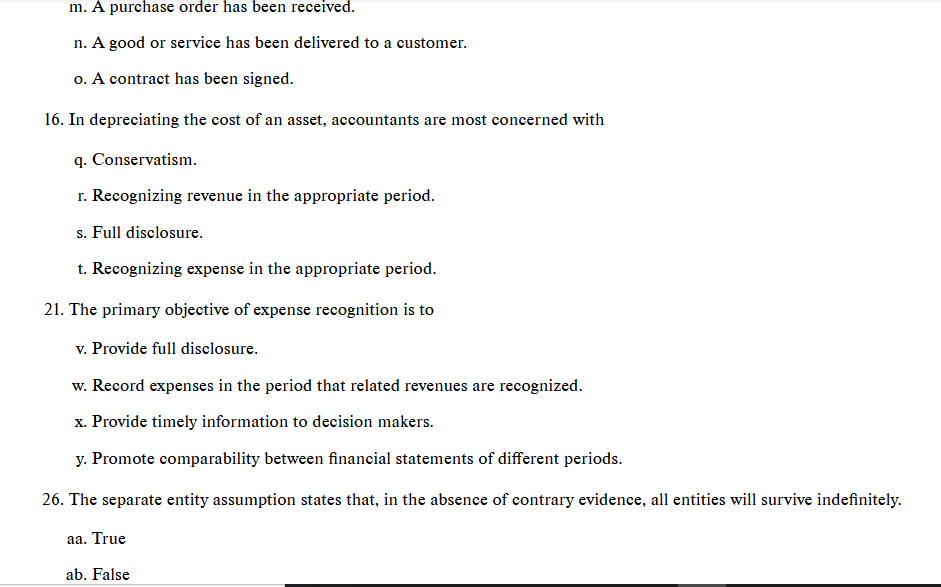

E 113 Basic assumptions and principles L017 through 1019 For each of the following situations, state whether you agree or disagree with the financial reporting practice employed, and briefly explain the reason for your answer. 1. The controller of the Dumars Corporation increased the carrying value of land from its original cost of $2 million to its recently appraised value of $3.5 million. 2. The president of Vosburgh Industries asked the company controller to charge miscellaneous expense for the purchase of an automobile to be used solely for personal use. 3. At the end of its 2020 fiscal year, Dower, Inc., received an order from a customer for $45,350. The merchandise will ship early in 2021. Because the sale was made to a long-time customer, the controller recorded the sale in 2020. 4. At the beginning of its 2020 fiscal year, Rossi Imports paid $48,000 for a two-year lease on warehouse space. Rossi recorded the expenditure as an asset to be expensed equally over the two-year period of the lease. 5. The Reliable Tire Company included a note in its financial statements that described a pending lawsuit against the company. 6. The Hughes Corporation, a company whose securities are publicly traded, prepares monthly, quarterly, and annual financial statements for internal use but disseminates to external users only the annual financial statements. E 115 Multiple choice; concept statements, basic assumptions, principles L016 through 101-9 Determine the response that best completes the following statements or questions. 1. The primary objective of financial reporting is to provide information b. About a firm's management team. c. Useful to capital providers. d. Concerning the changes in financial position resulting from the income-producing efforts of the entity. e. About a firm's financing and investing activities. 6. Statements of Financial Accounting Concepts issued by the FASB g. Represent GAAP. h. Have been superseded by SFASs. i. Are subject to approval of the SEC. j. Identify the conceptual framework within which accounting standards are developed. 11. In general, revenue is recognized when 1. The sales price has been collected. m. A purchase order has been received. n. A good or service has been delivered to a customer. o. A contract has been signed. 16. In depreciating the cost of an asset, accountants are most concerned with q. Conservatism. r. Recognizing revenue in the appropriate period. s. Full disclosure. t. Recognizing expense in the appropriate period. 21. The primary objective of expense recognition is to v. Provide full disclosure. w. Record expenses in the period that related revenues are recognized. x. Provide timely information to decision makers. y. Promote comparability between financial statements of different periods. 26. The separate entity assumption states that, in the absence of contrary evidence, all entities will survive indefinitely. aa. True ab. False