Answered step by step

Verified Expert Solution

Question

1 Approved Answer

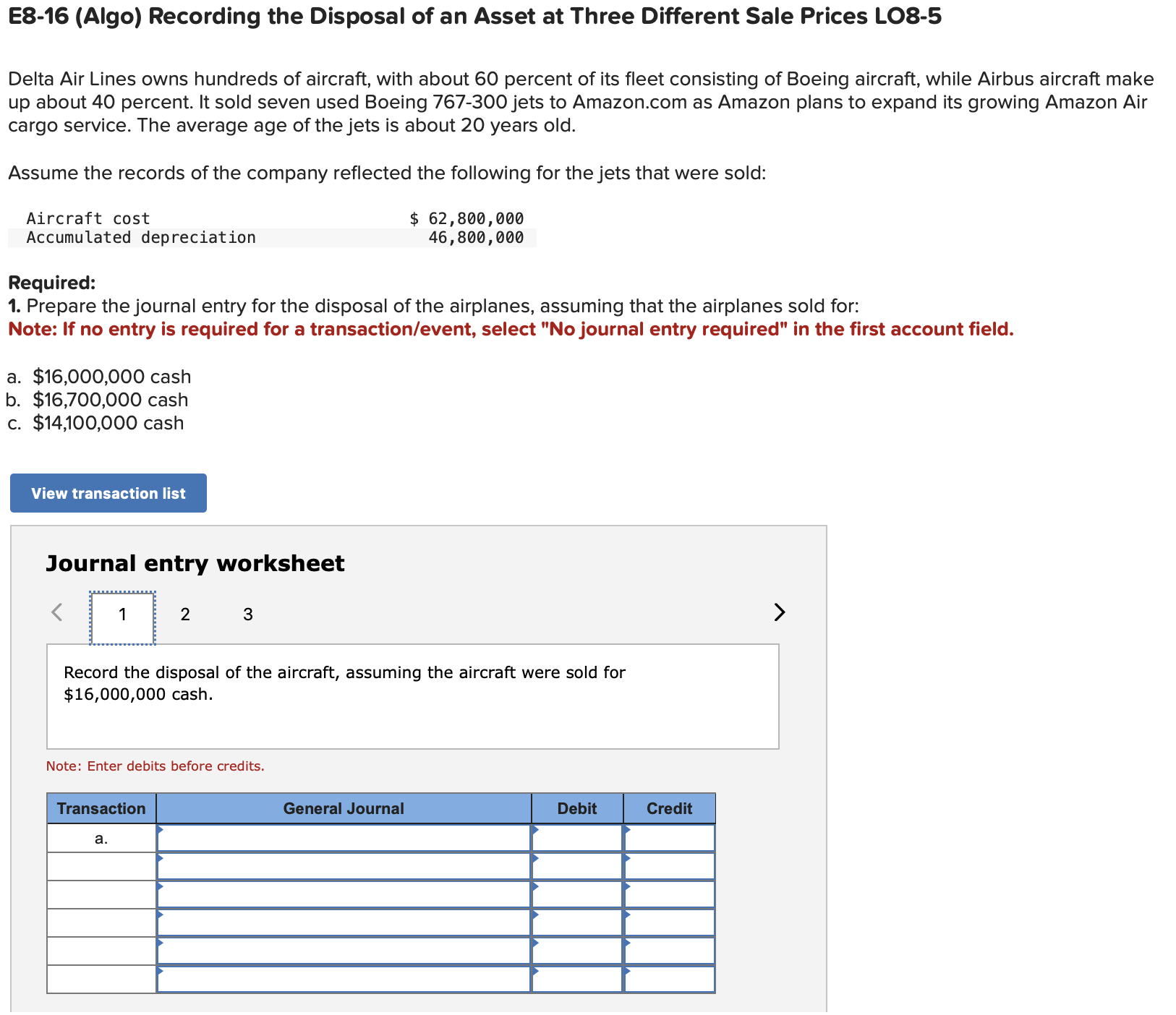

E 8 - 1 6 ( Algo ) Recording the Disposal of an Asset at Three Different Sale Prices LO 8 - 5 Delta Air

EAlgo Recording the Disposal of an Asset at Three Different Sale Prices LO

Delta Air Lines owns hundreds of aircraft, with about percent of its fleet consisting of Boeing aircraft, while Airbus aircraft make up about percent. It sold seven used Boeing jets to Amazon.com as Amazon plans to expand its growing Amazon Air cargo service. The average age of the jets is about years old.

Assume the records of the company reflected the following for the jets that were sold:

Aircraft cost $

Accumulated depreciation

Required:

Prepare the journal entry for the disposal of the airplanes, assuming that the airplanes sold for:

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

$ cash

$ cash

$ cash Journal entries need answered: Record the disposal of the aircraft, assuming the aircraft were sold for $ cash. Record the disposal of the aircraft, assuming that the aircraft were sold for $ cash. Record the disposal of the aircraft, assuming the aircraft was sold for $ cash.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started