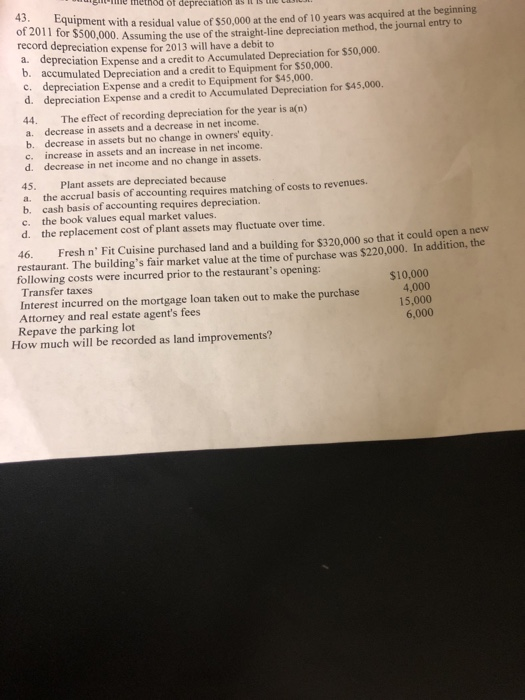

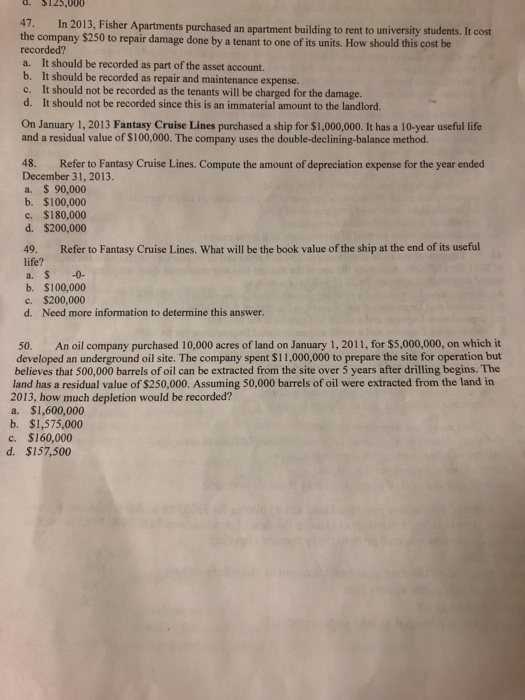

e tmethod of depreciation as It is dn of 2011 for record uipment with a residual value of $50,000 at the end of 10 vears was acquired at the beginning 0,000. Assuming the use of the straight-line depreciation method, the journal entry to depreciation expense for 2013 will have a debit to a. depreciation Expense and a credit to Accumulated Depreciation for $50,000 b. accumulated Depreciation and a credit to Equipment for $50,000. c. depreciation Expense and a credit to Equipment for $45,000. d. depreciation Expense and a credit to Accumulated Depreciation for $45,000. 44. The effect of recording depreciation for the year is a(n) a. decrease in assets and a decrease in net income. b. decrease in assets but no change in owners' equity increase in assets and an increase in net income. decrease in net income and no change in assets. c. d. 45. a. Plant assets are depreciated because the accrual basis of accounting requires matching of costs to revenues. cash basis of accounting requires depreciation. b. c. the book values equal market values. d. the replacement cost of plant assets may fluctuate over time. 46. Fresh n' Fit Cuisine purchased land and a building for $320,000 so that it could open a new restaurant. The building's fair market value at the time of purchase was $220,000. In addition, the following costs were incurred prior to the restaurant's opening: Transfer taxes Interest incurred on the mortgage loan taken out to make the purchase Attorney and real estate agent's fees Repave the parking lot 4,000 15,000 6,000 How much will be recorded as land improvements? 47. In 2013, the company $250 to repair damage done by a tenant to one of its units. How should this cost be recorded? a. It should be recorded as part of the asset account b. It should be recorded as repair and maintenance expense. c. It should not be recorded as the tenants will be charged for the damage. d. It should not be recorded since this is an immaterial amount to the landlord. isher Apartments purchased an apartment building to rent to university students. It cost On January 1, 2013 Fantasy Cruise Lines purchased a ship for $1,000,000. It has a 10-year useful life and a residual value of $100,000. The company uses the double-declining-balance method. 48. Refer to Fantasy Cruise Lines. Compute the amount of depreciation expense for the year ended December 31, 2013. a. $ 90,000 b. $100,000 c. $180,000 d $200,000 49. life? Refer to Fantasy Cruise Lines. What will be the book value of the ship at the end of its useful b. $100,000 c. $200,000 d. Need more information to determine this answer. 50. An oil company purchased 10,000 acres of land on January 1, 2011, for $5,000,000, on which it developed an underground oil site. The company spent $11,000,000 to prepare the site for operation but believes that 500,000 barrels of oil can be extracted from the site over 5 years after drilling begins. The land has a residual value of $250,000. Assuming 50,000 barrels of oil were extracted from the land in 2013, how much depletion would be recorded? a. S1,600,000 b. $1,575,000 c. $160,000 d. $157,500