Question

e. Suppose Orleans Limited follows a strict residual dividend policy. Calculate the dividend per share they will pay if planned investments for this year are

e. Suppose Orleans Limited follows a strict residual dividend policy. Calculate the dividend per share they will pay if planned investments for this year are $262,500. Orleans Limited has a target D/E ratio of 0.5.

f. Suppose Orleans Limited declares a dividend per share of $.90 this year and a $.60 per share dividend next year. You own 600 shares of the stock and you do not want any dividend this year but as much dividend income as possible next year. If your required return on this stock is 9 percent, what will your total homemade dividend be next year? Ignore taxes.

g. Suppose Orleans Limited announces a stock repurchase of $32,938. How many shares would be outstanding and what will the price per share be after the repurchase?

h. Discuss the importance of dividend policy in the context of homemade dividends. Do you think dividend policy is irrelevant in practice? Why or why not?

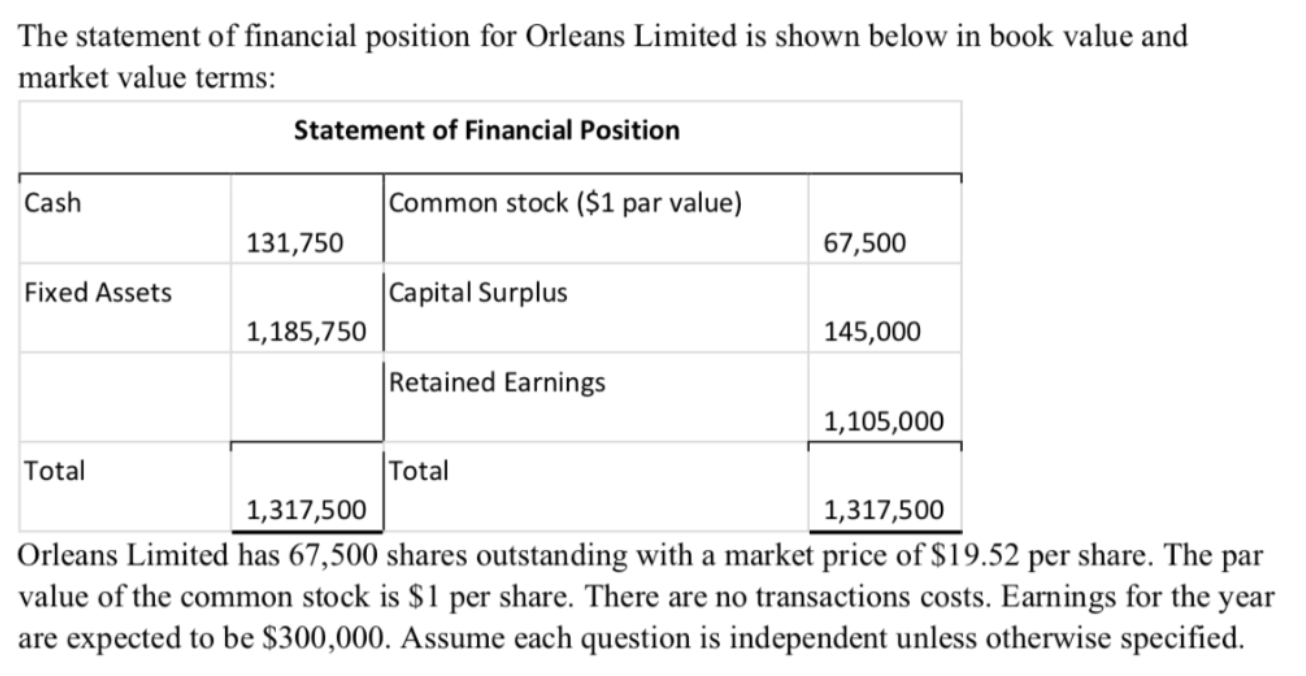

The statement of financial position for Orleans Limited is shown below in book value and market value terms: Statement of Financial Position Cash Common stock ($1 par value) 131,750 67,500 Fixed Assets Capital Surplus 1,185,750 145,000 Retained Earnings 1,105,000 Total Total 1,317,500 1,317,500 Orleans Limited has 67,500 shares outstanding with a market price of $19.52 per share. The par value of the common stock is $1 per share. There are no transactions costs. Earnings for the year are expected to be $300,000. Assume each question is independent unless otherwise specifiedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started