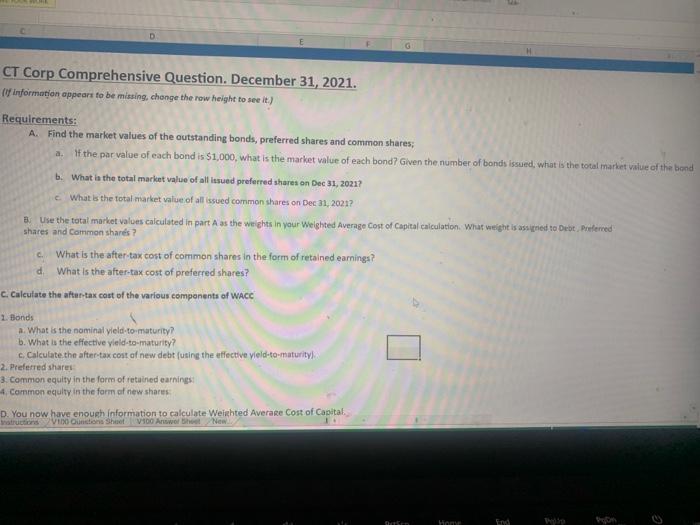

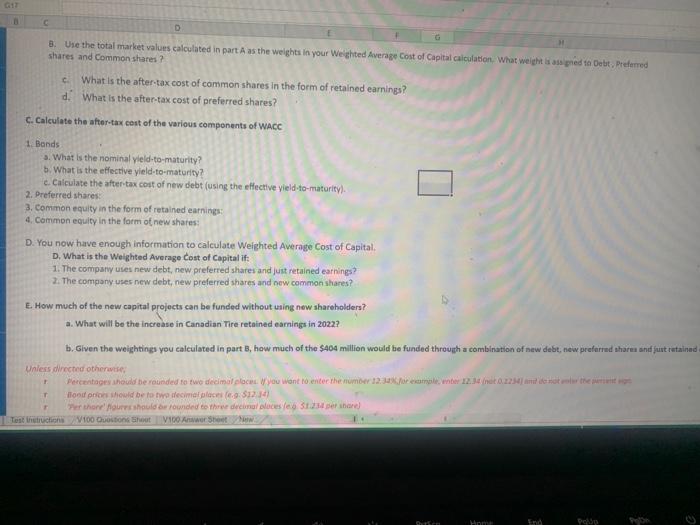

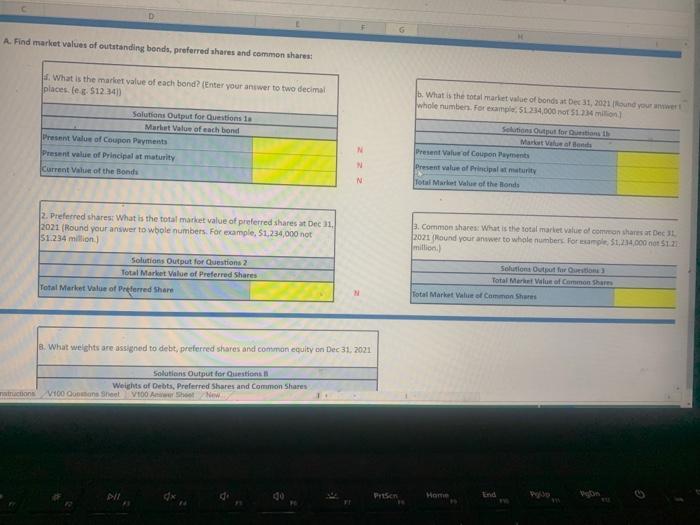

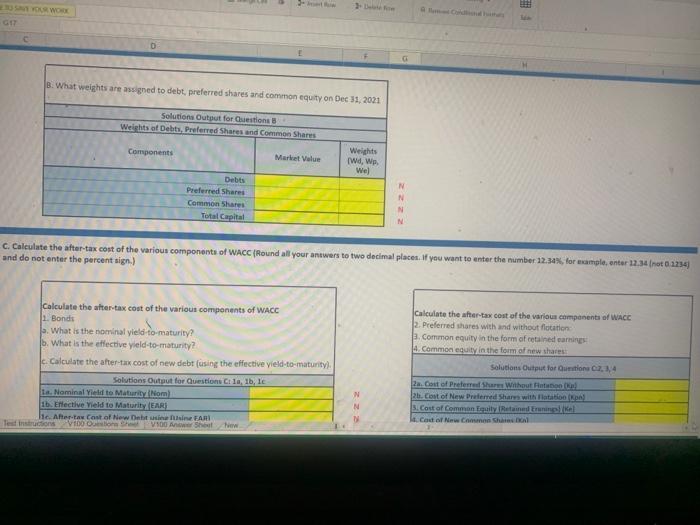

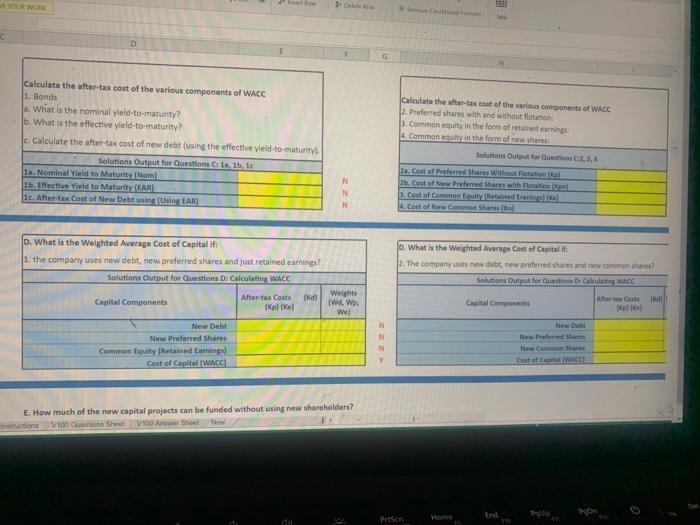

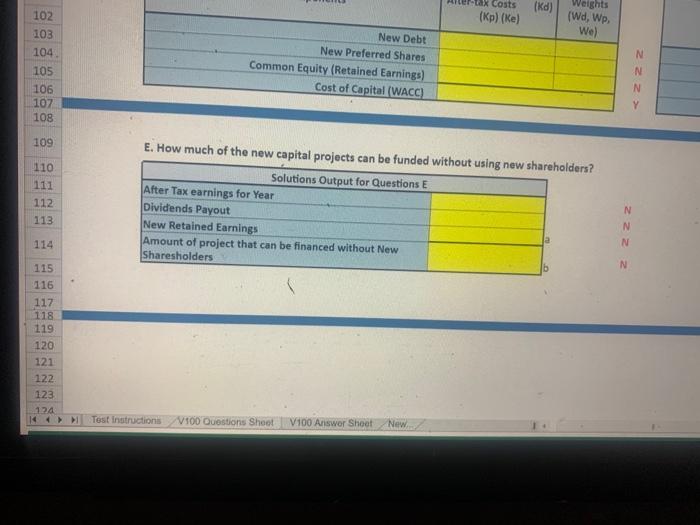

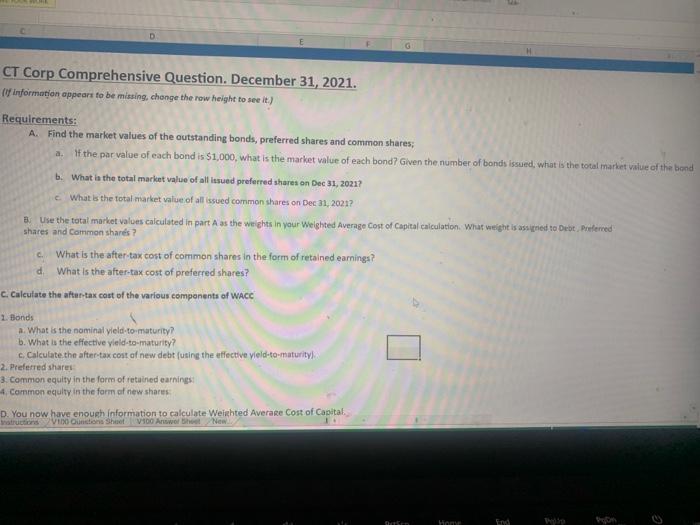

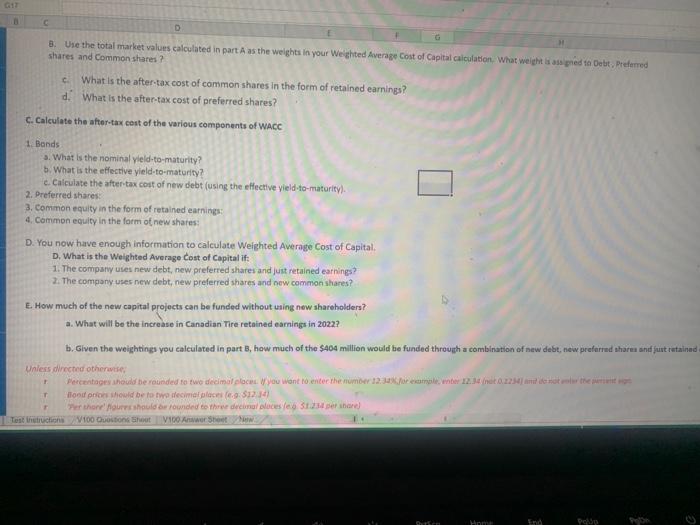

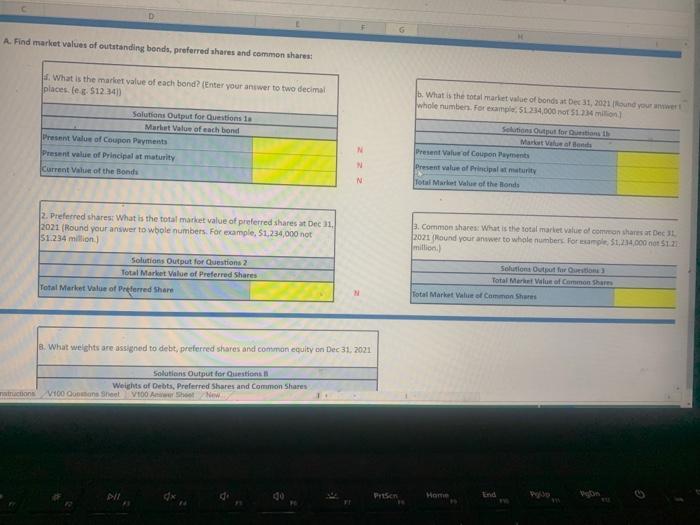

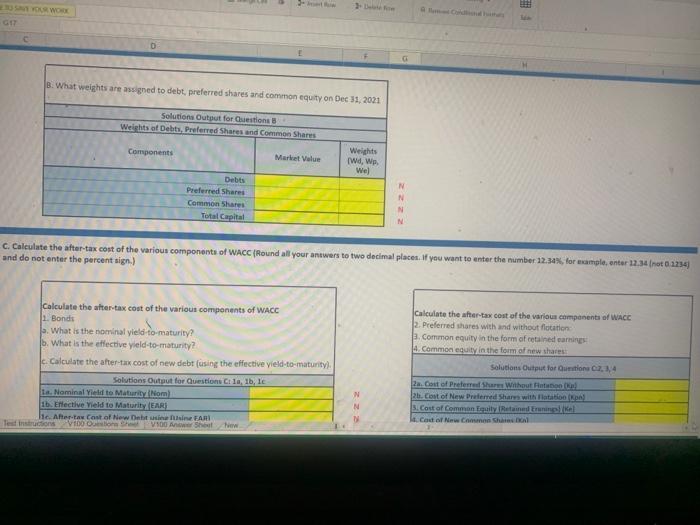

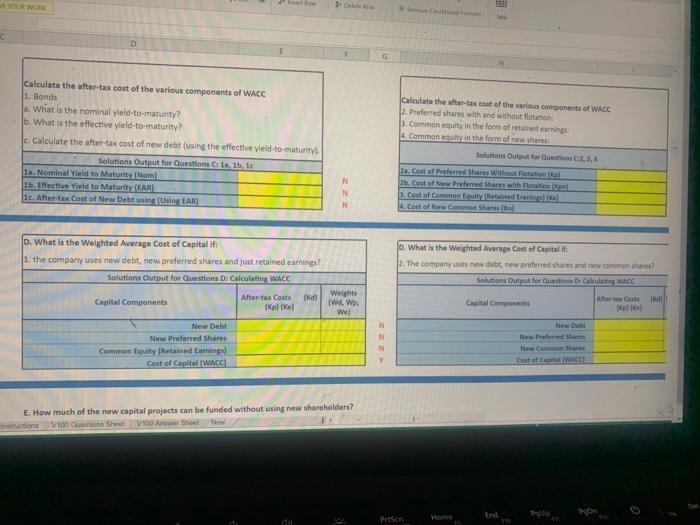

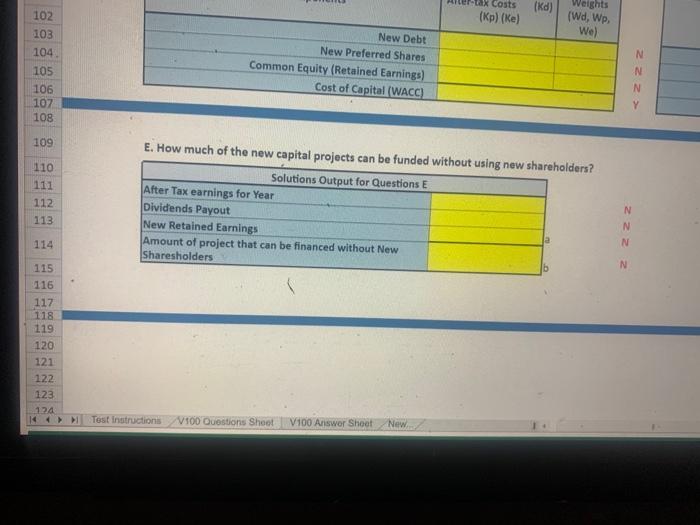

E. How much of the new capital projects can be funded without using new shareholden? A. Find market values of cutstanding bends, preferred ahares and commen b. What is the total market value of bonds at bera1, 2024 /Round your amwet: 3. Commos shares: What is the rotal mariet value of common shanes at Dec 31 8. What welghts are assigned to debt, preferred shares and comman equity on Dec 31.2021 8. Use the total market values calculated in part A as the weights in your Weighted Average Cost of Capital caiculation, What weient is ass pred ta Detrt, Preforred shares and Commonshares? c. What is the after-tax cost of common shares in the form of retained earnings? d. What is the after-tax cost of preferred shares? c. Calculate the after-tax cent of the various compenents of WACC 1. Bonds 3. What is the nominal yield-to-maturity? b. What is the effective yield-to-maturity? c. Calculate the after-tax cost of new debt (using the effective vield-to-matority). 2. Preferred stiares: 3. Common equity in the form of retained earnings: 4. Common equity in the form of new shares: D. You now have enough information to calculate Weighted Average Cost of Capital. D. What is the Weighted Average Cost of Capital if: 1. The compary uses new debt, new preferred shares and just retained earnings? 2. The company uses new debt, new preferred shares and new common shares? E. How much of the new capital projects can be funded without using new shareholders? a. What will be the increase in Canadian Tire retained earnings in 2022? b. Given the weightings you calculated in part B, how much of the \$404 million would be funded through a combination of new debt, new praferred aharea and furt ratainac Unless direcred otherivese: C. Calculate the after-tax cont of the various components of WACC (Round all your antwers to two decimal places. If you want to enter the number 12.343, for example, enter 12.34 (not 0.2734 ) and do not enter the percent sign.) E. How much of the new capital proiects can he fundad ...tit lolders? (If information oppears to be missing, chenge the row height to see it.) Requirements: A. Find the market values of the outstanding bonds, preferred shares and common shares; a. If the par value of each bond is $1,000, what is the market value of each bond? Given the number of bonds issued, what is the total imarket value of the bond b. What i the total market value of all issued preferred shares on Dec 31, 2021? c. What is the total market value of all issued common shares on Dec 31, 2021? B. Use the total market values calculated in part A as the weights in vour Weighted Average Cost of Capital calculation. What veight is assigned to Debt, Pirferned: shares and Common shars? c. What is the after-tax cost of common shares in the form of retained eamings? d. What is the after-tax cost of preferred shares? C. Calculate the aftentax cost of the various components of WACC E. How much of the new capital projects can be funded without using new shareholden? A. Find market values of cutstanding bends, preferred ahares and commen b. What is the total market value of bonds at bera1, 2024 /Round your amwet: 3. Commos shares: What is the rotal mariet value of common shanes at Dec 31 8. What welghts are assigned to debt, preferred shares and comman equity on Dec 31.2021 8. Use the total market values calculated in part A as the weights in your Weighted Average Cost of Capital caiculation, What weient is ass pred ta Detrt, Preforred shares and Commonshares? c. What is the after-tax cost of common shares in the form of retained earnings? d. What is the after-tax cost of preferred shares? c. Calculate the after-tax cent of the various compenents of WACC 1. Bonds 3. What is the nominal yield-to-maturity? b. What is the effective yield-to-maturity? c. Calculate the after-tax cost of new debt (using the effective vield-to-matority). 2. Preferred stiares: 3. Common equity in the form of retained earnings: 4. Common equity in the form of new shares: D. You now have enough information to calculate Weighted Average Cost of Capital. D. What is the Weighted Average Cost of Capital if: 1. The compary uses new debt, new preferred shares and just retained earnings? 2. The company uses new debt, new preferred shares and new common shares? E. How much of the new capital projects can be funded without using new shareholders? a. What will be the increase in Canadian Tire retained earnings in 2022? b. Given the weightings you calculated in part B, how much of the \$404 million would be funded through a combination of new debt, new praferred aharea and furt ratainac Unless direcred otherivese: C. Calculate the after-tax cont of the various components of WACC (Round all your antwers to two decimal places. If you want to enter the number 12.343, for example, enter 12.34 (not 0.2734 ) and do not enter the percent sign.) E. How much of the new capital proiects can he fundad ...tit lolders? (If information oppears to be missing, chenge the row height to see it.) Requirements: A. Find the market values of the outstanding bonds, preferred shares and common shares; a. If the par value of each bond is $1,000, what is the market value of each bond? Given the number of bonds issued, what is the total imarket value of the bond b. What i the total market value of all issued preferred shares on Dec 31, 2021? c. What is the total market value of all issued common shares on Dec 31, 2021? B. Use the total market values calculated in part A as the weights in vour Weighted Average Cost of Capital calculation. What veight is assigned to Debt, Pirferned: shares and Common shars? c. What is the after-tax cost of common shares in the form of retained eamings? d. What is the after-tax cost of preferred shares? C. Calculate the aftentax cost of the various components of WACC