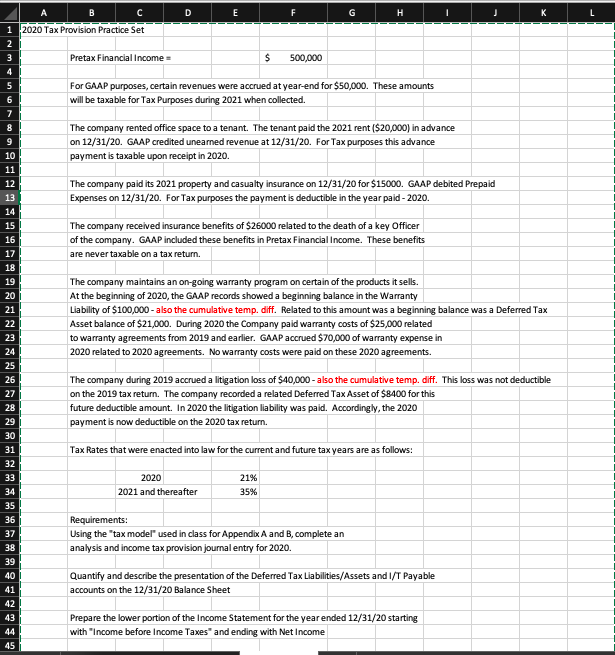

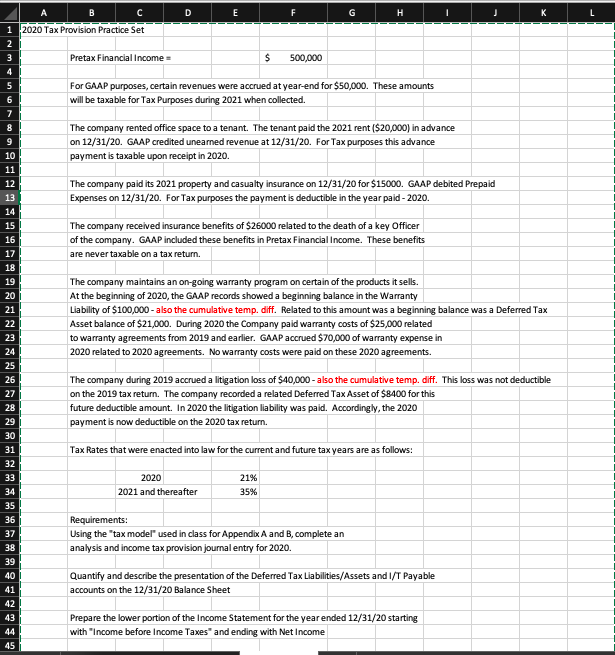

E H 1 2020 Tax Provision Practice Set Pretax Financial Income = $ 500,000 2 3 4 5 For GAAP purposes, certain revenues were accrued at year-end for $50,000. These amounts will be taxable for Tax Purposes during 2021 when collected 6 7 8 9 10 The company rented office space to a tenant. The tenant paid the 2021 rent ($20,000) in advance on 12/31/20. GAAP credited unearned revenue at 12/31/20. For Tax purposes this advance payment is taxable upon receipt in 2020. The company paid its 2021 property and casualty insurance on 12/31/20 for $15000. GAAP debited Prepaid Expenses on 12/31/20. For Tax purposes the payment is deductible in the year paid - 2020. 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 The company received insurance benefits of $26000 related to the death of a key Officer of the company. GAAP included these benefits in Pretax Financial Income. These benefits are never taxable on a tax return. The company maintains an on-going warranty program on certain of the products it sells. At the beginning of 2020, the GAAP records showed a beginning balance in the Warranty Liability of $100,000 - also the cumulative temp. diff. Related to this amount was a beginning balance was a Deferred Tax Asset balance of $21,000. During 2020 the Company paid warranty costs of $25,000 related to warranty agreements from 2019 and earlier. GAAP accrued $70,000 of warranty expense in 2020 related to 2020 agreements. No warranty costs were paid on these 2020 agreements. The company during 2019 accrued a litigation loss of $40,000 - also the cumulative temp. diff. This loss was not deductible on the 2019 tax return. The company recorded a related Deferred Tax Asset of $8400 for this future deductible amount. In 2020 the litigation liability was paid. Accordingly, the 2020 payment is now deductible on the 2020 tax return. 30 Tax Rates that were enacted into law for the current and future tax years are as follows: 31 32 33 34 2020 2021 and thereafter 21% 35% 35 36 Requirements: Using the "tax model used in class for Appendix A and B, complete an analysis and income tax provision journal entry for 2020. 37 38 39 40 41 42 43 44 45 Quantify and describe the presentation of the Deferred Tax Liabilities/Assets and 1/T Payable accounts on the 12/31/20 Balance Sheet Prepare the lower portion of the Income Statement for the year ended 12/31/20 starting with "Income before Income Taxes and ending with Net Income E H 1 2020 Tax Provision Practice Set Pretax Financial Income = $ 500,000 2 3 4 5 For GAAP purposes, certain revenues were accrued at year-end for $50,000. These amounts will be taxable for Tax Purposes during 2021 when collected 6 7 8 9 10 The company rented office space to a tenant. The tenant paid the 2021 rent ($20,000) in advance on 12/31/20. GAAP credited unearned revenue at 12/31/20. For Tax purposes this advance payment is taxable upon receipt in 2020. The company paid its 2021 property and casualty insurance on 12/31/20 for $15000. GAAP debited Prepaid Expenses on 12/31/20. For Tax purposes the payment is deductible in the year paid - 2020. 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 The company received insurance benefits of $26000 related to the death of a key Officer of the company. GAAP included these benefits in Pretax Financial Income. These benefits are never taxable on a tax return. The company maintains an on-going warranty program on certain of the products it sells. At the beginning of 2020, the GAAP records showed a beginning balance in the Warranty Liability of $100,000 - also the cumulative temp. diff. Related to this amount was a beginning balance was a Deferred Tax Asset balance of $21,000. During 2020 the Company paid warranty costs of $25,000 related to warranty agreements from 2019 and earlier. GAAP accrued $70,000 of warranty expense in 2020 related to 2020 agreements. No warranty costs were paid on these 2020 agreements. The company during 2019 accrued a litigation loss of $40,000 - also the cumulative temp. diff. This loss was not deductible on the 2019 tax return. The company recorded a related Deferred Tax Asset of $8400 for this future deductible amount. In 2020 the litigation liability was paid. Accordingly, the 2020 payment is now deductible on the 2020 tax return. 30 Tax Rates that were enacted into law for the current and future tax years are as follows: 31 32 33 34 2020 2021 and thereafter 21% 35% 35 36 Requirements: Using the "tax model used in class for Appendix A and B, complete an analysis and income tax provision journal entry for 2020. 37 38 39 40 41 42 43 44 45 Quantify and describe the presentation of the Deferred Tax Liabilities/Assets and 1/T Payable accounts on the 12/31/20 Balance Sheet Prepare the lower portion of the Income Statement for the year ended 12/31/20 starting with "Income before Income Taxes and ending with Net Income