Question

E. Now assume that the equipments residual value could be as low as $0 or as high as $400,000, but $200,000 is the expected value.

E. Now assume that the equipments residual value could be as low as $0 or as high as $400,000, but $200,000 is the expected value. Because the residual value is riskier than the other relevant cash flows, this differential risk should be incorporated into the analysis. Describe how this could be accomplished. (No calculations are necessary, but explain how you would modify the analysis if calculations were required.) What effect would the residual values increased uncertainty have on Lewiss lease-versus-purchase decision?

"Please create your own answer which is different with some answers I can find on my own!!"

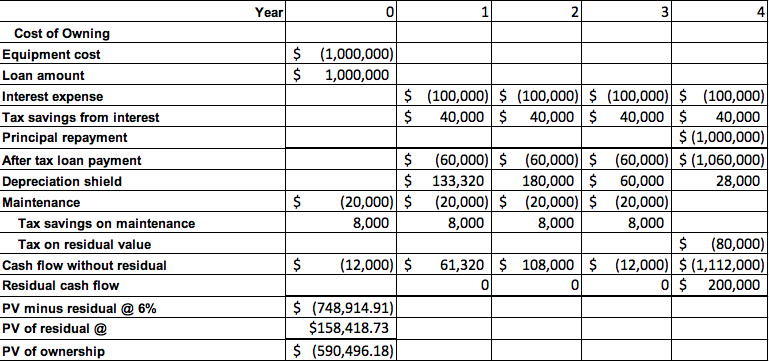

Year Cost of Owning Equipment cost Loan amount Interest expense Tax savings from interest Principal repayment After tax loan payment Depreciation shield Maintenance Tax savings on maintenance Tax on residual value Cash flow without residual Residual cash flow PV minus residual @ 6% PV of residual @ PV of ownership $ (1,000,000) $ 1,000,000 $ (100,000) $ (100,000) $ (100,000) $ (100,000) $ 40,000 $ 40,000 $ 40,000 $ 40,000 $ (1,000,000) $ (60,000) $ (60,000) $ (60,000) $ (1,060,000) $ 133,320 180,000 $ 60,000 28,000 (20,000) $ (20,000) $ (20,000) $ (20,000) 8,000 8,000 8,000 8,000 $ 80,000) (12,000) $ 61,320 $ 108,000 $ (12,000) $ (1,112,000) 0 0 0 $ 200,000 $ (748,914.91) $158,418.73 $ (590,496.18) Year Cost of Owning Equipment cost Loan amount Interest expense Tax savings from interest Principal repayment After tax loan payment Depreciation shield Maintenance Tax savings on maintenance Tax on residual value Cash flow without residual Residual cash flow PV minus residual @ 6% PV of residual @ PV of ownership $ (1,000,000) $ 1,000,000 $ (100,000) $ (100,000) $ (100,000) $ (100,000) $ 40,000 $ 40,000 $ 40,000 $ 40,000 $ (1,000,000) $ (60,000) $ (60,000) $ (60,000) $ (1,060,000) $ 133,320 180,000 $ 60,000 28,000 (20,000) $ (20,000) $ (20,000) $ (20,000) 8,000 8,000 8,000 8,000 $ 80,000) (12,000) $ 61,320 $ 108,000 $ (12,000) $ (1,112,000) 0 0 0 $ 200,000 $ (748,914.91) $158,418.73 $ (590,496.18)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started