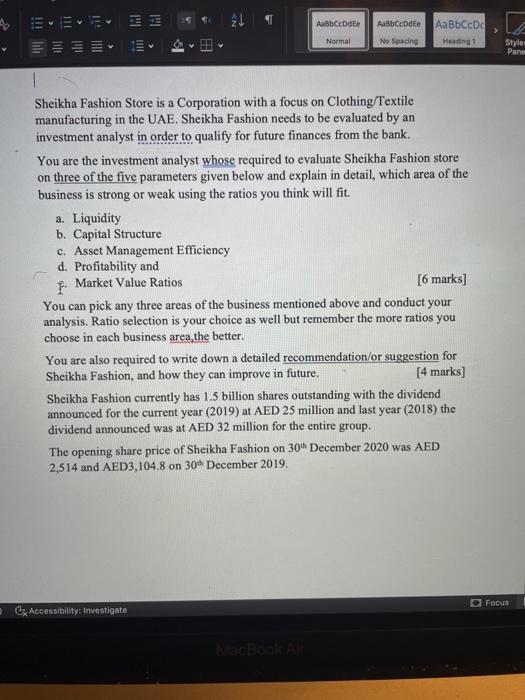

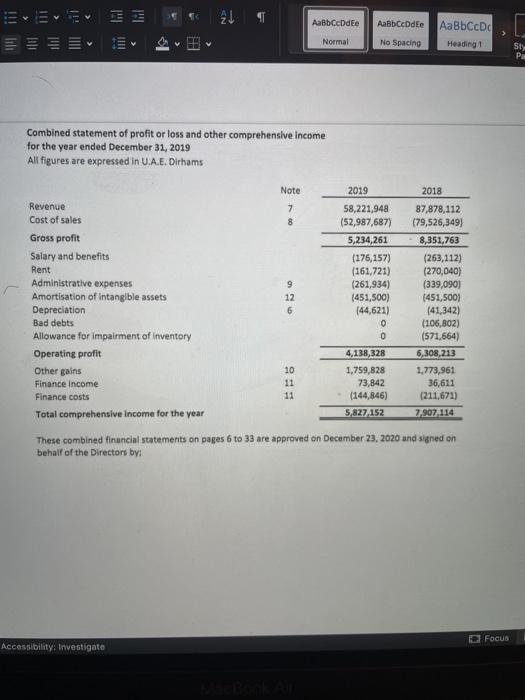

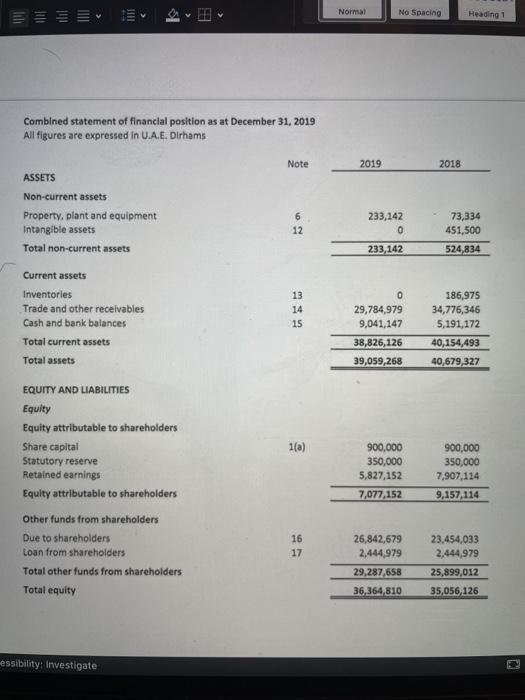

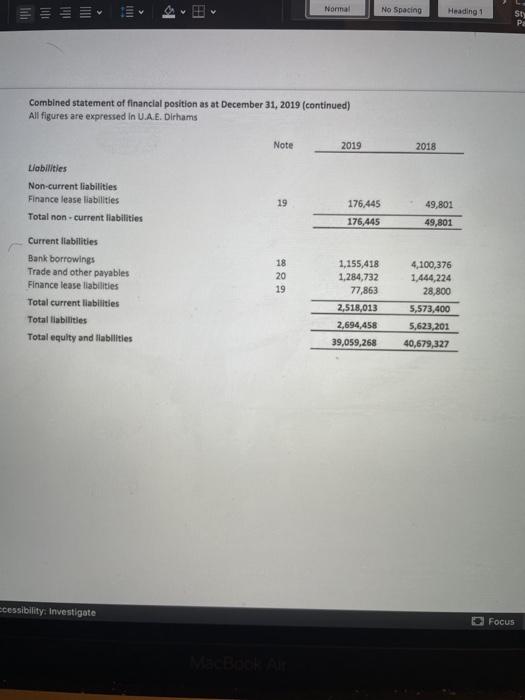

E AaBbccde ABCDER AaBCCDC Normal No Spacing 110 all Heong 1 IS Style Pane Sheikha Fashion Store is a Corporation with a focus on Clothing/Textile manufacturing in the UAE. Sheikha Fashion needs to be evaluated by an investment analyst in order to qualify for future finances from the bank. You are the investment analyst whose required to evaluate Sheikha Fashion store on three of the five parameters given below and explain in detail, which area of the business is strong or weak using the ratios you think will fit. a. Liquidity b. Capital Structure c. Asset Management Efficiency d. Profitability and Market Value Ratios [6 marks] You can pick any three areas of the business mentioned above and conduct your analysis. Ratio selection is your choice as well but remember the more ratios you choose in each business area, the better. You are also required to write down a detailed recommendation/or suggestion for Sheikha Fashion, and how they can improve in future. [4 marks] Sheikha Fashion currently has 1.5 billion shares outstanding with the dividend announced for the current year (2019) at AED 25 million and last year (2018) the dividend announced was at AED 32 million for the entire group. The opening share price of Sheikha Fashion on 30th December 2020 was AED 2,514 and AED3,104.8 on 30 December 2019, Focus Ci Accessibility: Investigate AaBbccbdee AaBbc dee Aa BbCcD III ili > Normal No Spacing Heading SU P Combined statement of profit or loss and other comprehensive income for the year ended December 31, 2019 All figures are expressed in U.A.E. Dirhams 9 Note 2019 2018 Revenue 7 58,221,948 87,878,112 Cost of sales 8 (52,987,687) (79,526,349) Gross profit 5,234,261 8,351,763 Salary and benefits (176,157) (263,112) Rent (161,721) (270,040) Administrative expenses (261,934) (339,090) Amortisation of intangible assets 12 (451,500) (451,500) Depreciation 6 (44,621) (41,342) Bad debts 0 (106,802) Allowance for impairment of Inventory (571,664) Operating profit 4,138,328 6,308,213 Other gains 10 1,759,828 1,773,961 Finance Income 11 73,842 36,611 Finance costs 11 (144,846) (211,671) Total comprehensive Income for the year 5,827,152 7.907, 114 These combined financial statements on pages 6 to 33 are approved on December 23, 2020 and signed on behalf of the Directors by: 0 FOCUS Accessibility: Investigate III HII Normal No Spacing Heading 1 Normal No Spacing Heading SU P Combined statement of profit or loss and other comprehensive income for the year ended December 31, 2019 All figures are expressed in U.A.E. Dirhams 9 Note 2019 2018 Revenue 7 58,221,948 87,878,112 Cost of sales 8 (52,987,687) (79,526,349) Gross profit 5,234,261 8,351,763 Salary and benefits (176,157) (263,112) Rent (161,721) (270,040) Administrative expenses (261,934) (339,090) Amortisation of intangible assets 12 (451,500) (451,500) Depreciation 6 (44,621) (41,342) Bad debts 0 (106,802) Allowance for impairment of Inventory (571,664) Operating profit 4,138,328 6,308,213 Other gains 10 1,759,828 1,773,961 Finance Income 11 73,842 36,611 Finance costs 11 (144,846) (211,671) Total comprehensive Income for the year 5,827,152 7.907, 114 These combined financial statements on pages 6 to 33 are approved on December 23, 2020 and signed on behalf of the Directors by: 0 FOCUS Accessibility: Investigate III HII Normal No Spacing Heading 1