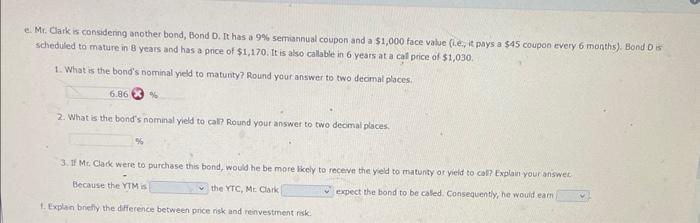

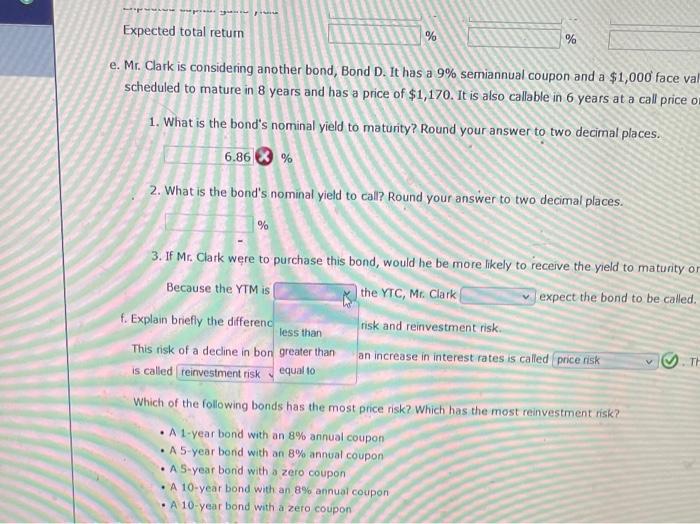

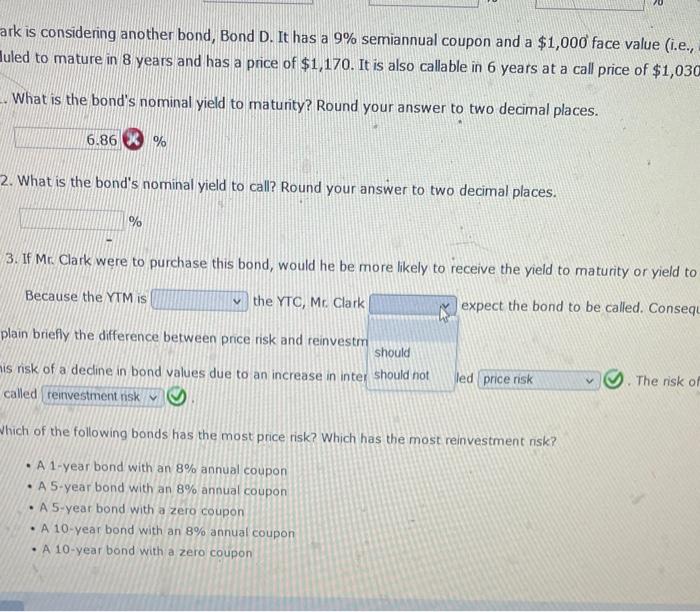

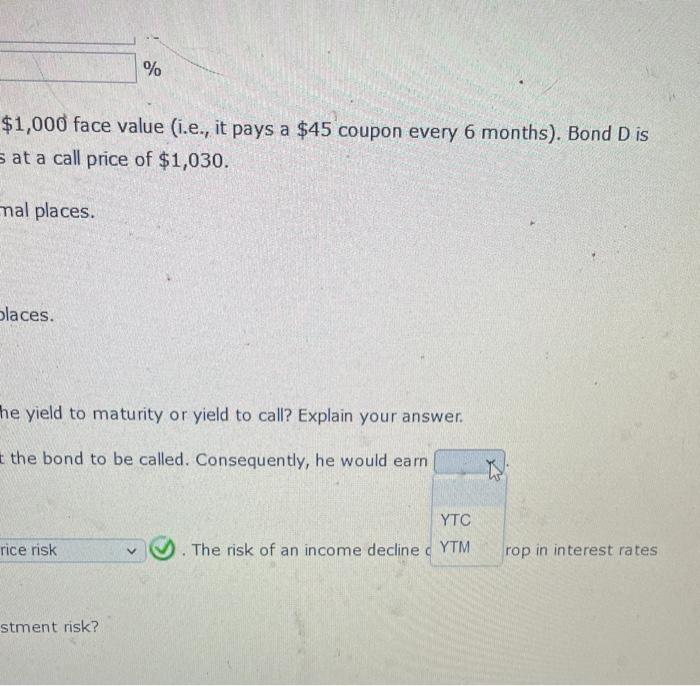

e. Mr. Clark is considering another bond, Bond D. It has a 9% semiannual coupon and a $1,000 face value (he., it pays a $45 coupon every 6 months). Bond 0 is scheduled to mature in 8 years and has a price of $1,170. It is also callable in 6 years at a cal price of $1,030. 1. What is the bond's nominal yeld to matunty? Round your answer to two decimal places. 3 is 2. What is the bond's nominal yied to cali? Round your answer to two deomal places. 3. If Mc, Clark were to purchase this bend, would he be more Hoely to receve the yeld to matunty or yeld to cal? Explain your answet Becouse the YTM is the ric, Mr. Clark expect the bond to be caled. Conseavently, he would eam 1. Explain briefly the difference between price risk and reinvestment risk. e. Mr. Clark is considering another bond, Bond D. It has a 9% semiannual coupon and a $1,000 face val scheduled to mature in 8 years and has a price of $1,170. It is also callable in 6 years at a call price o 1. What is the bond's nominal yield to maturity? Round your answer to two decimal places. 3% 2. What is the bond's nominal yield to call? Round your answer to two decimal places. % 3. If Mr. Clark wre to purchase this bond, would he be more likely to receive the yield to maturity or Because the YTM is the YTC, Mr. Clark_ expect the bond to be called. f. Explain briefly the differenc risk and reinvestment risk. This risk of a decline in bon is called an increase in interest rates is called Which of the following bonds has the most price risk? Which has the most reinvestment risk? - A 1-year bond with an 8% annual coupon - A 5-year bend with an 8% annual coupon - A 5-year bonid with a zero coupon - A 10-year bond with an 8% annual coupon - A 10-year bond with a zero coupon ark is considering another bond, Bond D. It has a 9% semiannual coupon and a $1,000 face value (i.e., luled to mature in 8 years and has a price of $1,170. It is also callable in 6 years at a call price of $1,030 What is the bond's nominal yield to maturity? Round your answer to two decimal places. (2) % 2. What is the bond's nominal yield to call? Round your answer to two decimal places. 3. If Mr. Clark were to purchase this bond, would he be more likely to receive the yield to maturity or yield to Because the YTM is expect the bond to be called. Consequ plain briefly the difference between price risk and reinvestrr is risk of a decline in bond values due to an increase in intel called Which of the following bonds has the most price risk? Which has the most reinvestment nisk? - A 1-year bond with an 8\% annual coupon - A 5-year bond with an 8\% annual coupon - A 5-year bond with a zero coupon - A 10-year bond with an 8% annual coupon - A 10-year bond with a zero coupon $1,000 face value (i.e., it pays a $45 coupon every 6 months). Bond D is $ at a call price of $1,030 nal places. blaces. he yield to maturity or yield to call? Explain your answer. the bond to be called. Consequently, he would earn The risk of an income decline