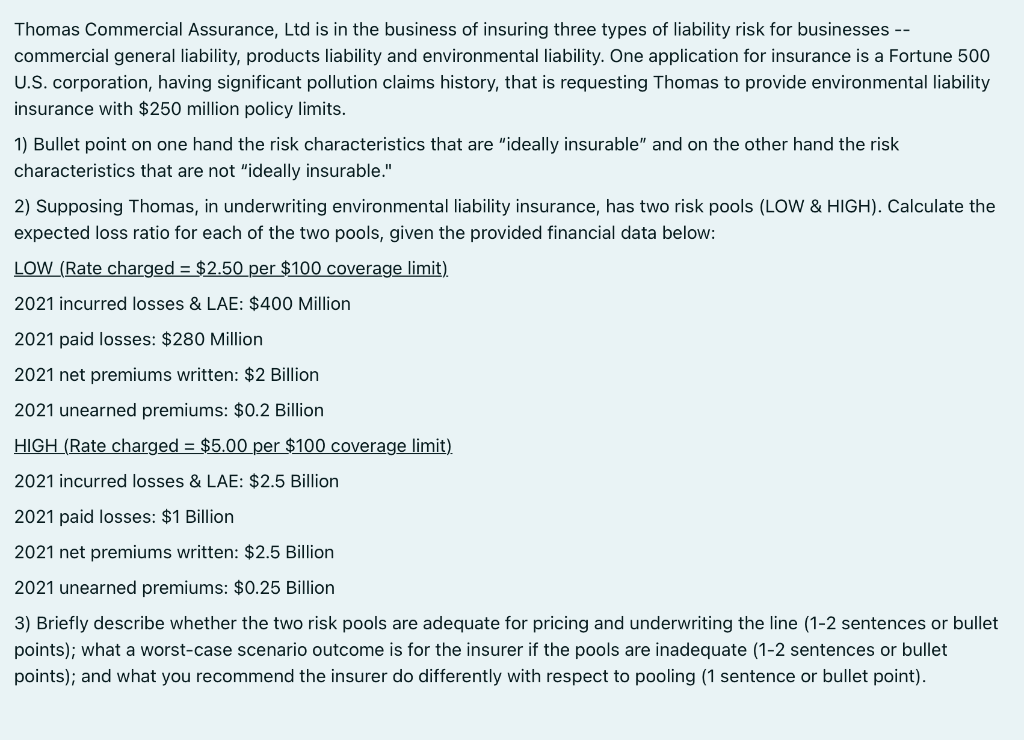

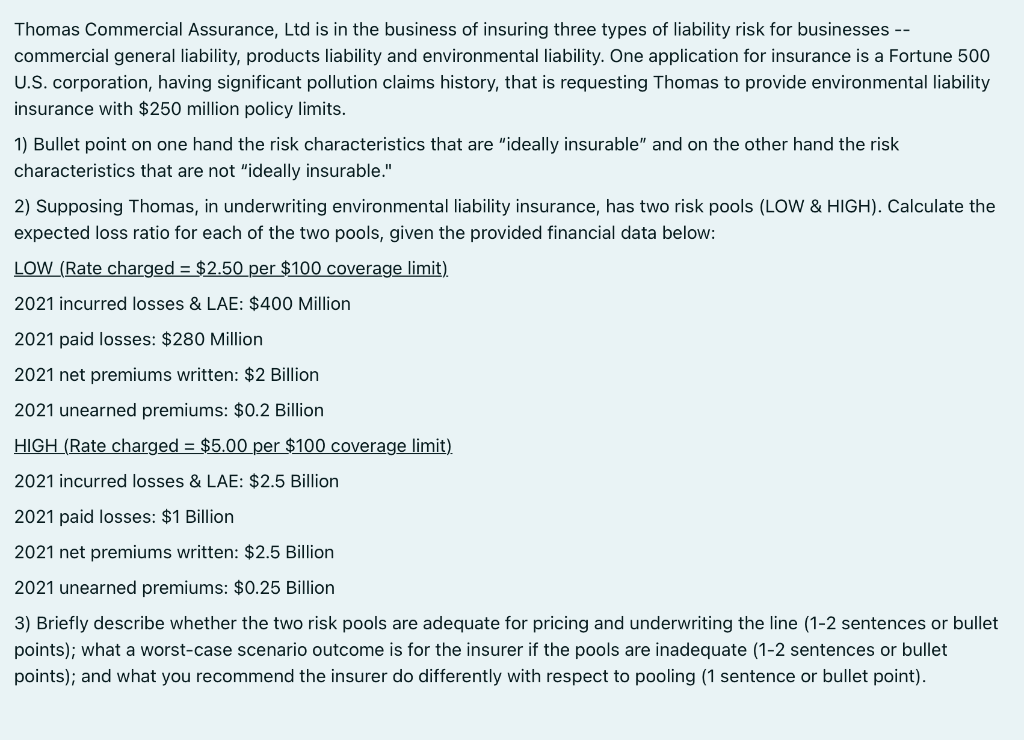

Thomas Commercial Assurance, Ltd is in the business of insuring three types of liability risk for businesses -- commercial general liability, products liability and environmental liability. One application for insurance is a Fortune 500 U.S. corporation, having significant pollution claims history, that is requesting Thomas to provide environmental liability insurance with $250 million policy limits. 1) Bullet point on one hand the risk characteristics that are "ideally insurable" and on the other hand the risk characteristics that are not "ideally insurable." 2) Supposing Thomas, in underwriting environmental liability insurance, has two risk pools (LOW & HIGH). Calculate the expected loss ratio for each of the two pools, given the provided financial data below: LOW (Rate charged = $2.50 per $100 coverage limit) 2021 incurred losses & LAE: $400 Million 2021 paid losses: $280 Million 2021 net premiums written: $2 Billion 2021 unearned premiums: $0.2 Billion HIGH (Rate charged = $5.00 per $100 coverage limit) 2021 incurred losses & LAE: $2.5 Billion 2021 paid losses: $1 Billion 2021 net premiums written: $2.5 Billion 2021 unearned premiums: $0.25 Billion 3) Briefly describe whether the two risk pools are adequate for pricing and underwriting the line (1-2 sentences or bullet points); what a worst-case scenario outcome is for the insurer if the pools are inadequate (1-2 sentences or bullet points); and what you recommend the insurer do differently with respect to pooling (1 sentence or bullet point). Thomas Commercial Assurance, Ltd is in the business of insuring three types of liability risk for businesses -- commercial general liability, products liability and environmental liability. One application for insurance is a Fortune 500 U.S. corporation, having significant pollution claims history, that is requesting Thomas to provide environmental liability insurance with $250 million policy limits. 1) Bullet point on one hand the risk characteristics that are "ideally insurable" and on the other hand the risk characteristics that are not "ideally insurable." 2) Supposing Thomas, in underwriting environmental liability insurance, has two risk pools (LOW & HIGH). Calculate the expected loss ratio for each of the two pools, given the provided financial data below: LOW (Rate charged = $2.50 per $100 coverage limit) 2021 incurred losses & LAE: $400 Million 2021 paid losses: $280 Million 2021 net premiums written: $2 Billion 2021 unearned premiums: $0.2 Billion HIGH (Rate charged = $5.00 per $100 coverage limit) 2021 incurred losses & LAE: $2.5 Billion 2021 paid losses: $1 Billion 2021 net premiums written: $2.5 Billion 2021 unearned premiums: $0.25 Billion 3) Briefly describe whether the two risk pools are adequate for pricing and underwriting the line (1-2 sentences or bullet points); what a worst-case scenario outcome is for the insurer if the pools are inadequate (1-2 sentences or bullet points); and what you recommend the insurer do differently with respect to pooling (1 sentence or bullet point)